What is the High Watermark?

Asset managers use different methods to calculate their fees. The high watermark is a variant of the fee calculation. Performance-based asset management fees can be calculated using the high watermark method. The highest value reached by a custody account or investment fund, for example, is referred to as the high watermark and serves as a reference value. The cumulative historical returns are used to determine the high watermark. This figure is used to measure the asset manager’s performance in the following year. The high watermark ensures that the asset manager does not earn large sums for poor performance. If the asset manager loses money in a certain period, for example, he must bring the portfolio or fund above the high watermark before he receives a performance bonus from the assets under management (AUM). This bonus is paid by the investor as aperformance fee.

The high watermark is different from a hurdle rate, which is another method of charging asset managers. The hurdle rate represents the lowest profit that a hedge fund, for example, must achieve in order to receive an incentive fee. The high watermark method and the hurdle rate method can also be combined.

Example for calculating the high watermark

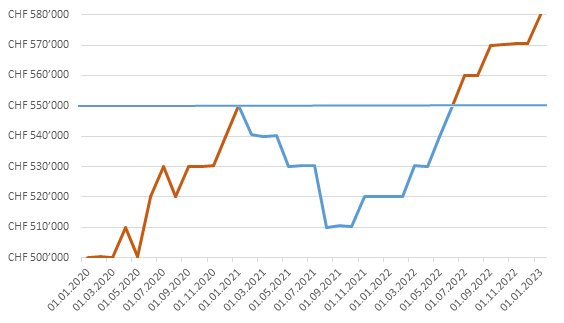

Assume an investor opens a custody account with CHF 500,000. In 2020, the assets were increased to CHF 550,000 by the asset manager. The highest level, i.e. CHF 550,000, therefore represents the new high watermark. A performance fee is charged for the profit (CHF 50,000). If this is 10%, for example, a fee of CHF 5,000 would be due. Assuming the following year does not go so well and the value of the custody account is CHF 520,000 at the end of the year. As the high watermark of CHF 550,000 was not exceeded at any time in this year, no performance fee is charged. Assuming that in 2022 the portfolio now rises to CHF 580,000, the value of the portfolio in January 2022 is CHF 520,000. No performance fee is charged for the performance from CHF 520,000 to CHF 550,000, which is due to the high watermark of CHF 550,000. A high watermark thus ensures that the performance fee is not paid twice. A high watermark protects investors from double performance fees and motivates asset managers to perform well in order to earn fees. This ensures that the asset manager’s interests are aligned with those of their clients. If the client earns money, the asset manager also earns money. If the client does not earn money, the asset manager does not receive a performance fee either. The performance fee is only charged as soon as the high watermark, in this example CHF 550,000, is exceeded. In this case, this would be CHF 30,000 (CHF 580,000 – 550,000), resulting in a fee of CHF 3,000 for a 10% performance fee. The new maximum value, namely CHF 580,000, now also represents the new high watermark for the next period.

This calculation is shown in the following illustration. The orange curve shows when performance fees are charged.

The high watermark and the free rider

If an investor enters a fund that is underperforming, they could benefit from an increase in value without paying a performance fee, depending on the fund. This benefit can be achieved if an investor enters a fund at a net asset value below the high water mark. This situation allows new investors to benefit from investing in an underperforming fund without penalizing existing investors. Some funds deliberately avoid this situation by charging a performance fee for each positive performance.