What is the real return?

The real return indicates the actual purchasing power of the amount of money over time. The real return is therefore a more accurate measure of investment performance than the nominal return. In contrast to the “normal” return, the real return is adjusted for inflation. The nominal return is the annual net gain or loss on an investment, expressed as a percentage of the original cost of the investment. Nominal yields are therefore usually higher than real yields, as the aim of the monetary policy of countries or currency unions is usually moderate inflation and nominal yields are not adjusted for inflation. In rare cases, e.g. in times of zero inflation, yields are roughly the same, while in times of deflation, real yields are higher than nominal yields.

Discounting is another way of taking into account the time value of money. Once the effect of inflation is taken into account, we call this the real rate of return (or the inflation-adjusted rate of return).

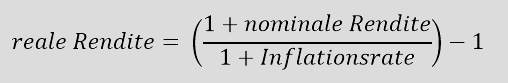

The formula for the real return

To calculate the real return, the inflation ratemust be deducted from the nominal return.

Assuming a bond pays a return of 4% per year and the inflation rate is 1%, the real return is only 3%. The purchasing power of the money has fallen over the year due to inflation.

Historically, equities have traded at around 8% in nominal terms. Assuming an inflation rate of 2%, this results in a real return of around 6% for equities (= 8% – 2%).

Nominal or real return?

The question arises as to whether an investor should generally prefer to rely on nominal or real returns. Real returns show an accurate historical picture of the development of an investment. However, you will only ever find information on nominal returns in investment opportunities. The real return can only be calculated once the inflation rateis known. In addition to the inflation adjustment, investors must also take into account the effects of other factors such as taxes, investment fees and transaction costs when assessing the return achieved. Only then can the “actual” return be calculated. The “real” return can help you choose between different investment options. A good, independent asset manager can provide you with the best possible support in this assessment.