Independent Wealth Management Basel

Independent Wealth

Management Basel

Estoppey Value Investments is at your side for all matters relating to investment strategies and wealth management in Basel and the surrounding area.

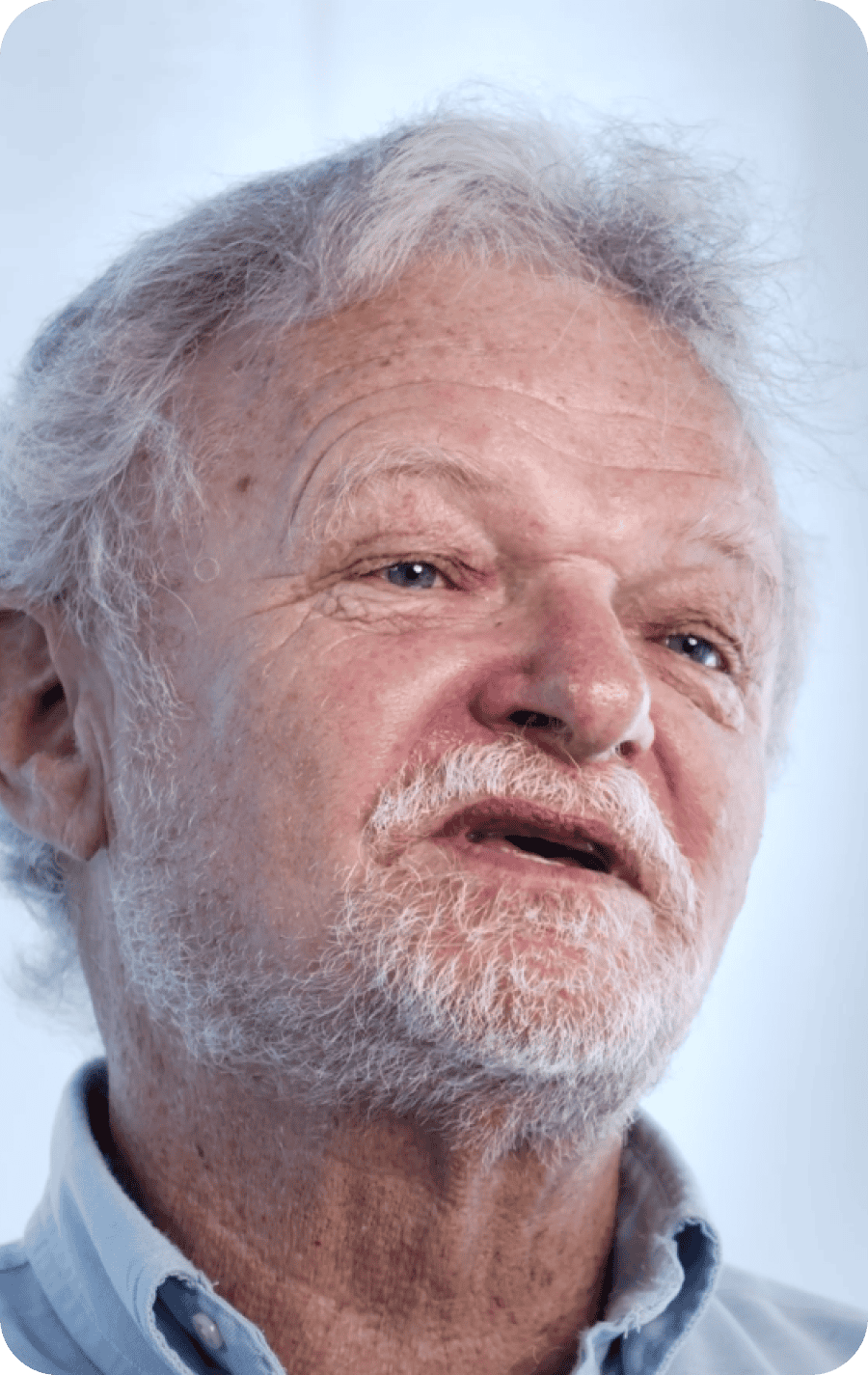

Olivier Estoppey

Qualified Wealth Manager

Personal, Transparent and Independent

Do you want your investment advice to be transparent and independent?

Your wealth management as well?

Would you like first-hand experience?

See and hear what experiences other clients have had with Estoppey Value Investments’ asset management.

Heath Driscoll

Company ABC

Heath Driscoll

Company ABC

Heath Driscoll

Company ABC

Would you like to achieve sustainable returns?

With my value-oriented investment strategy, I ensure that you achieve stable and sustainable returns in the long term.

Are you unsure who you can trust with your money?

As an independent asset manager in Basel, I act exclusively in your interests and offer you full transparency and security.

Do you have little financial knowledge and don't know where to start?

I will accompany you step by step with a clear and individual strategy that is tailored to your needs.

Your advantages with your asset manager Basel

My approach is based on an individual investment strategy that is tailored to your specific needs and goals. I love analyzing complex initial situations and deriving optimal and individual strategies from them.

Value-Oriented Investing

Through value investing, we achieve sustainable high returns - and minimize investment risks at the same time.

Diversification & Security

With a sound investment strategy, we ensure a balanced investment portfolio that matches your individual risk profile.

Individuality & Quality

You have your individual goals and values - that's why I develop an approach that is precisely tailored to them.

Advice with Consistency

I review your asset strategy on an ongoing basis - as soon as something changes in the market, I will inform and advise you.

Independence

As an independent asset manager, I act exclusively in your interests, free from external influence and commissions.

Always There for You

We discuss all strategically important decisions together - and sometimes quick action is required. That is why I am always available for you.

Make an appointment

- Do you attach great importance to individual and independent asset management for your finances?

- Would you like personal, trustworthy advice that focuses on your financial situation and your financial goals?

- Then opt for the services of asset management company Estoppey Value Investments from Basel.

Olivier Estoppey

Qualified Wealth Manager

Thanks to my sound training and my varied experience with several companies in tax and financial consulting, I have extensive expertise and know-how as a wealth advisor and asset manager.

Professional Experience

- Estoppey Value Investments

- VZ VermögensZentrum

- PricewaterhouseCoopers (PwC)

- Swiss Re

Olivier Estoppey

Qualified Wealth Manager

As an investment advisor and asset manager, I have a great deal of specialist knowledge.

Customer Testimonials

Experience of our customers Satisfaction Trust and excellent cooperation

Heath Driscoll

Company ABC

Heath Driscoll

Company ABC

Heath Driscoll

Company ABC

Investment Strategy

My investment strategy combines proven principles with individual customization to ensure long-term financial success.

Value Investing

At Estoppey Value Investments in Basel, I rely on the proven principle of value investing. My focus is on managing your investments in a value-oriented and risk-optimized manner in order to ensure stable growth in the long term.

Diversification & Risk Management

A sound investment strategy requires balanced diversification in order to spread risks effectively. That's why I create a customized investment portfolio for you that is tailored to your personal goals and risk tolerance.

Transparent

Terms and Conditions

Transparency and trust are the be-all and end-all in financial matters. It is therefore essential for me to offer you fair conditions – without hidden fees or pitfalls.

Administration Fee

0,25%

per quarter of assets under management

Transaction Fees

From CHF 3.-

Depending on transaction volume & asset class

Profit Sharing

10%

of net profit with high watermark*

Retrocessions

0%

I will credit you in full for any remuneration such as kick-backs or finder’s fees in order to maintain my independence.

Custody Fees

Max. 0,025 %

with a cost limit of CHF 50 per quarter

*In the event of negative performance, the profit participation is not levied until the assets have returned to the level they had before the first negative performance (high watermark).

Our

Process

At Estoppey Value Investments in Basel, we attach great importance to a clearly structured and transparent process in order to design your asset management efficiently and individually.

Our approach is based on a clear structure and an individual investment strategy that is tailored to your needs.

Initial Consultation & Needs Analysis

In a non-binding initial consultation, I will get to know your financial goals and needs in order to develop a customized investment strategy.

Strategy Development & Implementation

I develop an individual approach and a tailored investment strategy and take care of the execution and ongoing monitoring of the investments.

Transparency & Ongoing Review

You have online access to your portfolio at all times, while I regularly review your investment strategy and adapt it to current market developments.

Initial Consultation & Needs Analysis

In a non-binding initial consultation, I will get to know your financial goals and needs in order to develop a customized investment strategy.

Strategy Development & Implementation

I develop an individual approach and a tailored investment strategy and take care of the execution and ongoing monitoring of the investments.

Transparency & Ongoing Review

You have online access to your portfolio at all times, while I regularly review your investment strategy and adapt it to current market developments.

Frequently Asked Questions

What does private asset management mean?

Private wealth management encompasses all financial services relating to the management of private financial assets. Management is geared towards the individual needs of the client. In concrete terms, this means that a private wealth manager always takes the circumstances and personal wishes of their clients into account in all considerations and solutions. This is because asset management is far more than just managing shares and other investments with a focus on returns; it requires an individual approach.

Why does asset management make sense?

Asset management helps you to optimize your wealth situation. Thanks to a well-founded, long-term strategy, your assets are preserved and increased in the long term. An independent asset manager carries out a precise analysis of your financial situation and defines an investment strategy based on this. In turn, you benefit from their investment expertise: this comes into play in the selection of investments as well as in the regular monitoring of investments.

As a result, you save a lot of time as you don’t have to find out about investment opportunities and potential yourself. You also benefit from the fact that your assets are protected and increased in times of negative interest rates.

Why an independent asset manager?

An independent asset manager acts in your interests – and not those of a bank or insurance company. This means that they are your personal contact who advises and represents you to the best of their knowledge and belief, and not simply a seller of financial products. They do not receive any commission, bonus payments or hidden fees from third parties, but are remunerated transparently.

What do the services of an asset manager include?

First, the framework conditions are set out in an investment profile and an asset management agreement. He then opens a custody account for you in your name and manages it for you. You will receive your own access to your custody account with your own IBAN and account number. Your money is then managed in this custody account. The asset manager has a so-called limited power of attorney to manage this custody account and can thus work with your money and/or invest it in accordance with your investment strategy. Only you can continue to make deposits and withdrawals. Thanks to your own access, you have full control and insight into your custody account and your investments at all times.

How safe is my money?

Your money is held at a well-capitalized Swiss bank. Your securities always belong to you, because even if the bank goes bankrupt, they will NOT become part of the bankruptcy estate. The bank only holds your securities in custody for you, so to speak; you are and remain the owner. Furthermore, the asset manager cannot transfer your money to another account; only you as the client can do this.

What are the advantages of Estoppey Value Investments?

You will be assigned a trustworthy, competent contact person who will act in your interests and on your behalf, providing you with personal support and advice on investment issues. At Estoppey Value Investments, this means asset management:

- Ongoing review of your investments

- Customized management of your assets

- Sound investment advice

And all this from a single source.

I want to invest money, what is the next step?

At the beginning, I will have an initial, non-binding meeting to get to know you and your financial goals. Your personal expectations and needs are at the forefront so that I can tailor my service to you. At the same time, you have the opportunity to get to know me and clarify any unanswered questions.

Is there a minimum term for the investment?

There is no minimum term. After all, this is your money. You should be able to decide for yourself what to do with it. This means you can withdraw money from the custody account at any time if necessary.