What is the weighted average cost of capital (WACC)?

The weighted average cost of capital (WACC) comprises the average after-tax cost of capital of a company from various sources of financing such as equity and debt. It reflects the expected return at which bondholders and shareholders are prepared to invest in the company. Shareholders expect certain returns, which makes the expected return a cost factor for the company. If these expectations are not met, shares may be sold, which can have an impact on the share price and the overall value of the company.

A higher WACC is often associated with the volatility of equities and risky debt as investors seek higher returns to offset perceived risks. The WACC is often used to value projects and acquisitions, but its complexity lies in elements such as the fluctuating cost of equity. Determining the cost of equity requires an estimate of the expected shareholder return, taking into account the uncertain value of the shares. However, this estimate, which is based on models such as the CAPM, does not guarantee accurate forecasts for the future due to its dependence on historical data.

Understanding the WACC helps to evaluate a company’sprofit potential. A low WACC indicates a healthy company that attracts investor money at low cost, while a high WACC indicates risky companies that demand higher returns.

The calculation of the WACC reflects the attractiveness of a company for investment and the guaranteed returns and helps to evaluate investment options in terms of financial strength and risk. The ratio influences important financial decisions by determining whether the return on a project exceeds the cost of capital. In addition, the WACC often serves as a reference interest rate for the approval of an investment project by comparing it with the internal rate of return (IRR) of a new project.

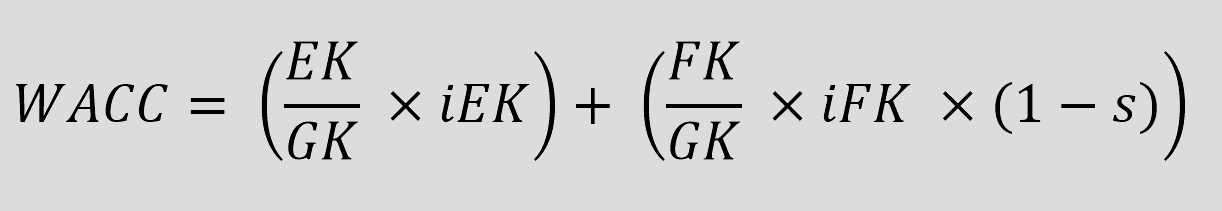

The formula for calculating the WACC

The WACC is calculated by multiplying the weighted shares of a company’s equity and debt capital by their respective costs. The cost of equity, which represents the shareholders’ expected return, is multiplied by the share of equity in the company’s overall capital structure. At the same time, the cost of debt after tax is multiplied by the share of debt in the capital structure. These weighted costs of equity and debt are then added together to derive the WACC.

where:

EK = Market value of equity

FK = Market value of debt

GK = EK+ FK

iEK = Cost of equity: The expected return of equity providers

iFK = Cost of debt: The interest rate on the debt capital. interest ratethat lenders expect on capital employed

s=income tax rate

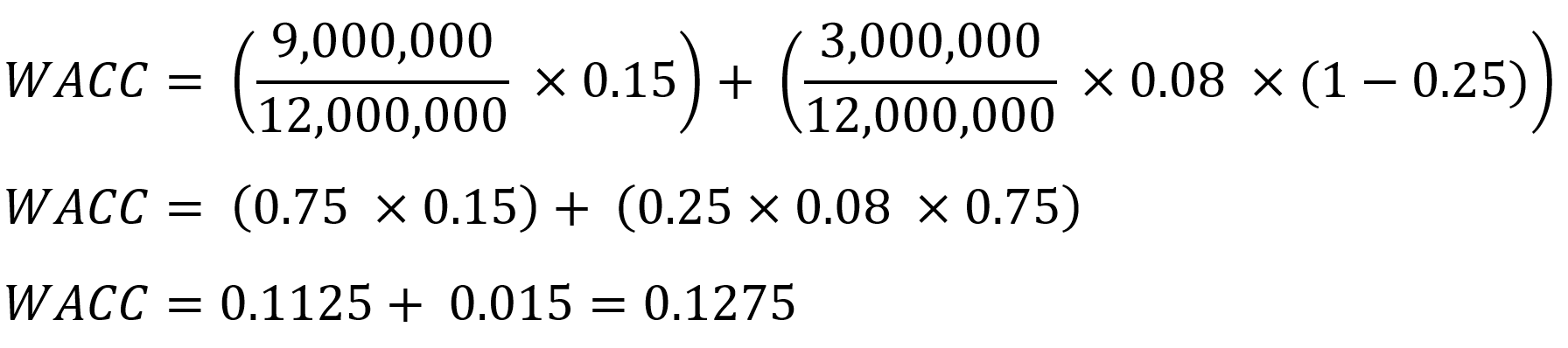

Example for calculating the WACC

TechABCCo Inc., an innovative technology company, has a market capitalization (equity value) of CHF 9 million. The proportion of debt capital, however, is CHF 3 million.

It is assumed that the cost of equity (expected minimum shareholder return) for TechABCCo Inc. is 15%. The calculation of E/V results in 0.75 (CHF 9,000,000 equity value divided by CHF 12,000,000 total equity value), which leads to a weighted average cost of equity of 0.1125 (0.75 × 0.15).

To determine TechABCCo’s weighted cost of debt, the calculation of D/V is 0.25 (CHF 3,000,000 debt divided by CHF 12,000,000 total capital). Assuming that the cost of debt is 8 % and taking into account a tax rate of 0.25 or 25 %, the weighted cost of debt is 0.015 (0.25 × 0.08 × 0.75).

Adding the weighted cost of debt (0.015) to the weighted cost of equity (0.1125) results in a WACC of 0.1275 or 12.75% (0.1125 weighted cost of equity + 0.015 weighted cost of debt).

The calculated value represents TechABCCo Inc.’s average cost of capital, which represents how much the company has to spend on average to attract investors and achieve the expected return. This is in relation to the company’s financial position and its risk profile compared to other investment opportunities.

Limits of the WACC

Determining the cost of equity and debt is critical to calculating the WACC, but is a challenge for private companies that do not have publicly available data. Public companies have various methods at their disposal, but there is no universal formula, which makes estimating the cost of equity in WACC calculations complex.

The WACC assumes a constant debt/equity ratio, which influences the forecast enterprise value. However, this assumption contradicts reality, as these ratios tend to fluctuate and affect the WACC forecasts.

In summary, the weighted average cost of capital (WACC) provides a comprehensive approach to assessing a company’s cost of capital and the feasibility of projects. However, the complexity of the calculation and the assumptions made require caution and the addition of other key figures in order to make well-founded investment decisions.