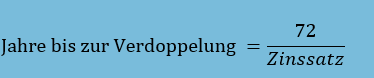

The formula for the rule of 72

where: interest rate = annual return on an investment

The rule of 72 can be applied to anything that grows at a certain rate, e.g. population, macroeconomic figures, fees or loans. If the gross domestic product (GDP) grows by 2% annually, the economy is expected to double in 72 / 2 = 36 years.

In terms of fees eating into investment gains, the rule of 72 can be used to show the long-term impact of these costs. An investment fund that charges 2% in annual fees will reduce the investment capital by half in about 36 years. A borrower paying 10% interest on their credit card (or any other form of credit that charges compound interest ) will double the amount owed in around seven years.

The rule can also be used to determine the time it takes for the value of money to halve due to inflation. If inflation is 3%, then the purchasing power of money will only be worth half in about 24 years (72 / 3 = 24). If inflation rises from 3 % to 6 %, an investment is expected to lose half its value in 12 years instead of 24 years.

In addition, the rule of 72 can be applied to all types of maturities as long as the return accrues annually. If interest is 6% per quarter (but interest only accrues annually), then it will take (72 / 6) = 12 quarters or 3 years to double the principal. If the population of a nation grows at a rate of 0.5 % per month, it will double in 144 months or 12 years.

What can we learn from the rule of 72?

The rule of 72 shows that it is extremely important for successful investing to understand the effect of compound interest in order to double your assets. Costs, inflation and, above all, the annual return are crucial to successful investing. To find out more, it is advisable to consult an independent asset manager or financial advisor.