What is the price-to-book ratio (P/B ratio)?

The price-to-book ratio is used to compare the market capitalization – share pricemultiplied by the total number of outstanding shares – of a company with the company’s equity. For the calculation, the share price is divided by the book value per share. The price-to-book ratio is therefore the value that market participants attach to a company’s equity.

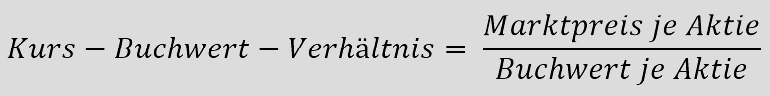

The price-to-book ratio formula

To calculate the book value per share, the total liabilities are deducted from the total assets and then divided by the number of shares outstanding. The market price per share is the current share price.

The interpretation of the price-to-book ratio

The price-to-book ratio sets the market price in relation to the book value. The market price of a share is forward-looking and therefore takes into account the future cash flows of a company. However, the book value of equity is an accounting ratio. Accounting ratios are calculated based on the principle of historical costs. The book value of equity therefore reflects the shares issued in the past, increased by any profits or losses, and reduced by dividends and share buybacks.

The price-to-book ratio compares the market value of a company with its book value. In other words, the book value of a company is the value that would remain if a company were to liquidate all its assets and pay off all its debts.

The price-to-book ratio is therefore a very good indicator for investors looking for shares with growth potential at a good price. A low price-to-book ratio can mean that a share is undervalued. The price-to-book ratio is therefore often used by value investors. Traditionally, the aim of value investors is to buy shares that are undervalued. Therefore, value investors consider a value below 1 to be a very good price-to-book ratio. A value below 1 means that the share costs less on the stock exchange than its share of all the company’s stock, machinery and real estate. However, whether the company is a good investment must be analyzed further. If the price-to-book ratio is less than 1, the market assumes that the equity will be reduced by losses in the future. Due to accounting conventions on the treatment of certain costs, the market value of equity is usually higher than the book value, resulting in a ratio above 1. Under certain circumstances, such as financial difficulties, bankruptciesor expected declines in profitability, a company’s price-to-book ratio may fall below 1. Investors should therefore take other indicators into account, such as the return on equity. If there are large deviations between the price-to-book ratio and the return on equity, the investor should reconsider the investment. If the return on equity increases, the price-to-book ratio should also increase. As the selection of suitable investments is therefore complex, it may make sense to commission a good asset manager to analyze and manage the assets.

As with most financial ratios and ratios, the average ratio can vary from sector to sector. It is therefore difficult to determine a “good” price/book ratio. Comparisons should therefore only be made within the same industry. One approach is, for example, to set a certain range for the price-to-book ratio per company. In addition, other valuation benchmarks should then be used to assess the growth potential of a company.

Advantages and disadvantages of the price-to-book ratio

First of all, the price-to-book ratio is a simple indicator. The price-to-book ratio can also be used for companies with positive book values and negative earnings. This makes the ratio more useful than the price/earnings ratio, as there are fewer companies with negative book values than companies with negative earnings.

One disadvantage of the price-to-book ratio is when companies use different accounting standards. This is particularly the case for companies in different countries. The price-to-book ratios are then no longer comparable. Comparability across different sectors is also limited. The ratio is also less useful for service and information technology companies with little property, plant and equipment on their balance sheets. There are also events that influence the book value, such as write-downs, share buybacks or takeovers.