What is a balance sheet?

The balance sheet is the financial statement of a company. The balance sheet shows theassets, liabilities and equity of a company at a specific point in time. In other words, a balance sheet is a financial report that provides a snapshot of what a company currently owns and what a company currently owes. In addition, the balance sheet shows the amount invested byshareholders.

Depending on the company, different parties may be responsible for preparing the balance sheet. For small private companies, the balance sheet may be prepared by the owner or an accountant of the company. For medium-sized private companies, it may be prepared internally and then audited by an external accountant. Public companies, on the other hand, are required to be audited by external auditors and must also ensure that their books are kept to a much higher standard.

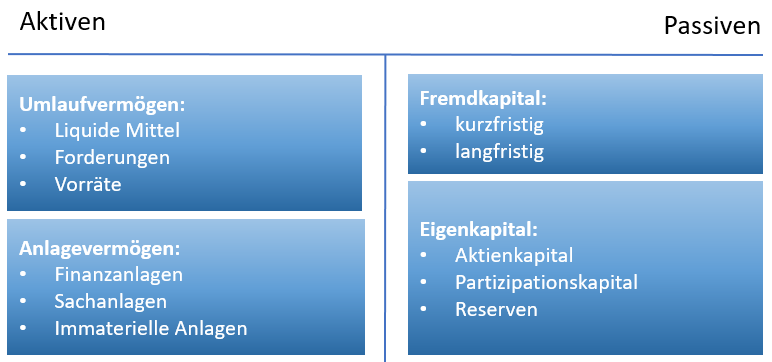

The following illustration shows a balance sheet. There is an assets side and a liabilities side with different categories. Current assets and fixed assets are on the assets side and liabilities and equity are on the liabilities side. Each category consists of several smaller accounts that break down the specifics of a company’s finances. These accounts vary widely by industry, and the same terms can have different applications depending on the type of business. However, there are some common components that investors and analysts are likely to come across.

Assets and liabilities balance each other out. A company has to pay for everything it owns. To do this, companies take out loans (debt) or receive money from investors (equity). Suppose a company were to take out a loan of CHF 50,000 to buy machinery for production (tangible assets). On the assets side of the balance sheet, the tangible fixed assets item would then increase by CHF 50,000. On the liabilities side, the liabilities item would increase by CHF 50,000, meaning that the balance sheet total of assets (assets side) and the balance sheet total of capital (liabilities side) would increase by CHF 50,000. The assets and liabilities side therefore remain balanced.

Components of a balance sheet

The active side

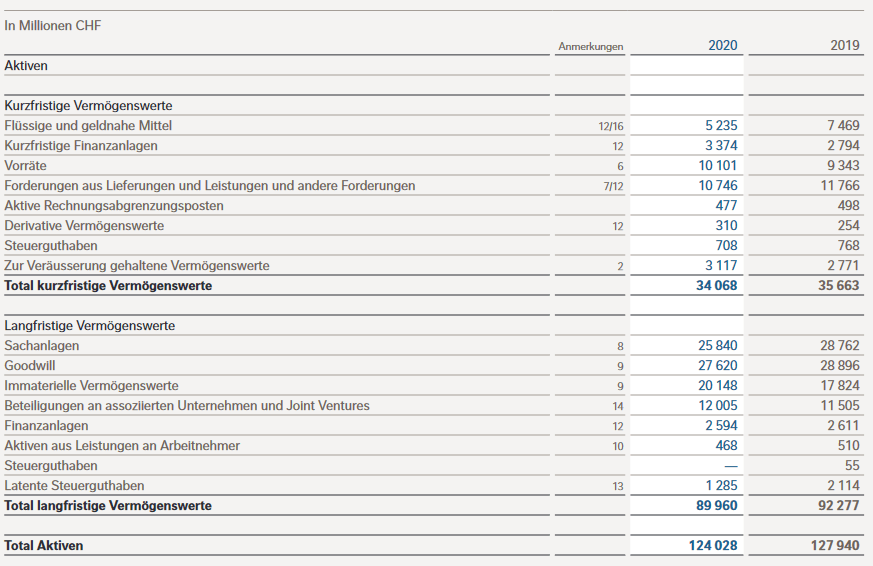

The following chart shows the assets side of Nestlé’s balance sheet for 2020. The accounts are arranged one below the other and according to theliquidity criterion. Currentassets are therefore in first place because they can be turned into cash (liquidated) more quickly than non-current assets.

The assets side of the Nestlé 2020 balance sheet – before profit distribution

Source: www.nestle.ch

Cash and cash equivalents are the most liquid assets. Current financial assets are, for example, shares that are traded on the market. Inventories are all goods available for sale. Trade receivables relate to money owed to the company by customers. This may include an allowance for doubtful accounts as some customers may not settle their debts. Prepaid expenses are expenses for the next financial period that the company is already paying in this financial period and must therefore also be recognized. These could be, for example, insurance policies, advertising contracts or rent, but the equivalent value and service will only be received in full or in part in the next reporting period. Derivative assets are financial instruments with a limited term whose value is based on the value of the underlying item (e.g. shares). Nestlé’s assets and liabilities held for sale for 2020 mainly consist of the Nestlé Waters business in North America. The business was classified as held for sale. The agreement to sell was signed on 16.02.21 and the divestment should be completed in the first half of 2021.

Non-current assets, which are also referred to as fixed assets, are securities that cannot be liquidated in the next year. Tangible assets include, for example, machinery, land and buildings. The definition of goodwill is somewhat more extensive. In short, goodwill represents the difference between the purchase price paid (e.g. market capitalization) of a company and the net asset value determined for accounting purposes. Long-term investments are securities that cannot or can no longer be liquidated in the next year. Intangible assets include non-physical (but nevertheless valuable) assets such as intellectual property and goodwill. These assets are generally only included in the balance sheet if they have been acquired and not developed by the company itself. Their value can therefore be greatly undervalued (e.g. by not including a globally recognized logo) or greatly overvalued.

The liabilities side

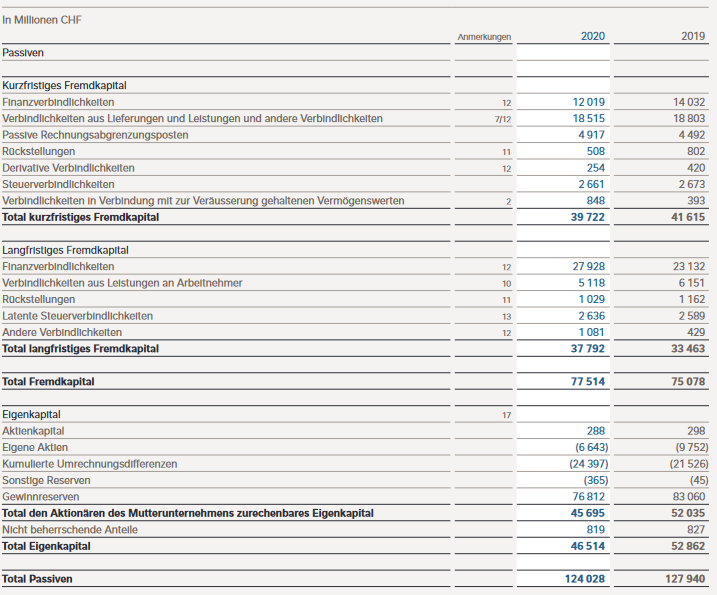

The following chart shows the liabilities side of Nestlé’s balance sheet for 2020. The accounts are arranged one below the other and, as with the assets side, according to the liquidity criterion. Current liabilities are therefore in first place because they fall due more quickly than non-current liabilities.

The liabilities side of the Nestlé 2020 balance sheet – before profit distribution

Source: www.nestle.ch

Borrowed capital, also known as liabilities, is the money that a company owes to third parties. Current liabilities include, for example, invoices that it has to pay to suppliers, interest on bonds, rent, utilities and outstanding salaries.

Non-current liabilities include all interest and the principal of bonds issued. Pension fund liabilities refer to the money that a company must pay into the pension accounts of its employees. Deferred tax liabilities (tax liabilities) are the amount of taxes that have been accrued but will not be paid until another year. In addition to the timing, this figure compensates for the differences between the financial reporting requirements and the way taxes are calculated, e.g. when calculating depreciation.

Equity is the money due to the owners of a company or its shareholders. It is also referred to as net assets, as it corresponds to the total assets of a company minus its liabilities or debts to non-shareholders. Treasury shares are the shares that a company has bought back. They can be sold at a later date to raise cash or to fend off a hostile takeover. In the case of a public limited company, 5% of the annual profit must also be allocated to the legal reserves until this cumulatively amounts to 20% of the share capital.

Fundamental analyses and the balance sheet

Balance sheets, income statements andcashflow statements are also used for fundamental analyses. Key performance indicators can be helpful here. As the balance sheet only represents a snapshot in time, the balance sheets of several years (e.g. up to 10 years ago) are usually used for analyses. This allows investors to form a picture of the company. One indicator that is easy to read from the balance sheet is the debt/equity ratio, for example.

Disadvantages of a balance sheet

The balance sheet contains a lot of information for investors and analysts. Unfortunately, however, the balance sheet is only a snapshot in time. This means that only the difference between certain points in time can be analyzed. The focus is on the past, which does not necessarily say anything about the future. In addition, there are different accounting systems and standards. Depreciation and inventories are handled differently, which changes the reported figures. This gives management the opportunity to manipulate the figures to their advantage and also makes it difficult to compare the balance sheets of different companies, even if they operate in the same industry. Proven experts such as analysts, but alsowell-trainedasset managers, know the pitfalls of company analysis and can take these into account when investing.