What is a bond?

A bond is a fixed-interest financial instrument that represents a loan from an investor (in this case a lender) to a borrower (usually a company or a state). The owners of a bond are the debtors, i.e. the borrowers. They are also referred to as the issuer. The buyer of a bond is by definition the lender. A bond therefore enables an investor (lender) to lend money to a company, for example, by the investor buying a bond from the company. Investors receive interest, also known as the coupon(rate) or bond interest. At the end of an often predefined term, the capital of the loan must be repaid to the owner of the bond (lender).

Most bonds have common basic characteristics, such as the nominal value, which is the amount due at the end of the term. The coupon rate is the interest rate that the issuer (borrower) of the bond pays on the face value of the bond. The most important factors determining the interest rate are creditworthiness and maturity. If an issuer has a poor credit rating, the probability of default is higher and the interest rate it must pay to compensate the lender for the risk is higher. Bonds with a very long term usually also pay a higher interest rate. Coupon dates are the dates on which the issuer of the bonds makes the interest payments. The maturity date is the date on which the issuer (borrower) pays the lender the nominal value of the bond. The issue price is the price at which the issuer originally sold the bond. Typical risks of bonds are interest rate risk, spread risk, credit risk, liquidity riskand other risks such as currency risk, inflation riskand risk of premature termination.

A bond is referred to as a fixed-interest instrument, as bonds traditionally pay a fixed interest rate(coupon) to the borrower. However, variable or fluctuating interest rates are now also common. Bonds offer a solution by allowing many individual investors to take on the role of lender. In addition, bonds can be traded. In other words, an investor does not have to hold a bond until its maturity date. It is also common for bonds to be repurchased by the borrower when interest rates fall or the borrower’s credit rating has improved and they can issue new bonds at a lower cost.

The issuers of bonds

The usual issuers of bonds are governments and companies. They issue bonds in order to borrow money.

Governments issue so-called government bonds. The money is needed to finance roads, schools and other infrastructure, for example.

Companies issue corporate bonds to invest in their business. As a rule, companies need far more money for this than the average bank can provide.

Different types of bonds

Bonds can be issued in different forms. The bonds available to investors therefore come in a wide variety of forms. They can be differentiated according to the interest rate or the type of interest or coupon payment, be recalled by the issuer or have other features.

Differentiation by security

e.g. senior bonds and subordinated bonds

While senior bonds are given priority in the event of bankruptcyof the issuing company, subordinated bonds are only taken into account after all other outstanding bonds have been repaid. For this reason, the risks and yields of subordinated bonds are higher than those of senior bonds.

Securitized rights or bonds with option rights

e.g. convertible bonds, callable and puttable bonds

These bonds are provided with an option. The convertible bond contains either a conversion right or a conversion obligation. The convertible bond thus gives the holder the right, or the obligation, to convert the bond into shares within a certain period of time. The mandatory convertible bond is a variant of the normal convertible bond. One example is the CoCo bond. This bond is automatically converted into equity when a predetermined event occurs. A callable bond is a bond that can be called by the company (borrower) before maturity. The so-called puttable bond allows bondholders to return or sell the bond to the company before it matures.

Issue currency and place of issue

e.g. hybrid bonds

This is a bond in which the payment and the current interest payment are made in a different currency than the repayment. There are also domestic bonds and foreign bonds.

Interest rate structure and maturity

e.g. straight bonds

The straight bond, for example, is a fixed-interest bond where the interest rate is fixed over the entire term. A so-called floater is a bond with a variable interest rate. The zero-coupon bond is a bond where no ongoing interest payments are made. In return, the investor is compensated by the difference between the lower issue price and the higher redemption price.

Interest rate risk of bonds

Interest rate risk is an important risk factor for bonds. The price of a bond therefore changes in response to interest rate trends in the economy. If the interest rate falls, a bond becomes increasingly attractive. If interest rates fall, investors on the market would bid up the price of the bond until it trades at a premium that corresponds to the prevailing interest rate environment. The bond would therefore no longer be traded at par (100%), but above par. As a result, the yield on the bond is lower than the nominal interest rate, because the buyer has paid more for the bond than the nominal value he will receive at maturity. For this reason, the famous statement that the price of a bond behaves inversely to interest rates applies. When interest rates rise, bond prices fall in order to bring the interest rate of the bond into line with current interest rates, and vice versa. This effect is also known as interest rate risk.

The valuation of bonds

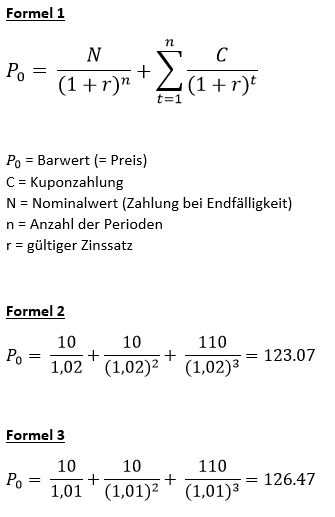

When buying a bond, the investor benefits from the interest and also from price increases. A bond does not have to be held until maturity. Bondholders can sell their bonds on the open market at any time. The price is often quoted as a percentage of the respective nominal value. A price of 110.25 means that a buyer must pay 110.25 % of the nominal value of the bond at the time of purchase. The present value of all expected future payments is used to value bonds. The general formula 1 shown applies.

Assume a bond has a term of 3 years. The nominal value is CHF 100 and a coupon of 10% is paid. The issue was carried out at par (=100%). The present value, i.e. the current value of this bond, can now be determined. The risk-free market interest rate is used as the interest rate. Assume that this is currently 2%. The calculation is shown in Formula 2.

Assume that the risk-free interest rates fall to 1% after the bond is purchased. This leads to an increase in the present value of the bond. The calculation is shown in Formula 3.

Yield to maturity (YTM)

The yield to maturity (YTM) of a bond is another way of looking at the price of a bond. YTM is the expected total return on a bond if the bond is held to maturity. The yield to maturity is considered the long-term bond yield, but is expressed as an annual rate.