What is the price-to-sales ratio?

The price/sales ratio (P/S ratio) compares the price of a share (share price of a company) with theincome/sales of the company. The P/S ratio is therefore another share ratio (see also price/earnings ratio) and indicates how the financial markets value each monetary unit of revenue generated by a company. In other words, the P/E ratio indicates how much an investor is prepared to pay for one franc of sales per share.

A low ratio could mean that the share is undervalued, while an above-average ratio could indicate that the share is overvalued. Price/sales ratios from the same sector should be used as a reference. If the P/S ratio is low compared to the P/S ratios of competing companies, the shares are generally also cheap.

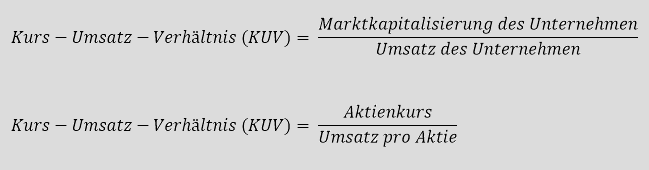

Calculation of the price/sales ratio (P/S ratio)

The P/E ratio can be calculated either by dividing the company’s market capitalization by the total turnover over a certain period (usually twelve months) or by dividing the share price by the turnover per share. Turnover per share can be calculated by dividing the turnover of a company by the number of shares issued.

The typical twelve-month period used for the KUV is usually the last four quarters (also referred to as “trailing 12 months” or TTM) or the last or current financial year. A KUV based on forecast sales for the current year is referred to as a forward KUV.

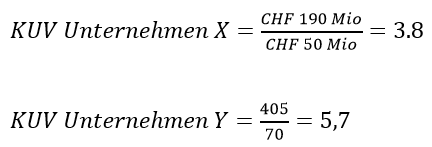

Example of calculating the price/sales ratio

A company X generated sales of CHF 50 million in 2020. The market capitalization is CHF 190 million. The share of company Y has a share price of CHF 405 and the turnover per share is CHF 70.

The P/E ratio of company X is 3.8 and the P/E ratio of company Y is 5.7. If the companies operate in the same sector, the price/sales ratios can be compared. In this case, the shares of company X are more favorable than those of company Y in terms of the P/E ratio. In general, shares with a P/S ratio of less than 1 are considered very favorable. However, the comparison should always be made at sector level, as different price/sales ratios may be common for each sector.

Advantages and disadvantages of the price/sales ratio

The P/E ratio can have advantages over the price/earnings ratio (P/E ratio). For example, very young companies rarely generate profits. Here, the P/E ratio can be used as an alternative to the P/E ratio. The P/E ratio enables a company to be valued independently of its profits. The P/E ratio is also very helpful when companies make losses. It cannot be ruled out that it is worth investing in a company that is currently making losses, e.g. if it is a growth company that is making high investments for future growth. Amazon, for example, did not generate any significant profits for a long time as it invested all of its earnings in its own growth. Nevertheless, an investment would certainly have paid off. Another advantage is that sales are less easy to influence than profits.

One disadvantage of the KUV is that it only takes into account sales and not profits. This is because there are also ways of influencing sales, e.g. if high discounts increase sales, although this could be detrimental to the company as the profit margins and therefore the profits per unit sold shrink. A comparison should not be made between different sectors, as not every sector can convert sales into profits to the same extent. In addition, the ratio ignores the debt of the companies. The enterprise value to sales ratio, for example, takes a company’s debt into account. A good investor therefore takes into account not just a single key figure when evaluating companies, but the overall picture in both quantitative and qualitative terms. It therefore makes sense to seek support from an expert, such as an independent asset manager.