What is the profit?

There are many definitions of profit. In accounting, profit arises when the income from a business activity exceeds the expenses, costs and taxes. Profit can either be paid out to the owners of a business or invested in the business. To calculate the profit, the total expenses are deducted from the total income. A negative profit is called a loss.

The three most important types of profit are gross profit, operating profit and net profit. These types of profit can be found in the income statement.

How the profit is calculated

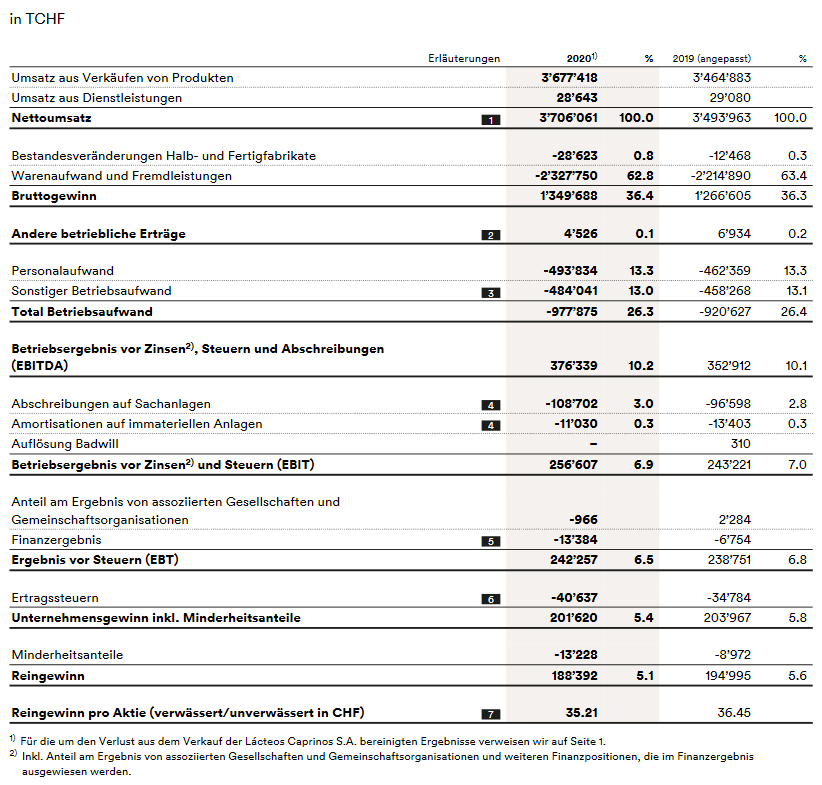

Gross profit is calculated by deducting all costs associated with a product or service from the sales of that product or service. Sales are the first line item in the income statement, and the cost of goods sold (COGS) is usually listed directly below it. The figure below shows the consolidated income statement of the Emmi Group in 2020 for illustrative purposes. The gross profit of the Emmi Group amounted to TCHF 1,349,688 in 2020.

Gross profit = net sales – cost of goods sold (COGS)

The operating result is calculated by deducting operating costs from gross profit. These are costs such as distribution, administration and general costs. The Emmi Group’s operating profit before interest and taxes (EBIT) amounted to TCHF 256,607 in 2020. The operating profit margin is calculated by dividing total salesby the operating profit.

Operating result (EBIT) = gross profit – operating expenses – depreciation and amortization

Operating profit margin = (net sales / operating result (EBIT))

Net profit is the profit remaining after payment of all expenses, including interest and taxes (IT). The Emmi Group’s net profit amounted to CHFT 188,392 in 2020.

Net profit = operating result (EBIT) – taxes and interest

Source: Emmi Group income statement 2020, www.group.emmi.com

Profit in cost accounting

The profit reported in the income statement is not really meaningful, as legal provisions and accounting policymeasures are applied. Internally, companies therefore use cost and performance accounting. Here, profit is defined as the difference between revenue and costs for a period. Revenues are the operating income (sales revenue and interest income) and costs are only the operating costs (e.g. wage costs, costs for raw materials).