What is a yield?

A return is thenetgain or loss on an investment over a period of time, expressed as a percentage of the original cost of the investment. When calculating the return, you determine the percentage change from the beginning of the period to the end.

A rate of return can be applied to any investment instrument, from real estate to bonds and stocks to exotic “assets” such as LEGO sets. Return calculations work with any asset, provided the asset is purchased at a specific time and generates a cash flow at a specific time in the future. Investments are valued in part based on past returns, which can be compared to investments of the same type to determine which investments are most attractive.

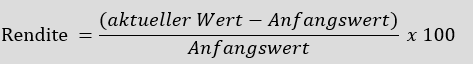

The formula for the return

The formula for calculating the return is as follows:

This simple rate of return is sometimes referred to as the growth rate or, alternatively, the return on investment (ROI). If you also consider the effect of the time value of money and inflation, the real rate of return can also be defined as the net amount ofdiscounted cash flows (DCF) you receive for an investment after adjusting for inflation.

Simple example of a yield calculation

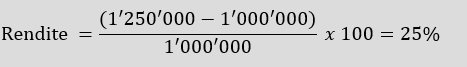

The yield can be calculated for any investment related to any type of asset. Let’s take the example of buying a house to understand how to calculate the rate of return. Let’s say you buy a house for CHF 1’000’000.

Ten years later, you decide to sell the house and you are able to sell the house for CHF 1,250,000 after deducting all fees and taxes. The simple return on the purchase and sale of the house is then calculated as follows:

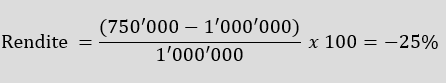

What if instead you sold the house for less than you paid for it, e.g. CHF 750,000? You can now use the same formula to calculate your loss or negative return:

Return on equities and bonds

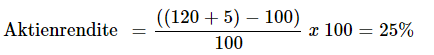

The calculation of the return for shares and bonds is slightly different. Assume an investor buys a share for CHF 100 per share, owns the share for five years and receives a total of CHF 5 in dividends. If the investor sells the share for CHF 120, his profit per share is CHF 120 – CHF 100 = CHF 20. In addition, he has earned CHF 5 in dividend income, which results in a total profit of CHF 20 + CHF 5 = CHF 25. The return on the share is therefore a profit of CHF 25 per share, divided by the cost of CHF 100 per share, i.e. 25%.

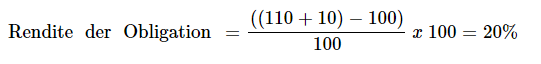

On the other hand, consider an investor who pays CHF 100 for a bond with a 5% coupon with a nominal value of CHF 100. The investment yields CHF 5 in interest incomeper year. If the investor sells the bond early after two years for CHF 110 and has earned a total of CHF 10 in interest, the investor’s return is the profit of CHF 10 from the sale plus CHF 10 in interest income (2 x CHF 5) divided by the acquisition cost of CHF 100, i.e. 20%.

How do you calculate the return in asset management?

Two main return ratios are used to calculate the return on a securities portfolio. One of these is the time-weighted return, better known as the time-weighted rate of return (TWR). The time-weighted rate of return is particularly suitable for comparing asset managers. This is because it measures how well the asset manager has invested your money compared to other asset managers. This is possible because the time-weighted return excludes or ignores incoming and outgoing payments, over which the asset manager generally has no influence. The disadvantage of the time-weighted return is that it can sometimes be confusing, as the time-weighted return can be positive due to this adjustment of deposits and withdrawals while the portfolio is in the red, or vice versa. It is therefore more suitable for comparing asset managers with one another than for effectively calculating the return of a securities portfolio.

The capital-weighted return or “money-weighted rate of return” (MWR) is more suitable for effectively calculating the average return of a securities portfolio. In contrast to the time-weighted rate of return, the capital-weighted rate of return takes into account the incoming and outgoing payments. A good asset manager reports both return figures. This means that an asset management client can use the time-weighted return to transparently understand how well the asset manager has performed, but can also use the capital-weighted return to understand the effective average return of the securities portfolio.

Real yield vs. nominal yield

The simple return is also referred to as the nominal return, as it does not take into account the effect of inflation over time. Inflation reduces the purchasing power of money so that, for example, a Swiss franc in ten years’ time will no longer be the same as a Swiss franc today.

Discounting is a way of taking into account the time value of money. Once the effect of inflation is taken into account, we call this the real rate of return (or the inflation-adjusted rate of return).

Real return vs. annual growth rate (CAGR)

A closely related concept to the simple rate of return is the compound annual growth rate (CAGR). The CAGR is the average annual return of an investment over a certain period of time, e.g. longer than one year, which means that growth over several periods must be taken into account in the calculation.

To calculate the average annual growth rate, we divide the value of an investment at the end of the relevant period by the value at the beginning of that period, raise the result to the power of one divided by the number of holding periods, e.g. years, and subtract one from the subsequent result.