Dividend in Kind CALIDA 2022

Tips & Financial Figures

One of the better-known non-cash dividends in Switzerland is the shareholder pyjamas from the CALIDA Group. Non-cash dividends are a popular way for companies to offer their shareholders something special. A shareholder gift is an ideal way to strengthen the emotional bond between the company and its shareholders. It is also a good and inexpensive way to advertise your company to an audience that is often already positively disposed towards it.

In 2022,Shareholder of CALIDA AG once again received a pair of pyjamas. However, there are a few conditions to be met in order to receive them. In this blog post, I will briefly introduce CALIDA AG. You will also find some tips on how to get your own CALIDA pyjamas. As an Independent Wealth Management from Basel I have, of course, once again prepared a few selected financial figures for CALIDA AG in as simple and clear a way as possible.

Attention! Don’t Miss out on the Draw!

Attention! Don’t Miss out on the Draw!

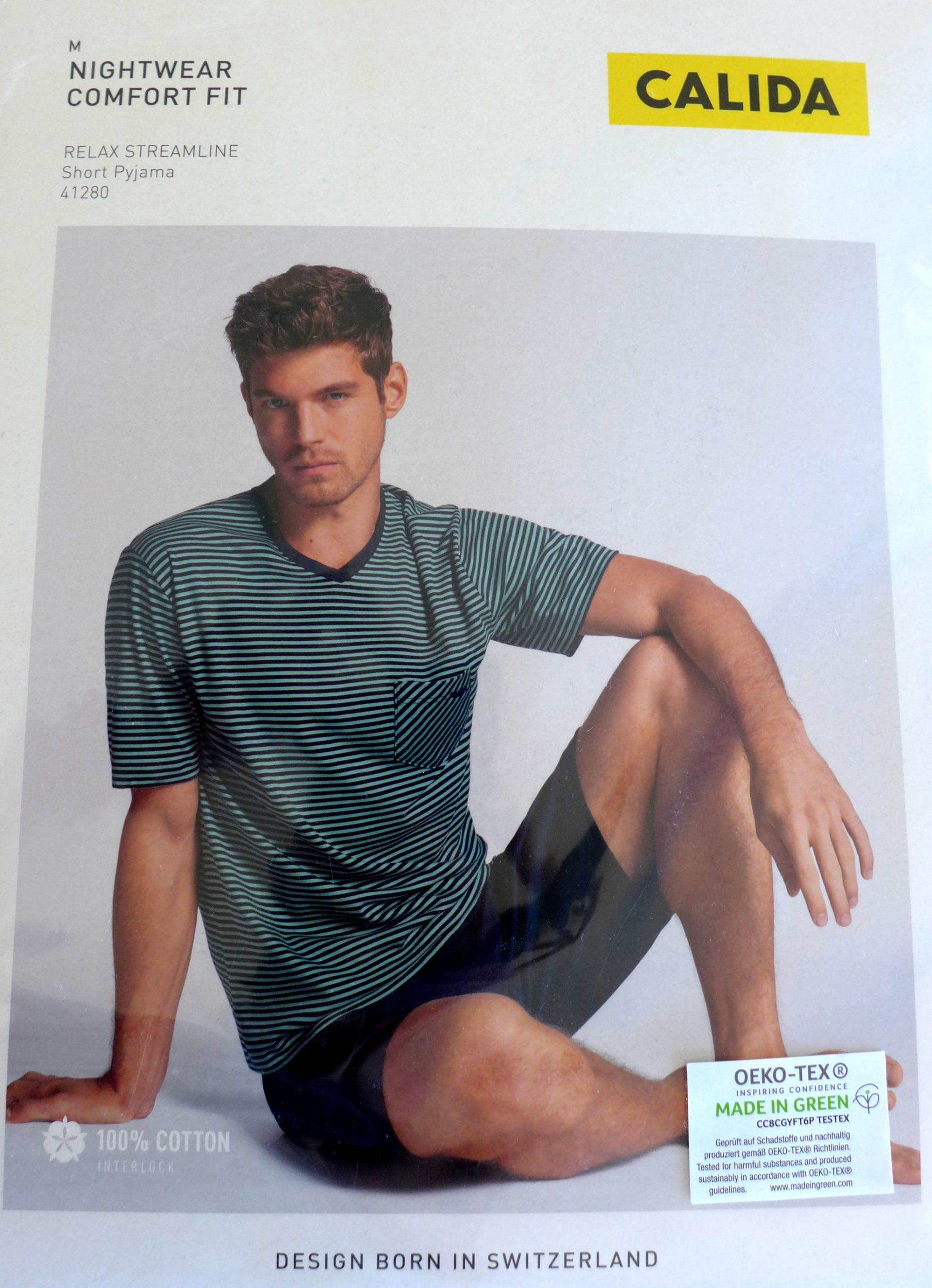

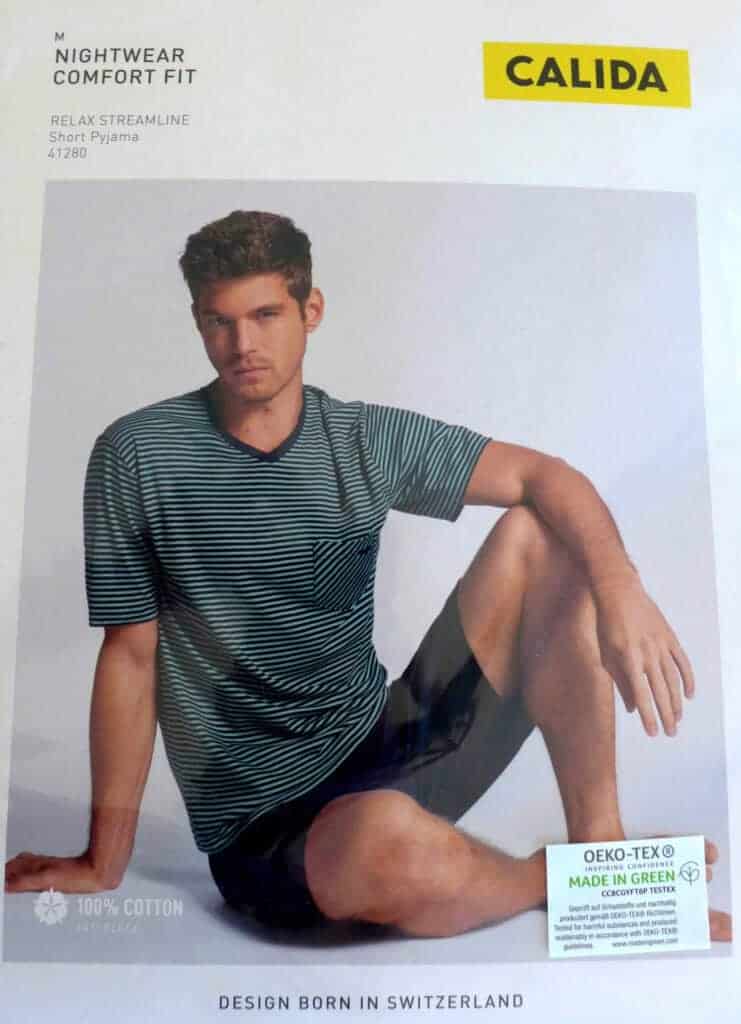

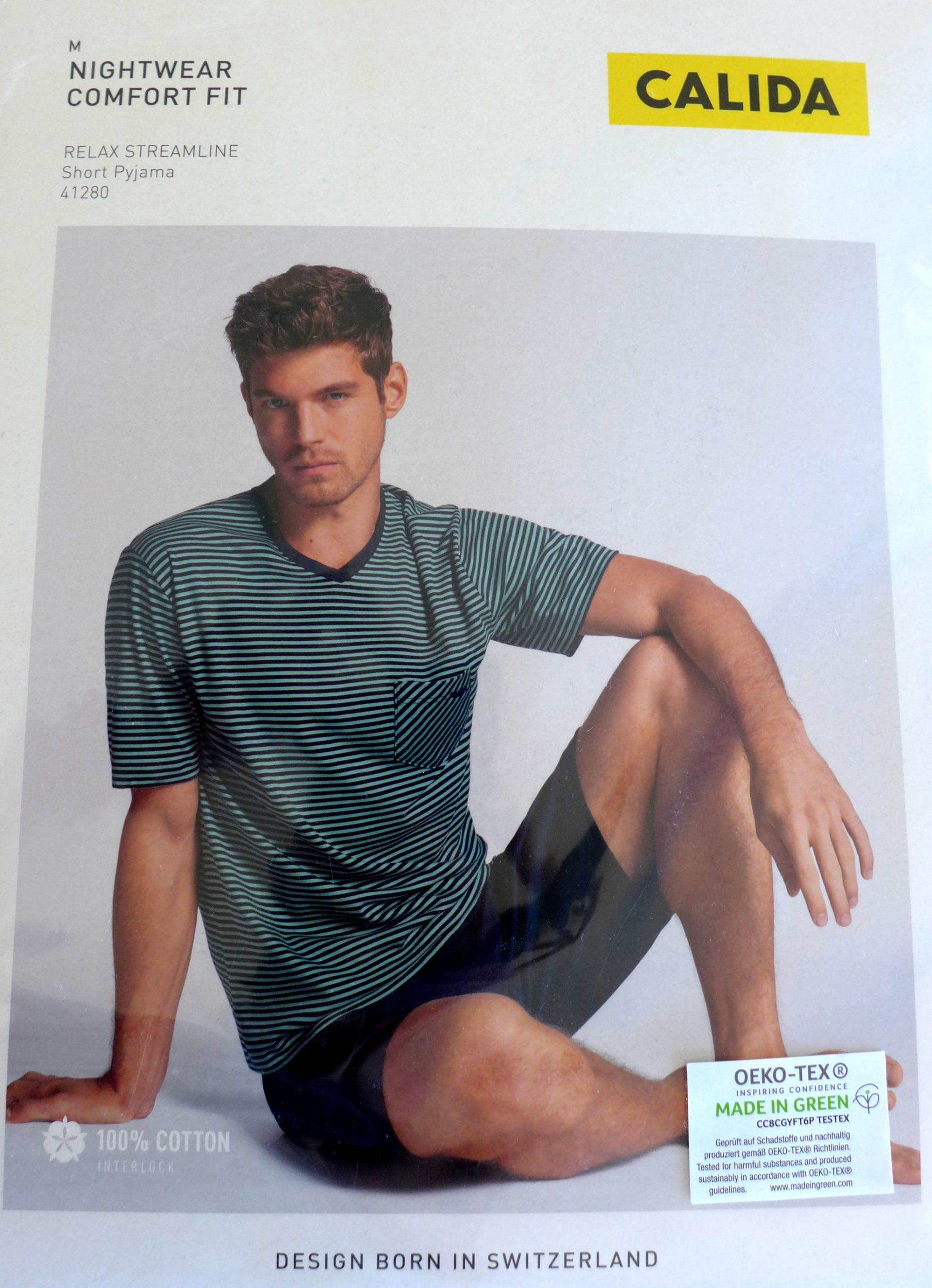

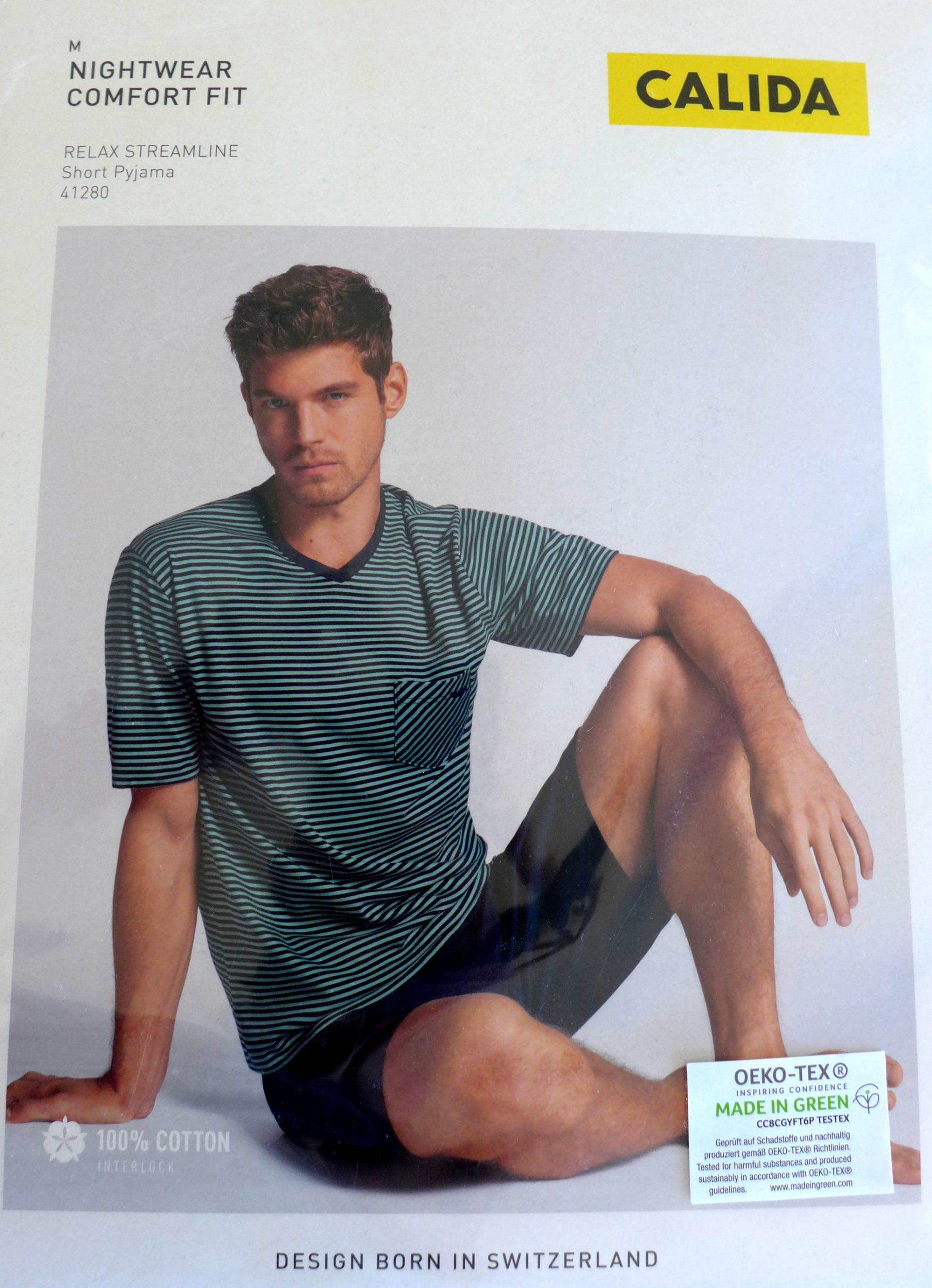

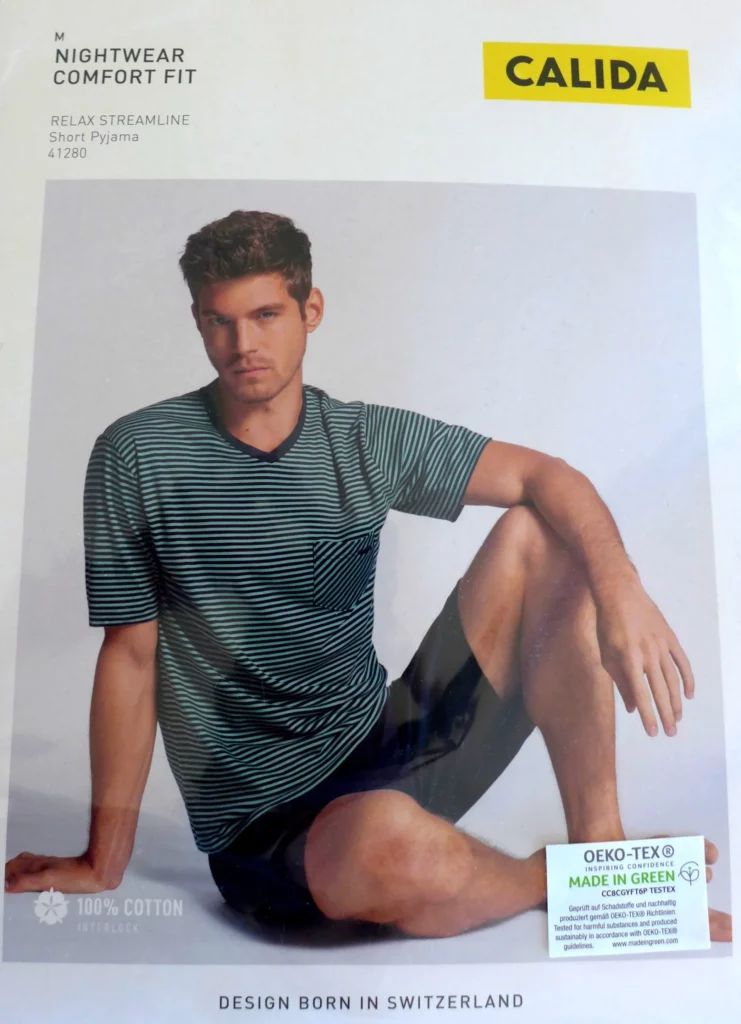

I am giving away my shareholder pyjamas, worth 79.90 Swiss francs, here. They are, of course, brand new and in their original packaging.

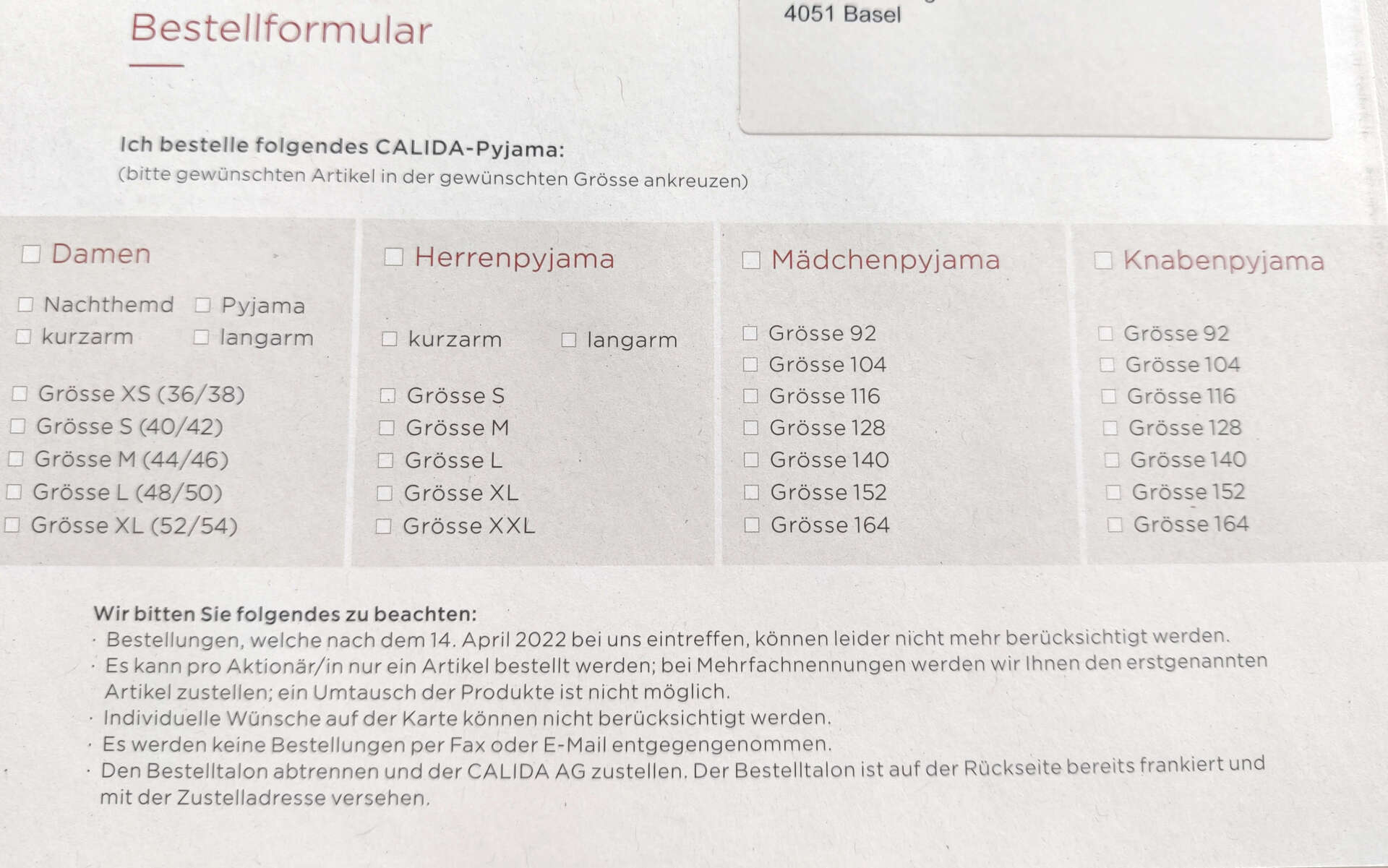

Perfect for the high summer temperatures, these are short-sleeved pyjama shorts in size M. They are made from 100% high-quality cotton in the best CALIDA quality.

To take part in the draw, simply scroll down to the bottom of the blog post. You will find the terms and conditions of entry there.

Perfect for the high summer temperatures, these are short-sleeved pyjama shorts in size M. They are made from 100% high-quality cotton in the best CALIDA quality.

To take part in the draw, simply scroll down to the bottom of the blog post. You will find the terms and conditions of entry there.

I am giving away my shareholder pyjamas, worth 79.90 Swiss francs, here. They are, of course, brand new and in their original packaging.

Perfect for the high summer temperatures, these are short-sleeved pyjama shorts in size M. They are made from 100% high-quality cotton in the best CALIDA quality.

To take part in the draw, simply scroll down to the bottom of the blog post. You will find the terms and conditions of entry there.

The CALIDA Group

The brand CALIDA is well known in Switzerland. The head office of CALIDA is located in Sursee in the Canton of Lucerne, Switzerland. CALIDA was founded in 1941 as a knitwear factory in Sursee. Since 1986, CALIDA has been a holding company and in 1987 it went public on the Swiss stock exchange.

Today, the CALIDA Group is internationally active with the following five brands in four countries:

- CALIDA – pyjamas, underwear and much more (Switzerland)

- AUBADE – women’s underwear (France)

- COSABELLA – premium lingerie (Italy)

- ERLICH TEXTIL – sustainable lingerie (Germany)

- LAFUMA MOBILIER – outdoor furniture (France)

The acquisition of the premium lingerie brand Cosabella was successfully completed just this year on 23 May 2022 – as can be seen from the CALIDA Group’s ad hoc press release dated 24 May 2022.

The erlich textil brand was also taken over by the CALIDA Group at the beginning of 2022 on 4 February. The ad hoc press release on the acquisition with more details can be found here. With topics such as sustainability and a purely digital distribution channel that focuses on a young target group, CALIDA is very much in tune with the times.

In 2021, CALIDA generated a turnover of 298 million Swiss francs. Further details can be found in the 2021 Annual Report, which can be downloaded directly here:

Download Geschäftsbericht CALIDA 2021

Shares of CALIDA AG

Calida AG’s shares plunged in the wake of the coronavirus crisis, as did almost all other stocks. From a high of 37.10 Swiss francs on 21 February 2020, the low on 17 March 2020 was 25. Swiss francs. This means that the share price fell by as much as 32.6 per cent. However, CALIDA Share then recovered very nicely. Particularly in 2021 – which was a very good year on the stock market.

The recovery continued at the beginning of 2022, reaching the current all-time high of 59. Swiss francs on 10 February 2022. This represents a value increase of 59 % in just under 2 years between February 2020 and 2022, or a 26 % Rate of Return per year from February 2020 to February 2022.

However, the Calida share was also unable to escape the negative stock market environment with the war in Ukraine and higher inflation. As a result, the price fell from 10 February 2022 to 1 July 2022 to its current level of 40.50 Swiss francs. Compared to the price of 37.10 Swiss francs on 21 February 2020, this still represents a gain in value of around 9.2 %.

As an Independent Wealth Management from Basel however, I don’t just look at the yield over the entire term. I’m also interested in the annual return: over a period of two years and 69 days, the yield is around 4.1 % or the price gain per year. But it can be a lot better – as it is with CALIDA. You can find out in the next section.

Shares, Dividends & Pyjamas

My experience with CALIDA began on 12 November 2020. I had missed out on the bottom price of 25 per share on 17 March 2020. But I really wanted these shareholder pyjamas! In November 2020, the opportunity seemed good because after the low of CHF 25 in March 2020, the share price recovered and was sometimes above CHF 30 per share. On 12 November 2020, I then received my Calida shares for CHF 26.70 per share. Despite the last crash to 40.50 Swiss francs, I still have a gain of 51.7 %. The holding period for this was 1 year and 232 days, which corresponds to a return of around 29 % per year – and that’s not including the dividend yield. And of course, neither are the two pairs of pyjamas from 2021 and 2022. On 23 April 2021, I received a dividend of 1.60 Swiss francs per share and on 22 April 2022, I received another 1.- per share. In addition, in 2021 there was a long-sleeved pyjama set worth 99 francs and in 2022 there was a short-sleeved pyjama set worth 79.90 francs. To receive these pyjamas, you have to hold at least 20 CALIDA Share.

I couldn’t help but write down all the numbers in a table and calculate what the investment would yield. Of course, this includes the shareholder pajamas – the Rate of Return is of course at its maximum if you only hold the minimum number of 20 shares. Because then you only have to divide the value per item of pyjamas by 20 to get the value per share. Because anyone who holds more CALIDA shares still only gets one set of pyjamas a year. You could probably optimise your return a little more if you always ordered the long-sleeved pyjamas, because these cost an extra CHF 20. But then you wouldn’t have anything for the warmer months. It also wouldn’t have been a bad idea to buy a few more CALIDA shares than just 20 if you look at the price gain per Share of 51.7 % over the entire holding period or 29 % per year. Including dividends, it was even 61.42 % or 34 % Rate of Return per year. For me, however, the investment in November 2020 was more of a gimmick because of the shareholder gift than a real investment case. Hindsight is always 20/20.

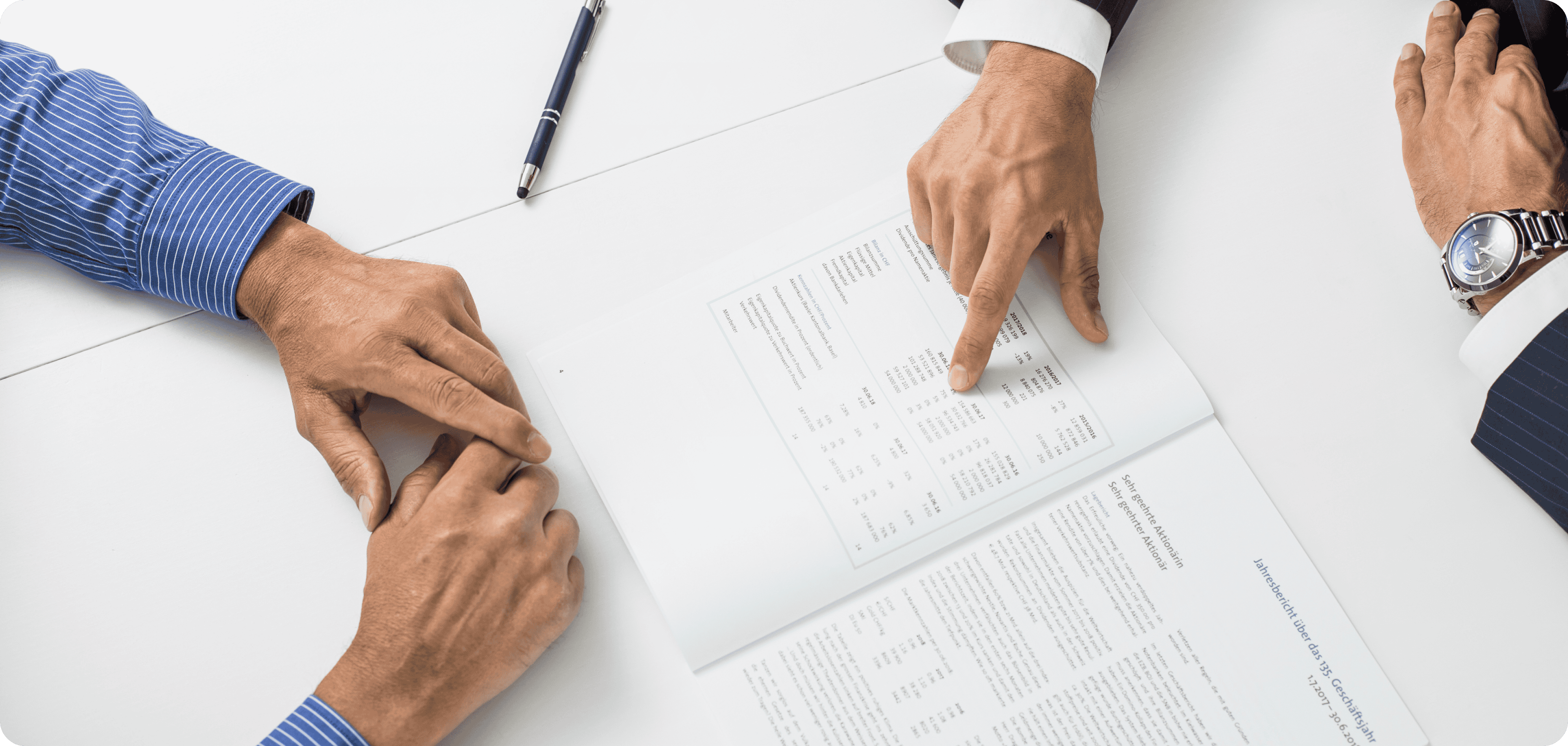

So here is a brief overview of the figures of my CALIDA pyjama adventure:

| Date | Event | CHF per share | Yield in % |

|---|---|---|---|

| 12. November 2020 | Purchase | 26.70 | |

| 23. April 2021 | Dividend | 1.60 | 5.99 % |

| April 2021 | Pyjamas | 4.95* | 18.54 % |

| 22. April 2022 | Dividend | 1.00 | 3.75 % |

| April 2022 | Pyjama | 4.00* | 14.98 % |

| 1. July 2022 | Share price | 40.50 | |

| 3. July 2022 | Capital gain per share | 13.80 | 51.70 % |

| Dividend income | 2.60 | 9.74 % | |

| Total revenue CHF | 16.40 | 61.42 % | |

| Total value of pyjamas | 8.95 | 30.70 % | |

| Total yield incl. pyjamas | 25.35 | 94.94 % | |

| Pyjama draw | -4.00 | -14.98 % | |

| Total return per share | 21.35 | 79.96 % | |

| Total return per year – holding period 1 year + 232 days | 43.2 % |

*= value of pyjamas (99 or 79.90) / 20 shares

Instructions for CALIDA Shareholder Pyjamas

Tips on How You Can Get a Pair of CALIDA Pyjamas Every Year:

1. Buy CALIDA shares: CALIDA AG shares are traded on the Swiss stock exchange. You can find them under ISIN: CH0126639464. IMPORTANT: You need at least 20 Share to receive a pair of pyjamas. Currently, 20 shares cost 810 Swiss francs.

2. Enter your name in the register: To let CALIDA know that you are a shareholder, you should enter your name in the register. This way, you will automatically receive the documents to order the shareholder pajamas. The process for doing this varies from bank to bank: Often there is a function that allows you to register directly in e-banking. It is best to inquire directly with your bank or broker.

3. Order form: You will receive an order form from CALIDA towards the end of March. You can use this to specify your size and preference (short-sleeved, long-sleeved, etc.). You must return the completed order form to CALIDA by mid-April.

- Buy CALIDA shares: CALIDA AG shares are traded on the Swiss stock exchange. You can find them under ISIN: CH0126639464. IMPORTANT: You need at least 20 Share to receive a pair of pyjamas. Currently, 20 shares cost 810 Swiss francs.

- Enter your name in the register: To let CALIDA know that you are a shareholder, you should enter your name in the register. This way, you will automatically receive the documents to order the shareholder pajamas. The process for doing this varies from bank to bank: Often there is a function that allows you to register directly in e-banking. It is best to inquire directly with your bank or broker.

- Order form: You will receive an order form from CALIDA towards the end of March. You can use this to specify your size and preference (short-sleeved, long-sleeved, etc.). You must return the completed order form to CALIDA by mid-April.

Shareholder Pyjamas 2022 – Short-Sleeved

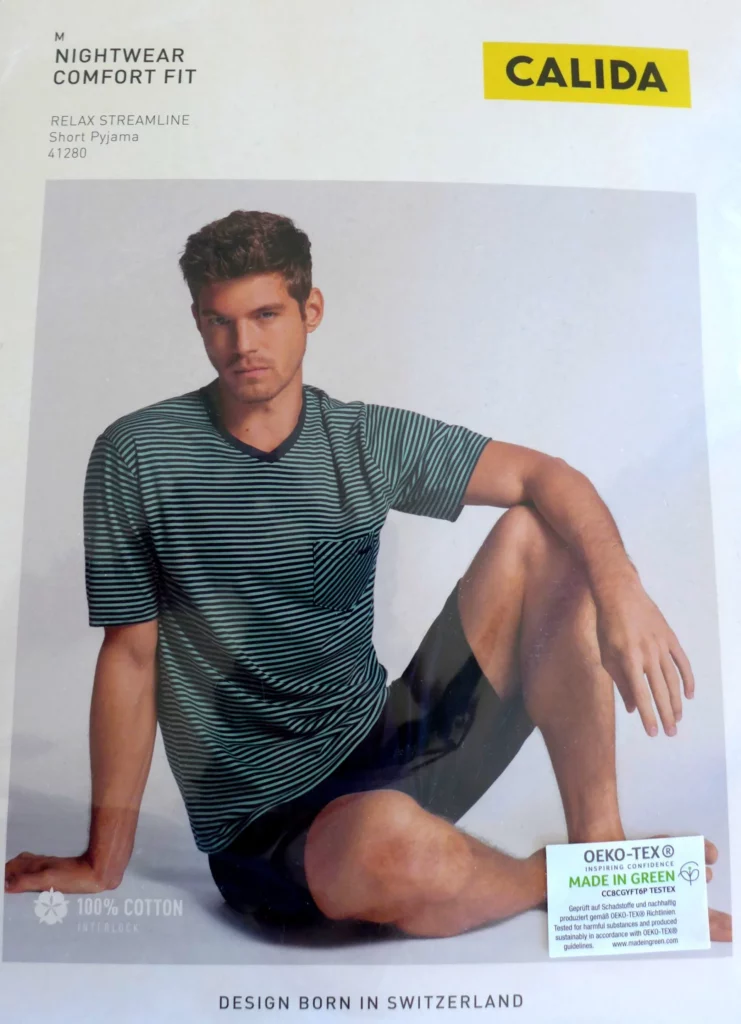

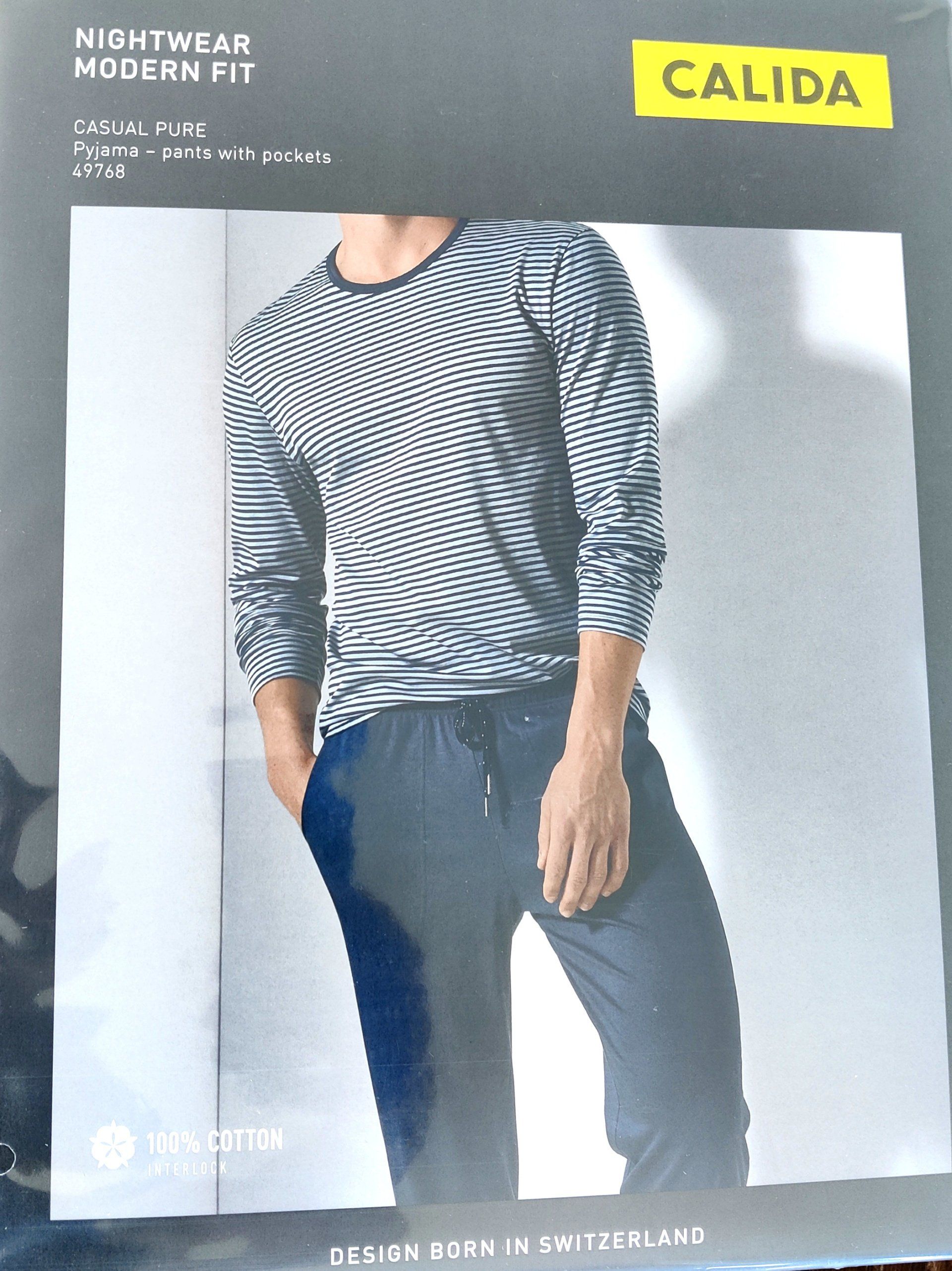

Shareholder Pyjamas 2021 – Long Sleeve

Shareholder Pyjamas 2021 – Long Sleeve

Selected Key Figures

CALIDA AG

As an Independent Wealth Management from Basel , of course I don’t just want to make you ‘taste’ the Calida pajamas, but above all I want to show you the investment side. A company can be analysed from different angles. On the one hand, Qualitative Analysis, but also quantitatively. I have put together some key figures here that I think are useful for getting a first impression of Calida AG. Among other things, I work with these key figures in my value and momentum strategy, even though many other factors are also included in the analysis.

| Calida AG | Key figures | Scoring | Remarks |

|---|---|---|---|

| ISIN | CH0126639464 | ||

| Country | Switzerland | ||

| Value metrics | Price-to-Book Ratio | 1.95 | fairly to highly valued |

| Price-Earn Ratio | 16.67 | fairly valued | |

| Price-to-Sales Ratio (P/S) | 1.13 | fairly valued | |

| EV/EBITDA | 7.01 | low to fair valued | |

| Price-Cash Flow Ratio | 6.28 | low to fair valued | |

| Return for shareholders | -1.07 % | Dilution by new shares | |

| Profitability | Return on assets (ROA) | 1 | Net profit CHF 20.3 million. |

| Cash Flow / ROA (CFROA) | 1 | Cash flow from operating activities CHF 40 million | |

| Change in the ROA | 1 | ROA improved from -0.0038 to 0.0641 | |

| Quality of earnings | 1 | CFROA (CHF 54.0 mn) is higher than ROA (CHF 20.3 mn) | |

| Financing | Debt restructuring | 1 | Gearing down from 0.118 to 0.096 |

| Change in working capital (liquidity) | 1 | Liquidity ratio 3 increased from 1.73 to 1.80 | |

| Change in the number of shares issued | 0 | Number of shares rose from 8.25 million to 8.35 million | |

| Efficiency | Change in gross margin | 1 | Gross margin increased from 69% to 71% |

| Change in the rate of turnover of assets | 1 | Asset turnover increased from 66% to 95% | |

| Piotroski F-Score | 8 |

Why these Value Metrics in Particular?

The basics of value investing are reasonably clear: value investors look for undervalued companies to invest in. This often involves a quantitative and a Qualitative Analysis. However, when it comes to the actual implementation, there are a large number of approaches. I think it is dangerous to focus on a single key figure, such as the Price-to-Earnings Ratio (P/E) or the price-book ratio, and to base your investment decision solely on these quantitative factors of Enterprise Valuation. In my opinion, a combination of Enterprise Valuation makes more sense – such as the Value Composite from O’Shaugnessy. In my opinion, such long-term studies are worth their weight in gold and also highly informative. He analysed a wide range of value indicators over a period of 45 years, from 1 January 1964 to 31 December 2009, to find out which value indicators could be used to select companies to achieve the best returns. This resulted in the so-called value composite, which is a combination of these value indicators. He tested this combined valuation ranking for all rolling 10-year periods over the 45-year period between 1964 and 2009. He found that it performed better in 82% of cases than companies that were undervalued based on a single valuation metric – but not when the other valuation metrics were also considered.

Why use the Piotroski F-Score?

The Piotroski F-Score provides an initial estimate of a company’s profitability, financing and efficiency. It was developed by Professor of Accounting Joseph D. Piotroski. In 2000, he wrote a research paper entitled ‘Value Investing: The Use of Historical Financial Statement Information to Separate Winners from Losers’. His results exceeded his most optimistic expectations.

The purchase of companies that scored the highest number of points of 8 or 9 on his nine-point scale or F-score, as he called it, led to an average excess return of 13.4 % over the market in the 20-year period from 1976 to 1996.

You can download his research paper as a PDF here:

Conclusion: CALIDA AG

Key Figures Calida AG

CALIDA AG seems to be fairly or even slightly undervalued at the moment. CALIDA AG’s figures are convincing in terms of profitability, financing and efficiency. The only downside is that the number of Shares Issued has increased. This means that the profit has to be divided by more shares and is thus diluted.

Value Composite

CALIDA AG has a value composite of 31, which means that from this perspective, the company is valued rather low.One negative point is that Revenues (Sales) have fallen by 4.31 % per year over the last five years. However, last year they rose again by 7.3 %.

Piotroski F-Score

CALIDA AG has an F-Score of 8. This is a very good value, which usually indicates a very healthy situation. Especially when you consider the research of Professor Joseph D. Piotroski: After all, companies that achieved the highest score of 8 or 9 were able to generate an average excess return of 13.4 % over the market over a 20-year period from 1976 to 1996. However, I would like to add a word of warning here: NOT every company with an F-score of 8 or 9 achieves such a Rate of Return! Some are significantly above it, some may be close to it and some are significantly below it. Such studies usually take into account a diversified Securities Portfolio . So it doesn’t just work to buy such a Share. In my own investmentsand especially as an Independent Wealth Management from Basel I make sure to keep a close eye on so-called individual stock risks.

Would I Buy CALIDA AG Shares Today?

Even though it all started as a joke, and I bought the CALIDA shares mainly because of the dividend in kind – the pyjamas, that is – a look at the figures shows that the company has come a long way. At the turn of the millennium, CALIDA was still in crisis and a candidate for going out of business after posting a loss for the first time in the company’s history in 1999. Today, management seems to be doing a number of things right and is pursuing a seemingly healthy expansion policy. Megatrends such as sustainability and digitalisation are also taken into account.

In the current environment, with high levels of inflation in some cases, particularly for raw materials, logistical problems in supply chains and the war in Ukraine, I am rather cautious about investing in the textile industry. In this environment – but also in general – you can’t just buy anything, you have to be very selective. At the moment, I see more opportunities in the commodities sector, as you can read in my last post on rebalancing. There are currently also profitable companies that can be bought more cheaply and also have positive momentum.

However, I will definitely keep my 20 Calida Share – they are of little significance in the Securities Portfolio and the pyjamas have always been reliably delivered.

When it comes to asset management for my clients, I look for a combination of low valuation and high momentum. The current portfolio of Estoppey Value Investments asset management can also be found here on the blog under the most recent rebalancing.

IMPORTANT – Terms and Conditions of Entry

To take part in the draw, you only have to do two things:

1. Write a comment:

For example, what is your favourite kind of dividend?

Hint: Comment as a guest – enter your name and simply tick the checkbox ‘I prefer to write as a guest’.

2. Send a short message:

Press the ‘Raffle’ button and use the contact form to let me know how I can best reach you after the raffle if you have won: e.g. by email.

The draw will take place until Sunday, 7 August 2022 – after which I will inform the winners by email and send the prizes by post. We only deliver to addresses in Switzerland and Europe.

The following readers won in the last draw in the article about Jungfraubahn Holding AG:

• A09: Shareholder voucher & First coin

• Tommy: Jungfraujoch & First Cliff Walk Coin Magnet

Thank you for participating and enjoy your prizes.

To take part in the draw, you only have to do two things:

- Write a comment:

For example, what is your favourite kind of dividend?

Hint: Comment as a guest – enter your name and simply tick the checkbox ‘I prefer to write as a guest’. - Send a short message:

Press the ‘Raffle’ button and use the contact form to let me know how I can best reach you after the raffle if you have won: e.g. by email.

The draw will take place until Sunday, 7 August 2022 – after which I will inform the winners by email and send the prizes by post. We only deliver to addresses in Switzerland and Europe.

The following readers won in the last draw in the article about Jungfraubahn Holding AG:

- A09: Shareholder voucher & first coin

- Tommy: Jungfraujoch & First Cliff Walk Coin Magnet

Thank you for participating and enjoy your prizes.

The Prize Draw is for:

2022 Shareholder pyjamas:

• Value: 79.90 Swiss francs

• Men’s short-sleeved pyjamas

• Size M

• 100% high-quality cotton

• Best CALIDA quality

2022 Shareholder pyjamas:

• Value: 79.90 Swiss francs

• Men’s short-sleeved pyjamas

• Size M

• 100% high-quality cotton

• Best CALIDA quality

2022 shareholder pyjamas.

- Value: 79.90 Swiss francs

- Men’s short-sleeved pyjamas

- Size M

- 100% high-quality cotton

- Best CALIDA quality