What is the compound annual growth rate (CAGR)?

The compound annual growth rate (CAGR) is the relative increase in a value over a period of time. It can therefore also be described as the rate of return that would be required for an investment to grow from its initial stock to its final stock. It is assumed that the profits would be reinvested at the end of each period of the life of the investment. The annual growth rate is therefore not a real rate of return, but a figure that describes the growth rate of an investment. The annual growth rate is used as an indicator for various economic aspects.

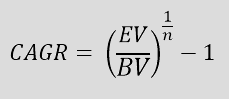

The formula for the annual growth rate

EV = final value

BV = initial value

n = number of years

Example for calculating the annual growth rate

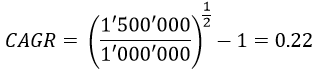

A company was worth CHF 1,000,000 at the beginning of the year. After one year, the company was worth CHF 1,400,000. After two years, the value of the company has risen to CHF 1,500,000. CHF 1,000,000 is therefore the initial value (BV). CHF 1,500,000 is the final value (EV). The return in the first year was therefore 40% and the return in the second year was 7%. The growth rates were therefore quite different. Annual growth may appear uneven due to market volatility. The annual growth rate smoothes out this effect. The average annual growth rate during these two years (n) is 22%. The annual growth rate therefore also makes it possible to compare different investments and forms of investment with different maturities.

Advantages and disadvantages of the annual growth rate

One advantage of the annual growth rate is that it is quick and easy to calculate. However, the annual growth rate does not take risk into account. Suppose an investor compares a savings account with a safe return with an equity portfoliowith an uncertain return. Suppose the annual growth rate of the savings account is 1% and the annual growth rate of the equity portfolio is 5%. It would appear that the equity portfolio is the better investment option. However, it cannot be ruled out that the equity portfolio will perform worse in future periods due to market volatility.

In addition, no account is taken if an investor adds or withdraws funds during the period. An inflow of funds could distort the annual growth rate upwards at the end of the period. Furthermore, no downward trends (or growth) are taken into account. Assuming a period of 10 years, the equity portfolio generated an above-average return in the first 4 years. In the following years, however, the return decreased continuously. This downward trend is not directly reflected in the annual growth rate. More complicated investments and projects or those that have many different cash inflows and outflows are therefore best evaluated using the IRR (internal rate of return). A good asset manager will be happy to help you and take all possible factors into account when evaluating investment opportunities.