What is X-efficiency?

X-efficiency refers to the degree of efficiency that companies maintain under conditions of imperfect competition. Neoclassical theory states that in perfect competition, companies are forced to operate X-efficiently (100%). This means that a company must generate the maximum output (product) with the available input (e.g. money and employees), otherwise it will be squeezed out by the competition and will not be able to survive. These companies are therefore X-efficient. However, this theory does not apply to situations with imperfect competition, such as a monopoly or duopoly. Here it is possible for companies to produce less than the maximum. These companies therefore operate X-inefficiently. X-efficiency was developed to measure how much more efficiently a company could operate under perfect competition.

Harvey Leibenstein and the X-efficiency

Harvey Leibenstein

Source: www.hetwebsite.net

In theory, it is assumed that economic actors act rationally. It would be rational if production is maximized and at the lowest cost. This also generally applies to markets that are inefficient (monopoly, duopoly). However, it has been observed that companies do not always act rationally. Harvard professor and economist Harvey Leibenstein called this anomaly, i.e. irrational behavior, “X”. Leibenstein thus introduced the human element, according to which there may be factors attributable to management or employees that do not maximize production or achieve the lowest cost in production. If there is no competition, this could lead to a loss of motivation from the company and employees, which in turn leads to X-inefficiency. However, some economists argue that the concept of X-efficiency merely represents compliance with the utility-maximizing trade-off between effort and employee leisure. The empirical evidence for the theory of X-efficiency is therefore mixed.

Reasons for X inefficiency

Economics provides several explanations as to why X-inefficiency can exist. Of course, several of these reasons can also be decisive for X-inefficiency.

- Monopoly power. A monopoly is the dominant position of a company in an industry or sector. The company has little or no competition and is therefore not subject to competition. As the monopoly is the only supplier, it is not particularly difficult to achieve above-average profits. For this reason, there is less need to focus on costs.

- State control. If a company is owned by the state, profit maximization takes a back seat. This also has an impact on reducing costs.

- Principal-agent problem. Basically, a shareholder ‘s goal is for the company to maximize profits and minimize costs. However, this can be at odds with managers and employees. They naturally want to keep their jobs and therefore have an incentive to keep costs down. At the same time, they also want the work to be as pleasant as possible, which often increases the costs for the company.

- Lack of motivation. Employees and management may lack motivation. There are many reasons that can lead to employees not being fully productive at work.

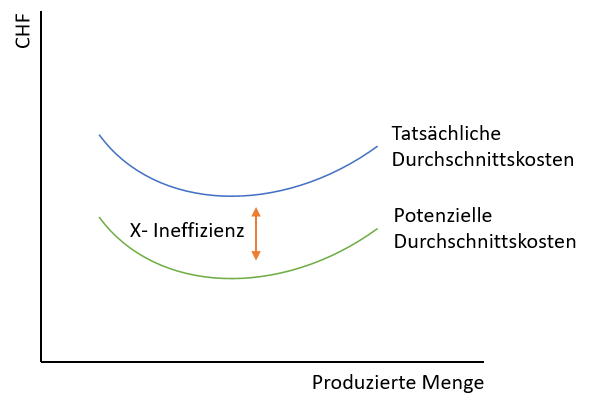

X-efficiency vs. X-inefficiency

In general, the two terms refer to the same concept. They indicate how efficiently a company operates. Efficiency is expressed as a percentage. For example, if a company’s X-efficiency is 75%, the company is using 75% of its optimal efficiency. The X-inefficiency actually measures the same thing, but refers to the gap between the efficiency a company achieves and the efficiency the company could achieve. The following figure shows the X-inefficiency.