What is the free cash flow yield?

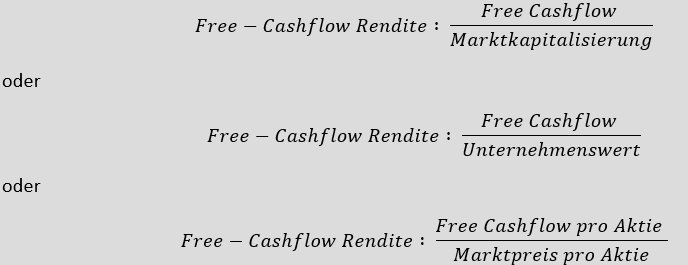

The free cash flow yield (FCF yield) measures solvency. This ratio represents a comparison between a company’s expected free cash flow and its market value. Since market capitalization is widely available, the most common method of determining FCF yield is to divide the free cash flow by market capitalization. A company’s FCF yield is similar to its earnings yield (the inverse of its price-to-earnings ratio), which describes the relationship between a company’s earnings and the current market price.

A second method of calculating the FCF yield is by dividing the FCF by enterprise value. As part of the enterprise value, debt, preferred shares, and minority interests are included, but cash and cash equivalents are excluded.

An organization’s free cash flow refers to the amount of cash that remains after capital expenditures have been made on long-term assets such as machines, and buildings, as well as original equipment, spare parts, and computer systems. A positive cash flow refers to the fact that a company receives more money than it expends. Having negative cash flows indicate that a company is unable to meet its obligations. As a result, cash flow is a valuable tool for evaluating a company’s performance. The FCF yield is calculated in order to determine how much a company earns per share. This representation is considered by some investors to be a more accurate reflection of the return shareholders receive as a result of investing in the company. In this case, investors are more interested in the free cash flow yield than the earnings yield.

A lower ratio indicates a less attractive investment opportunity. When a company generates a sufficient amount of cash to meet its debt and other obligations, including dividend payments, it is said to have a positive FCF yield. In terms of accounting, the FCF yield has the advantage of being more difficult to manipulate than the P/E ratio. For investments without a market price, caution is advised. This is because the calculated enterprise value can vary greatly depending on the valuation methodology and assumptions, and thus there is a risk that the ratio can be manipulated.

Formulas for calculating the free cash flow yield