What is a coupon?

A coupon is the annual interest rate paid on a bond. The interest rate can be fixed or variable. The coupon is paid every period, from the issue date of the bond to its maturity date. The coupon is paid regularly on fixed interest dates (e.g. full, half or quarterly). The coupon is expressed as a percentage of the nominal value of the bond. The coupon can also be referred to as the nominal yield, but should not be confused with the bond yield (current yield).

Difference between coupon and bond yield

The bond yield is the actual interest rate of a bond. As bonds can be traded before they mature, causing their market value to fluctuate, the actual yield (often simply referred to as the yield ) usually differs from the coupon or nominal yield of the bond.

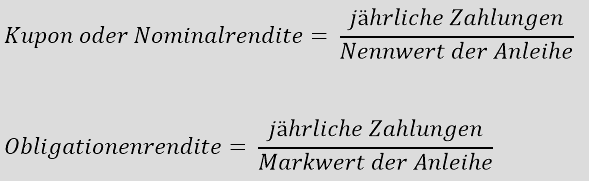

The calculations of the coupon and the bond yield

Assume a bond costs CHF 100 and has a fixed coupon of 2%. The number of payments per year is 2 (semi-annually). The investor would therefore receive CHF 1 per payment. In this example, the nominal yield, as well as the bond yield, is 2% per year.

Assume that the bond is traded at CHF 90 at a later date. The nominal yield (coupon yield) is still calculated on the basis of the nominal value of the bond and therefore remains at 2%. However, the bond yield increases. In this example, the bond yield would rise to 2.2% (CHF 2/ CHF 90).

Fixed interest and variable interest

The advantage of a fixed interest rate for the issuer is that the amount of the payments to the bond creditor (investor) can be calculated precisely. If market interest rates rise, this does not change the payments. On the other hand, the issuer does not benefit from interest rate reductions.

If the variable interest rate is used, the interest rate is adjusted on defined dates (to the current level of a reference interest rate). However, the coupon rate is not identical to the reference interest rate. As a rule, an interest premium is charged, which depends on the issuer’s credit rating and the term. An example of a bond with a variable coupon is the so-called “floater”. The investor participates in interest rate increases, which can be an advantage if the reference interest rate rises. Unfortunately, future interest rate trends are difficult to predict. Another advantage for the investor is the low price fluctuation of the bond. However, this also means that poorer price gains can be achieved. The disadvantage of variable interest rates is that it is difficult to calculate payments in advance.

The history of coupon bonds

Bond certificates used to have detachable coupons. Bonds with coupons were not registered. This meant that the holder of the bond certificate was the owner. In order to receive the coupon, the coupon had to be detached from the bond certificate and presented. Today, most investors and issuers prefer to keep electronic records of bond ownership. Nevertheless, the term “coupon” has been retained to describe the nominal yield of a bond.