What is the Nasdaq?

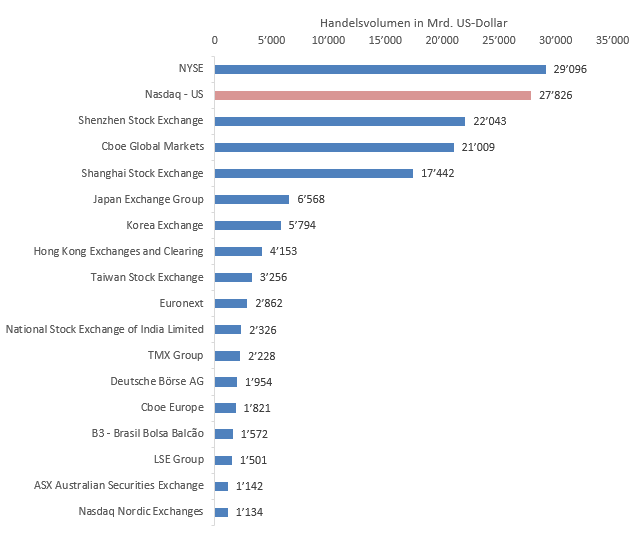

Nasdaq is an American stock exchange that enables investors to buy and sell securities electronically. Trading is therefore fully electronic, so that investors can trade without being present in person. To trade on Nasdaq, an investor only needs an account on a trading platform such as TD Ameritrade or E-Trade. The Nasdaq stock exchange is the second largest stock exchange in the world in terms of market capitalization (October 2021) and trading volume in shares in 2021. Trading takes place Monday through Friday from 9:30 a.m. to 4 p.m. Eastern Time (excluding major holidays). Adena Friedman has been CEO of Nasdaq since 2016, making her the first woman to head a major stock exchange in the USA.

The world’s largest stock exchanges by equity trading volume in 2021 (in billions of US dollars)

Source: www.statistia.com

The history of the Nasdaq

The stock exchange was founded in 1971. The Nasdaq Composite Index, which was published for the first time on February 5, 1971, was also created with Nasdaq. The name Nasdaq stands for “National Association of Securities Dealers Automated Quotations”, which translates as “National Association of Securities Dealers Automated Quotations”. Nasdaq was a subsidiary of the National Association of Securities Dealers (NASD), which is now known as FINRA (Financial Industry Regulatory Authority). Nasdaq was founded because the Securities and Exchange Commission (SEC) had called for the market to be automated. The most important historical dates of the exchange are as follows:

- 1975: Nasdaq invents the modern Initial Public Offering (IPO) by listing companies financed with venture capital. This enables the underwriting syndicates to act as market makers.

- 1985: Nasdaq creates the Nasdaq 100 Index.

- 1996: The stock exchange’s first website goes online: www.nasdaq.com.

- 1998: Nasdaq merges with the American Stock Exchange to form the NASDAQ-AMEX Market Group. The AMEX was taken over by NYSE Euronext in 2008 and its data was integrated into the NYSE.

- 2000: Nasdaq members vote to reorganize and spin off Nasdaq into a publicly traded, for-profit, shareholder-owned company: NASDAQ Stock Market Inc.

- 2007: Nasdaq acquires OMX, a Swedish-Finnish financial company, and changes its name to NASDAQ OMX Group. NASDAQ OMX acquires the Boston Stock Exchange.

- 2008: NASDAQ OMX acquires the Philadelphia Stock Exchange, the oldest stock exchange in the United States.

- 2009: NASDAQ OMX develops a mobile version of nasdaq.com, an industry first.

- 2016: Nasdaq buys the stock options exchange International Securities Exchange (ISE).

Since the exchange is fully electronic and therefore has no physical trading floor, the Nasdaq MarketSite was set up in Times Square in Manhattan.

Source: uxdesign.cc

Nasdaq indices

Like every stock exchange, Nasdaq uses indices. Indices represent a collection of stocks and provide a snapshot of current market performance. Nasdaq’s main indices are the Nasdaq Composite Index and the Nasdaq 100 Index. Both the NASDAQ Composite and the NASDAQ 100 include US companies as well as companies from abroad.

Nasdaq Composite Index

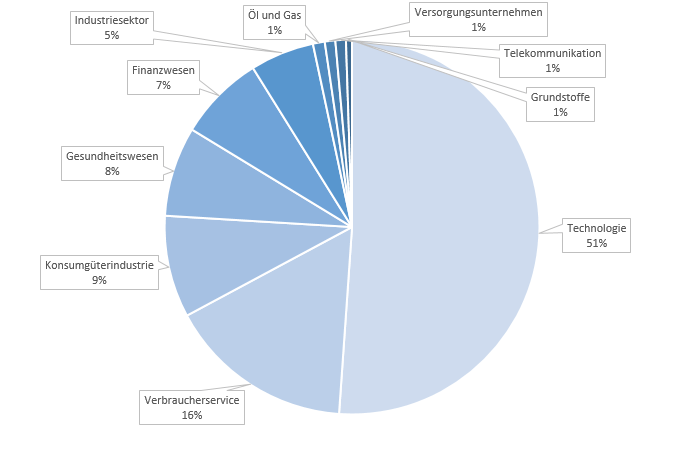

The Nasdaq Composite Index contains more than 3000 shares listed on the Nasdaq stock exchange. The index is weighted according to market capitalization. The index is broadly weighted and includes a large proportion of companies in the technology sector. The Nasdaq Composite Index is now part of financial market reporting. The chart shows the weighting of the Nasdaq Composite Index at the end of April 2022. The index includes the FAANG stocks Meta Platforms, Amazon, Apple, Netflix and Alphabet. The 10 most heavily weighted stocks in the Nasdaq Composite Index (April, 2022) were Apple Inc, Microsoft Corp, Amazon.com Inc, Tesla Inc, Alphabet Class C, Alphabet Class A, Nvidia Corp, Meta Platforms, Broadcom Inc, and Costco Wholesale.

Source: www.nasdaq.com

Nasdaq 100 Index

The Nasdaq 100 is a modified capitalization-weighted index. A capitalization-weighted index takes into account the market capitalization of companies. The Nasdaq 100 is therefore made up of the 100 largest companies traded on the Nasdaq by market value. Here, too, the largest companies are technology-related. Currently, the 10 largest companies in the index are Apple Inc, Alphabet Class C, Alphabet Class A, Amazon.com Inc, Costco Wholesale, Broadcom Inc, Comcast Corp, Adobe Inc, Cisco Systems Inc, and Intel Corp. Each year, companies can be added to or removed from the Nasdaq 100 depending on their market value.