What are liquidity ratios?

Liquidity ratios are used to indicate the extent to which current liabilities can be settled with cash and cash equivalents. Liquidity ratios can be calculated using the balance sheet. In general, there are 3 levels of liquidity used by analysts to analyze companies: The cash ratio or cash liquidity (liquidity 1st degree), quick ratio or acid test ratio (2nd degree liquidity) and the current ratio (3rd degree liquidity) . Diese Liquiditätsstufen werden auch als Liquiditätsgrade bezeichnet. Die Kennzahlen geben also an, in welchem Mass ein Unternehmen zahlungsfähig ist. Um die Liquiditätsgrade zu berechnet, werden die Zahlungsmittel ins Verhältnis zu den kurzfristigen Verbindlichkeiten gesetzt.

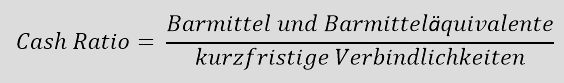

Cash ratio (liquidity ratio 1)

The cash ratio is calculated by dividing available cash and cash equivalents by current liabilities. The cash ratio therefore defines liquid assets exclusively as cash and cash equivalents, excluding receivables, inventories and other current assets. It therefore measures the ability of a company to remain solvent in an emergency. Even highly profitable companies can get into difficulties if they do not have the necessary liquidity to react to unforeseeable events. From a risk minimization perspective, a very high cash ratio would be a good thing. However, a high cash ratio also means that a lot of money is kept unused. The liquid funds are therefore not invested in the company, thus reducing the return.

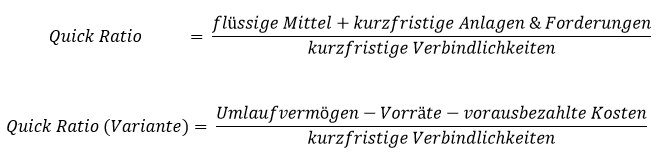

Quick ratio (liquidity ratio 2)

The quick ratio (also known as the acid test ratio) excludes inventories and other current assets, as these are less liquid. It is calculated by adding cash and cash equivalents and current assets and receivables and then dividing by current liabilities. The quick ratio should be 1 so that all current liabilities can be covered by receivables and cash and cash equivalents. Otherwise, there is a risk that receivables will default. When calculating another variant of the quick/acid test ratio, inventories and prepaid expenses are deducted from current assets and then divided by current liabilities.

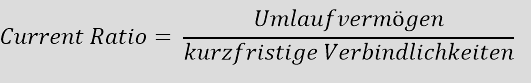

Current ratio (liquidity ratio 3)

The current ratio is also referred to as sales-related liquidity. It shows the relationship between a company’s current assets and its current liabilities. A current ratio of 2 is generally considered desirable. If the ratio were to be 1, this means that even a small bad debt could lead to financial difficulties.