Definition of price/earnings ratio (P/E ratio)

The price/earnings ratio (P/E ratio) is a key figure that is frequently used by investors or analysts to value a company or share, as it is characterized by its simplicity. It indicates the ratio of the current share price to earnings per share (EPS). The P/E ratio can be used to determine whether a share is overvalued or undervalued. The P/E ratio of a company can also be compared with other shares in the same sector. The P/E ratios of companies in different sectors can vary greatly. Therefore, the P/E ratio should only be used as a comparison tool when comparing companies in the same industry. The P/E ratio is sometimes also referred to as the price multiple or earnings multiple. The P/E ratio can be estimated on a retrospective or prospective basis. The ratio shows how much investors are willing to pay for the share in relation to the company’s earnings. In other words, it indicates the number of years in which the company will earn its market valuewhile maintaining constant profits.

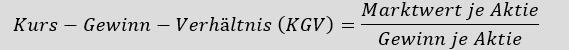

Formula and calculation of the price/earnings ratio

Forward price/earnings ratio and trailing price/earnings ratio

The P/E ratio is usually calculated on a forward-looking or backward-looking basis. The P/E ratio calculated on a forward-looking basis is also known as the forward price/earnings ratio (or estimated price/earnings ratio). Future earnings forecasts for the next 12 months are used for the calculation. This indicator is useful for comparing current profits with future profits. However, the informative value of the indicator depends heavily on the accuracy of the estimate. A variation of the forward price/earnings ratio is the price/earnings growth ratio (PEG). With the PEG ratio, investors can calculate whether the price of a share is overvalued or undervalued by analyzing both the current earnings and the expected growth rate of the company in the future.

The trailing P/E ratio is based on past performance. The current share price is divided by the total EPS (earnings per share) of the last 12 months. The informative value of the indicator depends on the accuracy of the balance sheet figuresor the earnings reported in the balance sheet. The advantage of this variant is that it is not based on forecasts. However, it is possible that the past is not a good indicator for the future. A sudden corporate event can have a strong impact on the share price, which is less well reflected in the trailing P/E ratio. Analysts expect earnings to rise if the forward P/E ratio is lower than the trailing P/E ratio.

Example: Valuation based on the P/E ratio

The P/E ratio indicates the amount that an investor must currently invest in a company in order to receive one monetary unit of that company’s profit (in the current year). In other words, the P/E ratio indicates an investor’s willingness to pay for one monetary unit of profit. Assuming a company is currently trading at a P/E ratio of 10, this means that an investor is willing to pay, for example, CHF 10 for CHF 1 of current earnings. The P/E ratio shows what the market is willing to pay for a share today based on its past and future earnings. A high P/E ratio could therefore mean that the share price is high in relation to earnings and therefore overvalued. Conversely, a low P/E ratio may mean that the current share price is low in relation to earnings.

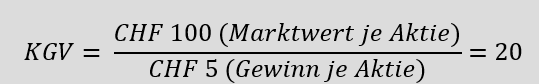

Assuming a share closes at a price of CHF 100, the company’s profit at the end of the financial year amounted to CHF 15 billion and the number of shares outstanding was CHF 3 billion.

Earnings per share (also known as EPS) are calculated by dividing profit by the number of shares. In this example, the earnings per share are CHF 5 (= 15 billion / 3 billion). The P/E ratio is therefore calculated as follows:

This means that the investor is prepared to pay CHF 20 for CHF 1 profit of the company in this period. In other words, the company would earn back the invested capital in 20 years if profits remain the same. In general, a high P/E ratio indicates that investors expect higher earnings growth in the future than for companies with lower P/E ratios. A low P/E ratio may indicate that a company is currently undervalued or that the company is performing above average compared to its past trends.

A low P/E ratio can mean that a share is cheap, or that earnings growth is expected to be weak or even negative. However, a high P/E ratio does not necessarily mean that a share is overpriced. A good asset manager also takes other factors into account when investing, for example by including industry trends in the analysis.