What is deflation?

Deflation is defined as a general fall in prices. This decline affects both goods and services. During deflation, the purchasing power of a currency therefore increases over time. Deflation is usually associated with a decline in the supply of money and credit in the economy. However, it is also possible that prices fall due to increases in productivity and technological innovations. Deflation does not always affect all sectors. Partial deflation may also occur.

During deflation, the nominal costs of capital, goods, services and labor fall, although relative prices remain the same. The consumer benefits from deflation in the short term, as the consumer can buy more with the same nominal income. However, falling prices have a negative impact on many other areas and sectors. The disadvantages relate in particular to the financial sector. Borrowers, for example, have to repay their loan with money that they could currently buy more with than with the money they borrowed at the beginning. Loan installments therefore rise indirectly. As deflation increases the real debt burden, the state also suffers from deflation.

Types of deflation

Basically, there is price deflation and monetary deflation. The more dangerous deflation is monetary deflation. In the latter, there is too little money in circulation in the economy. The effects of this deflation are high. With less money in circulation, less is invested and consumed in the long term. This then has an impact on production, i.e. less is produced. If a company produces less, it will probably lay off employees and cut wages. As a result, the state receives less money in the form of taxes, and these people will in turn consume less and may no longer be able to repay their loans. Deflation can therefore develop into a negative spiral.

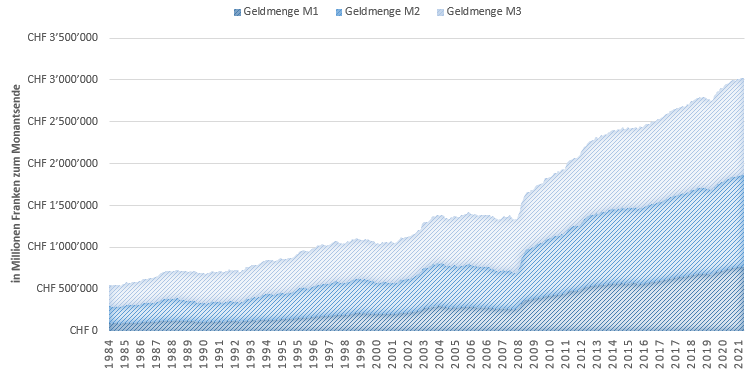

In Switzerland, the money supply continues to grow, as shown in the following chart. The M1 money supply includes currency in circulation, sight deposits and deposits in transaction accounts. The M2 money supply also includes savings deposits, while the M3 money supply also includes time deposits.

Price deflation refers to the fall in consumer prices. Economists argue that consumers cut back on their consumption when prices fall, as goods become cheaper over time. However, this effect cannot always be observed and depends on other factors. Overall, deflation is a positive message for an economy if it is caused by innovation with full employment. However, this form of deflation only occurs very rarely and, above all, it often does not affect all sectors equally.

Money supply M1, M2, and M3 in Switzerland

Own presentation, source of data: SNB, January 27, 2022

Reasons for deflation

In general, deflation exists when the following circumstances occur:

Risk of deflation =

falling economic growth

+ falling inflation rate

+ falling long-term interest rates

As a rule, monetary deflation is caused by a reduction in the supply of money or liquid financial instruments redeemable in money. Central banks can influence the supply of money. If the supply of money and credit falls and economic output remains constant, the prices of all goods fall. Deflation, for example, often occurs after a period in which the money supply has been artificially expanded. The last major deflation was in the USA in the 1930s. Bank collapses caused the money supply to fall sharply.

However, falling prices can also have other causes. One of these causes can be a decline in overalldemand. Aggregate demand shifts, for example, due to lower government spending, a collapse of the stock market, consumer saving, and tighter monetary policy (higher interest rates, for example). Similarly, higher productivity can cause prices to fall if economic output grows faster than the supply of circulating money and credit. This is often the case in industries that benefit from new technologies, as the new technologies can be used to work more efficiently. As a result, production costs and other costs can be reduced and the product can be offered at a lower price. This process differs from general price deflation, as not all prices are affected by the fall.

Changing views on the effects of deflation

After the Great Depression in the US, most economists considered deflation to be a negative phenomenon. Subsequently, most central banks adjusted their monetary policy to encourage a steady increase in the money supply, even if this led to chronic price inflation and encouraged debtors to borrow too much.

British economist John Maynard Keynes warned against deflation, believing that it contributes to a downward cycle of economic pessimism during recessions when asset owners see their prices fall and therefore reduce their willingness to invest. The economist Irving Fisher developed an entire theory for economic depressions based on debt deflation. Fisher argued that the repayment of debt following a negative economic shock can lead to a greater reduction in the supply of credit in the economy, which in turn leads to deflation, further increasing the pressure on debtors, which in turn leads to further repayments and a depressionary spiral.

Recently, economists have increasingly questioned the old interpretations of deflation, particularly following the 2004 study by economists Andrew Atkeson and Patrick Kehoe. After studying 17 countries over a 180-year period, Atkeson and Kehoe found that in 65 out of 73 deflation episodes there was no economic downturn, while in 21 out of 29 depressions there was no deflation. There are now a variety of opinions on the benefits of deflation and price deflation.

Excursus: The SNB and monetary policy

As already mentioned, central banks can influence the money supply. For example, the central bank can aim for a deflation rate. This may be desirable, for example, if inflation is to be restricted. The central bank uses monetary policy instruments for this purpose. In Switzerland, the SNB has the task of keeping the money market in Switzerland liquid. The permitted instruments are set out in Art. 9 NBA. The instruments of monetary policy are generally open market operations and standing facilities.

Open market operations

The SNB can conduct repo transactions within the framework of auctions. The SNB uses volume or variable rate tenders. In a volume tender, business partners (e.g. banks) can request liquidity from the SNB. The SNB sets a price for the liquidity. This price is known as the repo rate. In the case of a variable rate tender, the business partners ask for liquidity at a certain price(interestrate) that they are prepared to pay for the liquidity. The term of these repo transactions can be overnight (i.e. from one day to the next) or several months. There is also an electronic marketplace for repo transactions. The SNB can publish offers there at any time.

Standing facilities

Here, business partners are offered interest-free liquidity during the day via the intraday facility through repo transactions. The money must be repaid within the same bank working day.