What is a zero-coupon bond?

Bonds are issued by companies or government institutions, for example, in order to raise capital. The investor buys a bond and can therefore be described as a lender. In the case of bonds, investors already receive returns during the term , which are referred to as coupons. These can be paid out semi-annually or annually, for example. A zero-coupon bond (also known as a zero-coupon bond or zero bond) is a special bond that pays no coupon, i.e. no interest. As the zero-coupon bond does not pay coupons, the investor does not earn any money from the coupon payments.

A zero-coupon bond is traded at a discount. In the case of a standard bond, the lender receives back the amount invested (the nominal value) at the end of the term (maturity). Assuming the nominal value of a bond is CHF 1000, the investor would invest CHF 1000 at the beginning of the term, earn coupons during the term and receive CHF 1000 back at the end of the term. However, if a bond is traded at a discount, the investor can purchase the bond for a lower amount (e.g. CHF 900). If the bond is then repaid at maturity at the full nominal value (i.e. without the discount), the difference represents the profit for the investor (in this example CHF 100). There are bonds that are traded with a discount and coupon payments. However, a zero-coupon bond is only traded with a discount, which is usually higher.

The payment that the investor receives corresponds to the invested capital plus the interest compounded semi-annually at a fixed yield. However, the interest on a zero-coupon bond is imputed interest. The imputed interest rate is the estimated interest rate for the bond. It is therefore not a fixed interest rate. For example, a bond with a nominal value of CHF 10,000 that matures in 10 years and has a yield of 5% can be purchased for CHF 5,000. After the 10-year term, the investor receives the nominal value (CHF 10,000) and the discount, i.e. the difference between CHF 10,000 and CHF 5,000 (i.e. CHF 5,000). This CHF 5000 corresponds to the interest that automatically accrues until the bond matures.

The valuation of the zero-coupon bond

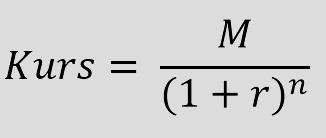

The price of a zero-coupon bond can be calculated using the following formula:

where,

M = nominal value or maturity value of the zero-coupon bond

r = required/desired interest rate interest rate

n = number of years until maturity.

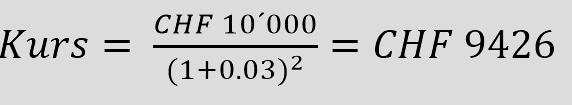

So if an investor wants to achieve a yield of 3% on a bond with a nominal value of CHF 10,000 that matures in 2 years, the investor can calculate the maximum price he would be willing to pay for a zero-coupon bond.

Advantages and disadvantages of the zero-coupon bond

One advantage for the investor is that the investor does not have to pay taxes during the term, as no coupons are paid out and therefore no profit has to be taxed. This also reduces administrative costs. In addition, there is no reinvestor risk. The profit in the form of coupons does not have to be reinvested. This means there is also no risk that the interest rate may deteriorate. A zero-coupon bond therefore has theeffect ofcompoundinterest. In times of falling interest rates, the zero-coupon bond is advantageous. In addition, the yield is already known at the beginning of the term. This makes it easier for the investor to plan for the future. It is generally also possible to sell the zero-coupon bond during the term.

Of course, the zero-coupon bond also has disadvantages. As no coupons are paid, all the money is tied to the term. In times of rising interest rates, it could also be advantageous to receive coupons in order to reinvest the coupons/profits paid out. As the term of zero-coupon bonds is usually very long and no payments are made during the term, the risk of the issuer becoming insolvent also increases. Another disadvantage of zero-coupon bonds is that the entire payment falls on the maturity date. This means that zero-coupon bonds are subject to high price fluctuations. The investment therefore has a high volatility (risk). The price reacts more strongly to market fluctuations. The high interest rate sensitivity can become a problem if an investor is unable to hold the investment to maturity and the market interest rate has risen.