What is a limit order?

A limit order is a type of order to sell or buy a security at a certain price or higher or lower. For example, when selling with a limit order, an investor sets a price below which the price may not fall. In contrast, when buying, the investor sets a price that may not be exceeded. The limit thus represents his maximum willingness to pay. In the case of limit sell orders, the order is only executed at the limit price or at a higher price, while in the case of limit buy orders, the order is only executed at the limit price or at a lower price. This definition enables investors to better control the prices they trade.

It is also possible that a partial execution occurs if, for example, a seller is willing to sell at the offeredprice but does not want to sell as many shares as the investor wanted to buy by limit buy order. Or if a buyer does not want to buy as many shares at the limit order price as a seller is offering in total.

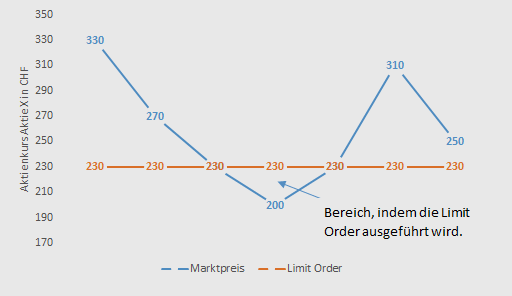

Example of a limit buy order

Suppose an investor wants to buy shares in company X. Only a maximum of CHF 230 is to be paid for each share. The current price is CHF 330. The investor instructs the trader, e.g. via his bank, to buy a certain quantity of shares as soon as the price is CHF 230 or lower. In addition, a certain duration (days, weeks, months or even a year) can often be specified as to how long the order should remain valid. Limit orders can therefore also be given an expiry date. The trader then places an order to buy these shares with a limit of CHF 230, meaning that a limit order will only be executed if the price is CHF 230 or lower. It is therefore possible that the order will not be executed if the price never falls to CHF 230 or below.

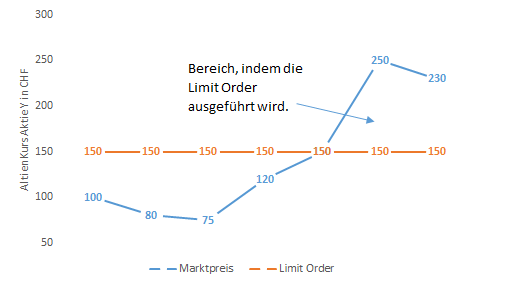

Example of a limit sell order

In the case of a limit sell order, the investor wants to sell share Y. However, the investor is only prepared to sell the share if he is offered or paid a certain price in line with his asking price. The investor then instructs his trader to sell a certain quantity of company Y shares. However, this should only be carried out if at least CHF 150 is offered or paid per share. The trader then places the sell order with a limit of CHF 150. If another investor is prepared to buy the offered quantity of share Y for CHF 150, the sale is completed. If, during the period in which the limit sell order is valid, no buyer is found who is prepared to buy the number of shares for the required CHF 150 per share, the order expires.