What are unicorn companies?

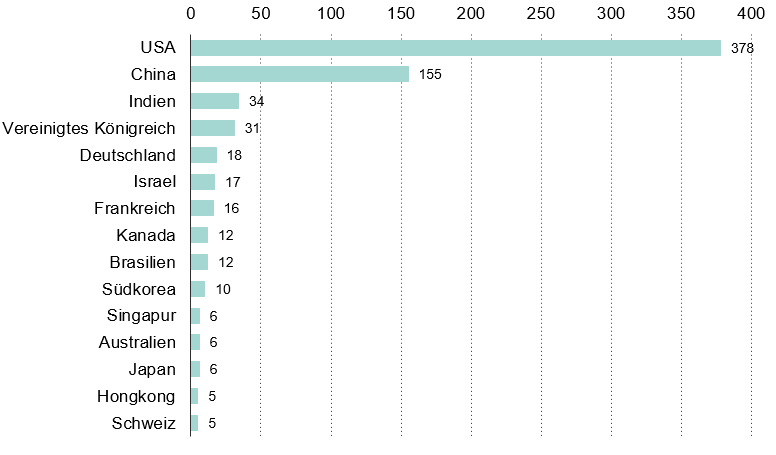

Start-up companies that are privately owned and have a value of over 1 billion US dollars are referred to as unicorn companies. There are more than 1000 of them worldwide (as of March 2022). The figure shows the number of unicorn companies worldwide by country in the first half of 2021. Five unicorn companies originate from Switzerland.

The five Swiss companies are:

- Sportradar – Sports data

- nexthink – Data management and analysis

- mindmaze – Medical technology

- Numbrs – Fintech

- Acronis – Software

As at 12.02.2021, according to CB Insights.

Number of unicorn companies worldwide by country in the first half of 2021

Source: statista

Unicorn companies are very rare and require a high degree of innovation. Due to their sheer size, unicorn investors are usually private investors or venture capitalists, which means they are out of reach for retail investors. Although this is not essential, many unicorns work their way up to an IPO.

The valuation of a unicorn company

The value of a unicorn company depends heavily on the assessment of its growth potential. Investors and venture capitalists rely on forecasts. The value therefore does not depend on the currentprofit. Start-up companies hardly generate any profit at the beginning. All the capital is invested in the further development and growth of the company. Forecasts are particularly difficult as start-ups usually have a high degree of innovation. It is therefore almost impossible to compare the company or the business model with other companies.

Exit options for a unicorn company

There are several exit options for unicorn companies. Firstly, there is the option of leaving the unicorn company in private ownership. The advantage of this is that the founder can retain full control. However, it is difficult for the company to grow in this way and therefore it is also more difficult to offer investors an appropriate return. Another option is to go public, also known as an initial public offering (IPO). Going public provides access to capital, which in turn allows the company to grow. The disadvantage of going public, however, is the dilution of ownership. Another option is to sell the company, for example to a strategic investor who integrates it into the value chain of another company. Finally, there is also the option of selling the company to a financial investor, such as a private equity company.

The term “unicorn company”

The term unicorn company comes from US venture capital angel investor and co-founder of Cowboy Ventures Aileen Lee. According to Lee, it is rare to find a start-up company that has the ability to reach a value of 1 billion US dollars. In her article “Welcome to the Unicorn Club: Learning from Billion-Dollar Startups”, she examined, among other things, the frequency of software startups that achieved a companyvaluation of 1 billion dollars. The result was that only 0.07% of companies ever reach a valuation of 1 billion dollars. According to Lee, it is just as difficult to find such a start-up company as it is to find the mythical unicorn.

Criticism of unicorn companies – risk investments

Benchmark Capital partner Bill Gurley wrote in a blog post about the difference between raising late-stage private capital and going public. He explained that since the 2010s, “an unprecedented 80 private companies have received financing with valuations in excess of $1 billion”. He further notes that “late-stage investors, desperate to miss out on acquiring stakes in potential ‘unicorn’ companies, have essentially abandoned their traditional risk analysis”.

The question of whether the unicorn companies in the technology sector represent a replay of the dotcom bubble of the late 1990s continues to generate debate. John Mullins, of the London Business School, for example, argues that the rise in companies reported to be worth more than $1 billion is a sign that the markets are over-exuberant. Others believe that the rise reflects a new wave of technology-driven productivity. It is also thought that globalization and central bank monetary policies since the Great Recession have led to large capital flows sweeping around the globe in pursuit of unicorns.

There is always a risk of buying a company at too high a price. That is why it is dangerous to simply participate in an IPO on instinct, for example. Here too, it is worth consulting an expert, such as an independent asset manager. They are familiar with company valuations and can provide an assessment of whether a company is fairly valued.