What is the 125/250d Adjusted Slope Momentum?

The 125/250d Adjusted Slope is a momentum indicator. The 125/250d Adjusted Slope Momentum strategy was developed by hedge fund manager Andreas F. Clenow. The strategy is explained in simple terms below. Further details can be found in Andreas F. Clenow’s book – Stocks on the Move: Beating the Market with Hedge Fund Momentum Strategies.

Basic knowledge of momentum strategies

Momentum strategies aim to profit from the continuation of an existing market trend. Momentum strategies usually involve a strict set of rules based on technical indicators that are intended to determine the entry and exit points for certain securities. The 125/250d Adjusted Slope Momentum indicator is one such indicator that is designed to help find the right moment to enter or exit an investment.

A momentum strategy is therefore about the following: If the price of a share (or another financial instrument) is trending upwards, the investor enters into a long position (long: buy the share). If its price is trending downwards, the corresponding position is shorted (short: sell the share). The idea is therefore that a trend normally lasts for a certain period of time and a return is to be generated from precisely this trend.

Momentum indicators

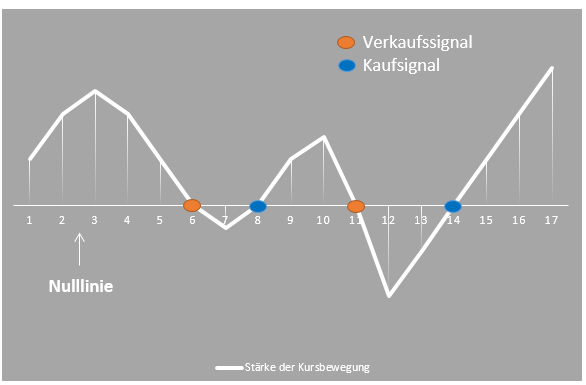

Momentum strategies are based on certain rules: Momentum investors use technical indicators to decide when to buy or sell certain securities. In the illustration, momentum shows the strength of the price movement. To calculate the momentum, for example, the current price value can be set in relation to the average price level in the past. A specific period is selected for this, such as 3, 6 or even 12 months. This is carried out at several points in time. The result is shown in the chart. If the price is higher than the average of the selected period in the past, the value is above the zero line. If the price is lower than the average for the selected period in the past, the value is below the zero line. As soon as the value falls below the zero line, the share should be sold according to this strategy. If the value rises above the zero line again, the share should be bought.

Source: based on www.comdirect.de

Some momentum investors use two longer-term moving averages (MA) as indicators. For example, this could be a 50-day and a 200-day MA. In this case, the 50-day MA above the 200-day MA generates a buy signal, while a 50-day MA below the 200-day MA generates a sell signal.

Other momentum strategies include a cross-asset analysis. For example, some momentum investors analyze the yield curve of government bonds to use it as a momentum indicator. For example, if a 10-year government bond yield is above the 2-year government bond yield, this is usually a buy signal, while a 2-year yield that is above the 10-year yield is a sell signal. In particular, a comparison of 2-year and 10-year government bond yields is a good indicator of recessions. In the past, there has often been a recession when 2-year government bond yields were higher than 10-year yields – this is also known as an inverted yield curve. Such indicators can also have an impact on the stock markets. A good asset manager takes these factors into account in his analyses and investment decisions.

Other strategies take both momentum indicators and fundamental factors into account. One such system is CAN SLIM, for example. This strategy focuses on quarterly and annual earnings per share (EPS). The investor generally looks for stocks with both earnings and sales momentumas well as stocks with price momentum.

Excursus : CAN SLIM

CAN SLIM is an acronym. The acronym stands for 7 characteristics that a share exhibits when it is on the verge of a strong increase in value:

- C = Current quarterly earnings: Quarterly earnings should be approx. 20 % higher than in the previous year.

- A = Annual earnings growth: The growth rate over 3 years should be more than 25 % and the ROE should be higher than 17 %.

- N = New product or service – new products or services: The company should demonstrate a certain degree of innovation.

- S = Supply and demand: When prices are rising, the trading volume should still be high.

- L = Leader or laggard: Market leaders have high ROEs, profit margins and a dynamic price trend.

- I = Institutional sponsorship – institutional investors are invested: If institutional investors support the price trend with high investment sums, this could indicate sustainable growth.

- M = Market direction: The overall market should generally perform well.

How does the 125/250d Adjusted Slope Momentum indicator work?

The 125/250d Adjusted Slope is a momentum indicator that is calculated as the average annual slope of a company’s share price over the last 125 and 250 trading days. The 125/250d Adjusted Slope is therefore a method that calculates the average of the adjusted 125-day and 250-day slope values. This is why the indicator was given this name.

By calculating the average, an average adjusted slope value is obtained. This is smoothed due to the use of the average, which means that unusually large movements in the share priceare not visible in the average. The smoothing of the average is necessary because there are many price movements that are based on extraordinary events, such as the announcement of a takeover or positive and negative surprises in the quarterly, half-yearly and annual figures and much more. However, these price movements are not what a momentum investor is ideally looking for. Such extreme price movements can be adjusted and smoothed with the 125/250d Adjusted Slope Momentum. This means nothing other than that the momentum indicator is adjusted for volatility. This indicator thus shows the trend of a share price. This trend is ultimately decisive for the decision to buy or sell the share.

To apply the strategy, it is necessary to define an investment universe. This means that certain shares or other financial instruments must be selected to be analyzed. Momentum investors already define certain rules for this selection. For example, they only select stocks from certain sectors, with a certain market value, with a certain number of outstanding shares, with a good turnover, with a certain free cash flow or on the basis of other indicators.

After selecting the investment universe, for example, the 125/250d Adjusted Slope is calculated for all shares for each month – or another selected period. The companies are then ranked according to this 125/250d Adjusted Slope – i.e. according to the best smoothed upward movement of the share price momentum. This list is then used to decide which stocks from the investment universe should be included in the portfolio. A certain threshold value is also determined for this. For example, only stocks with a 125/250d adjusted slope, which is higher than 35, could be added to the portfolio. In the asset management of Estoppey Value Investments, the 125/250d Adjusted Slope Momentum is used to select the best momentum stocks from the investment universe of value stocks.

Momentum strategies in particular require a great deal of specialist knowledge for correct implementation and are usually time-consuming and complex. It can therefore pay off to consult an expert such as an independent asset manager for implementation.