What is a discounted cash flow (DCF)?

The discounted cash flow (DCF) is a discounted cash flow and is used as a valuation method to estimate the value of an investment on the basis of the expected future cash flows (cash flow, cash flow, cash inflow or cash surplus). The aim is to estimate the return that an investor would receive from an investment, adjusted for the time value of money. The time value of money assumes that one franc today is worth more than one franc tomorrow. This is based on the assumption that the franc can be invested in alternative ways and that its value can therefore be increased.

In DCF analysis, the present value of the expected future cash flows of an investment is estimated using a discount rate (see also discounting). Investors can use the DCF analysis to determine whether the future cash flows of an investment or project are equal to or higher than the value of the original investment. This makes it possible to decide whether the investment is worthwhile. If the value calculated using DCF analysis is higher than the current cost of the investment, this option should be considered.

The DCF analysis is based on assumptions, which limits the informative value of the method. The investor must estimate the cash flows correctly. These depend on many factors, such as market demand and the economic situation. The discount factor must also be estimated accurately.

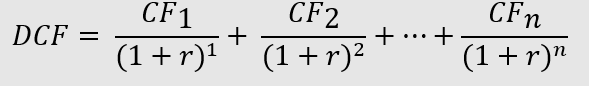

The formula for calculating the discounted cash flow

CF : Cash flow for the given year n

r : Discount factor

Example of calculating the discounted cash flow

Companies can use the DCF analysis to decide whether certain investments are worthwhile. Companies usually use their weighted average cost of capital as the discount factor. According to the shareholder value principle, a company should generate at least the cost of capital in the long term. The cost of capital can be defined as the compensation demanded by the capital market for an investment of a certain risk and a certain term. According to this principle, the cash flow figures are therefore discounted at the cost of capital. Possible cost of capital approaches are the WACC method (before tax) and the MECC method (after tax).

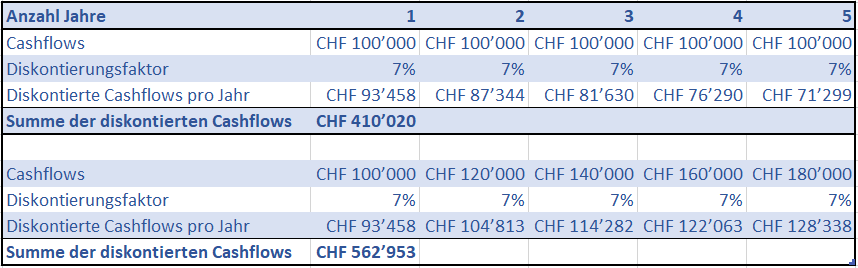

Assume the initial investment of the project is CHF 500,000. The project will run for five years and the company’s WACC is 7%. The investment generates cash flows of CHF 100,000 per year. If the cash flows per year are discounted with the WACC, the sum of the discounted cash flows is CHF 410,020. As this value is smaller than the CHF 500,000 invested, the project is not worthwhile in this case. Subtracting the initial investment from the sum of the discounted cash flows gives the net present value (NPV), which should be positive.

If the project were to generate a cash flow of CHF 100,000 in year 1, CHF 120,000 in year 2, CHF 140,000 in year 3, CHF 160,000 in year 4 and CHF 180,000 in year 5, the sum of the discounted cash flows would be CHF 562,935. In this case, the investment would be worthwhile, as the NPV is positive. The calculations are shown in the table below:

The DCF method for company valuation

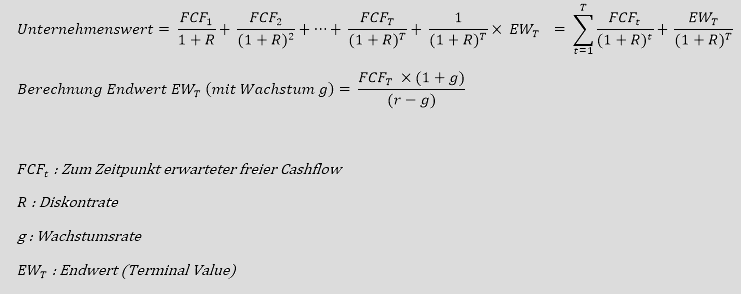

In addition to other methods, the DCF method is still frequently used today in company valuation. The aim here is to determine the fair value of a company on the basis of future cash flows. The series of cash flows that an investor expects over the duration T of the investment is added to the terminal value. The free cash flow serves as the base value. The free cash flow is the cash flow that could be distributed without affecting the current business plans.

The general formula for company valuation using the DCF method with terminal value

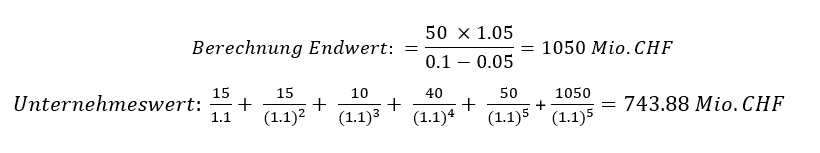

Example of company valuation using the DCF method with growth rate

Company Y expects the following free cash flows (in CHF million) for the next 5 years: 15, 15, 10, 40, 50. Free cash flows are forecast to grow by 5% per year thereafter. The capital market requires a discount rate of R = 10%. What is the enterprise value of company Y?

To calculate the value per share, the company value is divided by the number of shares issued. This value can be compared with the current market priceof the share. In the value investing approach, an investor tries to find undervalued shares whose market price is lower than the calculated value per share. If, on the other hand, the current market price is higher than the calculated value per share, the share may be overvalued by the market.