What is the profit margin?

The profit margin is one of the most commonly used profitability indicators. It measures the extent to which a company is making money by indicating what percentage of turnover isprofit. As such, the profit margin is an indicator of a company’s financial health, growth potential and, by extension, management capability.

If a company manages to reduce costs under otherwise unchanged conditions, the profit margin usually increases. The profit margin can also be increased by increasing turnover, all other things being equal. In theory, higher turnover can be achieved either by increasing prices, increasing the number of units sold or a combination of both. In practice, a price increase is only possible to a certain extent. On the one hand, the competitive advantage on the market must not be lost. Secondly, the sales volume depends on market dynamics such as overall demand, the company’s percentage market share and the current and future position of competitors. The scope for cost control is also limited. Although it is possible to reduce or eliminate an unprofitable product line in order to cut costs, the company will also lose the corresponding sales. As the implementation of this is complicated, the profit margin is therefore an indicator of the management and its pricing strategy.

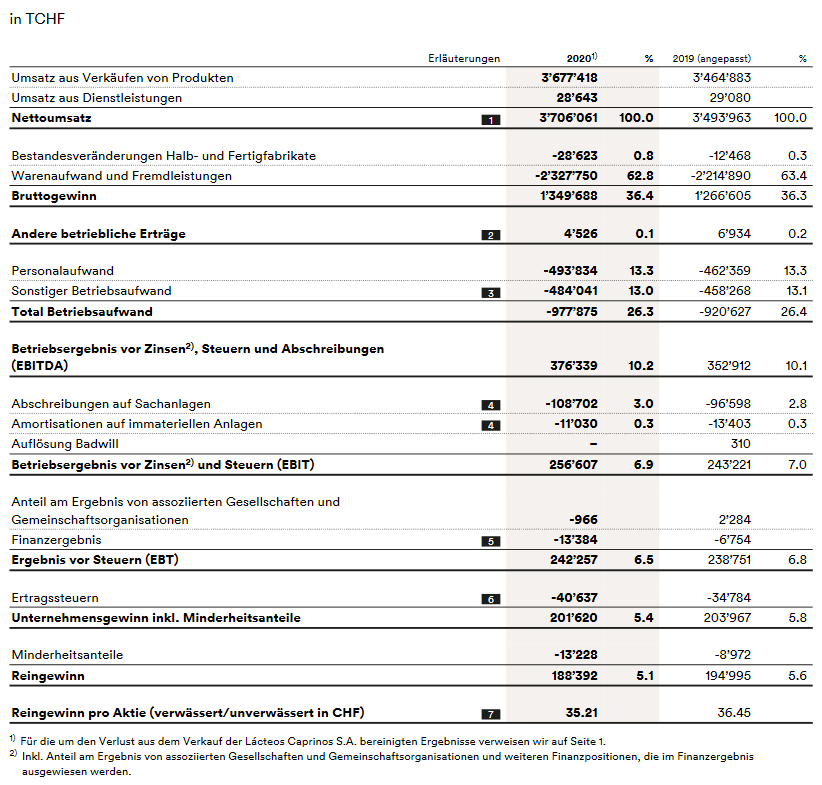

There are several profit margins, which are explained below. The most important, or the most commonly used profit margin, is the net profit margin. This excludes other expenses, including taxes, from the profit. When comparing profit margins of different companies, the industry of the company should be taken into account, as profit margins can vary greatly depending on the industry. In general, there are the following levels of profits, and therefore also of profit margins: Gross profit, operating profit and the net profit or net income. The figure below illustrates the profit of the Emmi Group in 2020.

A company earns sales(referred to as net sales in Emmi’s income statement) and pays the direct costs for the product or service. What remains is the gross profit. It then pays indirect costs (operating expenses) such as head office, advertising and research and development (R&D). What remains is the operating result before interest, taxes, depreciation and amortization (EBITDA). After that, interest on debt and any unusual costs or inflows that have nothing to do with the company’s main business are added or deducted, leaving the pre-tax margin (EBT). Finally, taxes are paid, leaving the net margin, also known as net income, net profit or net profit, which is the actual bottom line.

Source: Emmi Group income statement 2020

Excerpt from the Emmi Group’s press release dated March 2, 2021 (page 3/7):

“Emmi is proving secure and reliable in the crisis. Group sales exceeded CHF 3.7 billion for the first time, of which more than CHF 2.0 billion was generated outside Switzerland. The positive sales trend confirms the robustness of Emmi’s business model, the balance of its product and country portfolio and the organization’s ability to adapt.

To ensure sustainable success, Emmi stepped up its rigorous cost management last year and at the same time made targeted, value-creating investments to strengthen its innovation and growth plans in the long term. These include the construction of a new cheese dairy in Emmen and the construction of a state-of-the-art production facility in Brazil. Another investment in the future is the consistent work on the Emmi company portfolio. The acquisition of US-based Indulge Desserts not only gives Emmi its own presence in the world’s largest dessert market, but also additional distribution opportunities and economies of scale for the global dessert business. On the other hand, the majority stake in Lácteos Caprinos was sold in order to concentrate resources on high-growth and high-margin companies.

In addition to cost management, Emmi set other clear priorities during the crisis: Protecting employees, maintaining supply security and pursuing new sales opportunities. This clear concept has kept Emmi on course in this global crisis. As a result, the company’s own targets for 2020 were achieved in terms of both EBIT (CHF 256.6 million) and net profit margin (5.1 %), or even slightly exceeded after adjustment for the aforementioned one-off effect n.”

Calculations and types of profit margins

Different ways of calculating the profit margin are presented below. The Emmi Group’s figures are used to illustrate the calculation. Basically, the profit margins represent the share of the respective desired profit(e.g. gross profit, EBITDA, EBIT or net profit) in net sales, expressed as a percentage. The profit margins are shown in the Emmi Group income statement in the “%” column after the information on the amount of the respective profit.

Gross profit margin

The following formula is used to calculate the gross profit margin:

Emmi’s gross profit rose from CHF 1,266.6 million to CHF 1,349.7 million in the reporting year. Despite coronavirus, the gross profit margin increased slightly to 36.4 % (TCHF 1,349,688/3,706,061) in 2020. Gross profit shows how much a company earns from the direct sale of products. Operating costs or investments are not taken into account in the gross profit margin.

EBITDA margin

Firstly, the costs directly related to the manufacture of the product or service are deducted from turnover. This results in earnings before interest, taxes, depreciation and amortization (also known as EBITDA). For the Emmi Group, EBITDA amounted to TCHF 376,339 in 2020. Dividing EBITDA by net sales then gives the EBITDA margin. For the Emmi Group, the EBITDA profit margin in 2020 was therefore around 10.2% (376,339/3,706,061). The EBITDA margin shows whether a functioning business activity is in place.

Operating profit margin or EBIT profit margin

The operating profit margin is calculated by deducting selling, administrative and overhead costs or operating costs from a company’s gross profit, i.e. calculating EBITDA. Depreciation and amortization are also deducted. This gives the operating result before interest and taxes, also known as EBIT. This is the profit from a company’s ongoing operations. The operating profit margin is often used by bankers and analysts to evaluate a company. For the Emmi Group, the operating profit margin amounted to around 6.9% in 2020 (256,607/3,706,061).

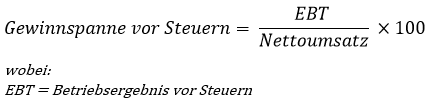

Profit margin before taxes

If interest is deducted from earnings before interest and taxes (EBIT), the result is earnings before taxes, also known as EBT. If EBT is divided by net sales, the result is the pre-tax profit margin. For the Emmi Group, the pre-tax profit margin in 2020 was approx. 6.5% (242,257/3,706,061).

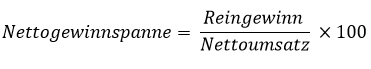

Net profit margin

The net profit margin is the most important of all profit margins. The net profit margin is an additional figure for investors to assess by how much a company’s income exceeds its expenses. Net profit (referred to as net profit in the Emmi Group’s income statement) is also used to calculate earnings per share. Net profit is therefore of particular interest to investors as it represents the profit attributable to shareholders. To calculate the net profit margin, net profit is divided by net sales. Net profit is calculated by subtracting all related expenses, including the cost of raw materials, labor, operations, rent, interestand taxes, from the total revenue generated. The excerpt from the income statement shows very clearly how net profit is calculated step by step. The net profit margin of the Emmi Group in 2020 was 5.1% (188,392/3,706,061).

Profit margins in comparison

The profit margin cannot be used as the sole criterion for comparison, as each company has its own business activities and each industry has its own specific characteristics. As a rule, all companies with low profit margins, such as retail and transportation, have high sales and high revenues, resulting in a high overall profit despite the relatively low profit margin. High-end luxury goods have low sales but high profits per unit and therefore a high profit margin.