What are zombie companies?

The term zombie company is used for companies that are still able to pay their interest payments but do not have sufficient financial resources to repay the debt. Often theinterest, or in some cases the repayments, are paid with new loans. In other words, zombie companies are just getting by. Overheads such as wages, rent and interest on debt are therefore covered. The problem, however, is that there is not enough money available to invest, so these companies cannot grow. There is a risk that unexpected events could cause the company to go bankrupt. As zombie companies are doomed to fail, so to speak, they represent a risky investment, which pushes their share pricesdown.

A company can become a zombie company if, for example, a company takes out a loan to make an investment, but the investment does not bring the desired success. This can happen, for example, ifsales cannot be realized due to an unforeseeable change in the market. Costs could also rise. As a result, the income is not sufficient to cover the costs or the installments of the loan taken out. An attempt is then made to delay insolvency by taking out further loans.

Zombie companies – The term

The term first appeared in relation to companies in Japan during the “lost decade” of the 1990s after the asset price bubble burst. Many companies were dependent on the banks to survive at that time. There are economists who argue that companies that are doomed to fail should not be bailed out. Although jobs can be saved, it reduces the growth of successful companies and therefore the creation of new jobs. In 2008, the term “zombies” became topical again for companies that were rescued by the government. During the financial crisis, there were some financial institutions that were zombie companies, but these companies had a large number of employees and were therefore classified as “too big to fail” (systemically relevant).

Zombie companies and the low interest rate policy

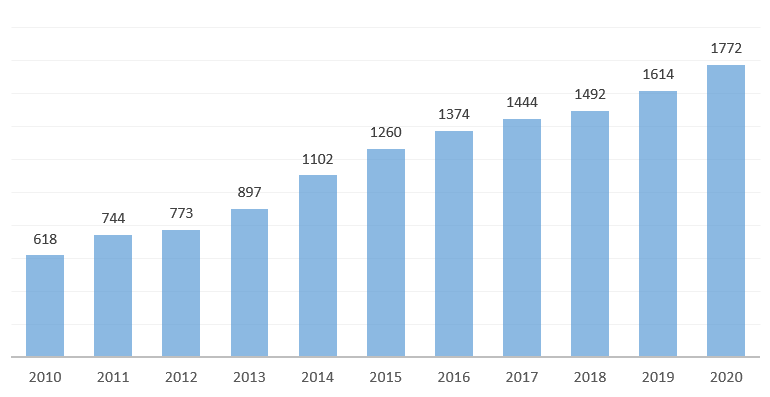

Monetary policy in recent years(high debt, low interest rates) is responsible for the sharp increase in the number of zombie companies, which can be seen in the chart. The low interest rate policy is therefore also referred to as zombification. Worldwide, the number of zombie companies has increased from 618 in 2010 to 1772 in 2020. With the coronavirus crisis, analysts expect the numbers to rise further.

Central banks are currently raising interest rates again to combat inflation. This could now pose a major problem for existing zombie companies if they are no longer able to pay the interest on their loans. There are also companies that have used the cheap loans for share buybacks to boost their share price instead of making investments. These were, for example, airlines in the years before the coronavirus crisis. Analysts disagree on how such a wave of bankruptciescould affect the economy. Some argue that the zombie companies tie up resources and skilled workers who would be better employed elsewhere. In times of inflation, the people made redundant would be better able to find a job. It would be worse if the zombie companies went bankrupt during a recession. Others are of the opinion that the wave of bankruptcies of zombie companies could lead to a recession.

Global number of listed zombie companies over the course of 2010-2020

Source: Kearney Analysis https://www.kearney.com/

Investing in zombie companies

Investing in zombies is very risky. The investment resembles an all-or-nothing situation. Suppose a small company puts all its financial resources into a particular product in the hope that this product will make a breakthrough. If this is not the case, the company is subsequently insolvent. An investor would lose his investment. If the breakthrough works, the company may have been a good investment. In practice, however, this is usually not the case. Only in rare cases do companies manage to get out of the situation. One example is ExxonMobil, which operates in the energy sector. Due to the corona pandemic, the company became a zombie company. However, due to the current rise in oil prices, which is also attributable to the war in Ukraine, the company is doing well again in the current market environment.

Zombie companies can therefore be a worthwhile investment for investors with a high risk tolerance who like to invest in speculative investments. However, due to the high risk involved, it may be helpful to seek advice from a specialist, such as a good asset manager.