What is the net asset value (NAV)?

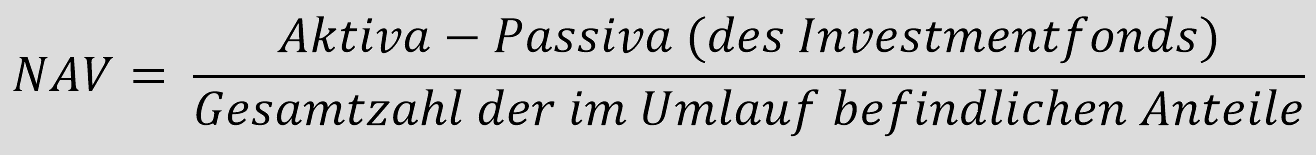

The net asset value (NAV) is the total value of a fund’s assets. The NAV is calculated by adding all theassets of an investment fund (assets) and then subtracting all the liabilities of the investment fund (liabilities). The result is divided by the number of units in circulation. The result is the net asset value per unit. The NAV is most commonly used in connection with an investment fund or an exchange-traded fund (ETF). It should be noted that the NAV does not include future prospects.

The net asset value often corresponds to or is close to the book value of a company. Companies that are expected to grow strongly are valued higher than the NAV. The net asset value can be compared with the market capitalization ofshares.

Investment funds collect money from a large number of investors and then use this money to invest in securities such as shares, bonds and money market instruments. Each investor receives a certain number of units in proportion to the amount invested. The price of each unit is based on the NAV.

In contrast to a share, whose price changes are announced during the course of the day, the pricing of investment funds is based on the end-of-day method, which is based on the activity of the securities in the fund.

The formula for calculating the NAV

Example of the NAV calculation

Assume that an investment fund is made up of investments in various securities. The total value of these securities is CHF 200 million. The total value is calculated by adding together all the daily closing prices of each asset. In addition, the investment fund has CHF 10 million in cash and CHF 12 million in total receivables. There are also CHF 20 million in current liabilities and CHF 5 million in non-current liabilities. The accrued income amounts to CHF 100,000 and the accrued costs for the day are CHF 20,000. The fund’s units amount to CHF 10 million.

The NAV is therefore calculated as follows:

NAV = (CHF 200 million + CHF 10 million + CHF 12 million + CHF 100,000 – CHF 20 million – CHF 5 million – CHF 20,000) / 10 million = CHF 19.7 MILLION

On this day, the units of the investment fund are traded at CHF 19.7 per unit.

Net asset value for closed-end funds and open-end funds

An open-ended fund can issue an unlimited number of units, is not traded on a stock exchange and is valued at its NAV at the close of trading each day.

Closed-end funds are listed on a stock exchange, are traded similarly to securities and can be traded at a price that does not correspond to their net asset value. Exchange traded funds (ETFs), for example, are closed-end funds. ETFs trade like stocks and their market value may differ from their actual NAV. This creates profitable trading opportunities for active ETF traders who can identify opportunities in good time. Similar to investment funds, ETFs also calculate their net asset value daily at market close for reporting purposes. In addition, the “indicative” net asset value (iNAV) is calculated several times a minute in real time.

The difference between the net asset value and the redemption and issue price of a fund

The redemption price of an investment fund unit is generally the net asset value per unit. However, the redemption price may differ as the fund company may charge a redemption fee. The redemption price may therefore be slightly lower. When buying units in an investment fund, the front-end load usually has to be paid. For this reason, the issue price may be slightly higher than the NAV.

NAV and fund performance

One way of assessing the performance of an investment fund is to calculate the difference between the net asset values between two points in time. For example, the NAV at the beginning of the year can be compared with the NAV at the end of the year. The change in value can be seen as a kind of performance of the fund, but it is not the best representation of the performance of an investment fund. This is because investment funds regularly distributedividends andinterest to theirshareholders. Accumulated realized capital gains must also be distributed to shareholders. These distributions also reduce the NAV. Although an investment fund investor generates income and returns, the individual returns are therefore not reflected in the absolute values of the NAV when they are compared between two points in time.

For this reason, for example, the annual total return, i.e. the actual return on an investment over a certain period of time, is a better measure of the performance of an investment fund. Another measure is thecompound annual growth rate (CAGR), which is the average annual growth rate over a selected period.