What are options?

An option offers the buyer of the option the opportunity to buy or sellan underlying asset (e.g. a share) at a predetermined price, at a specific time or within a specific period. An option represents a right, but not an obligation. Consequently, the buyer of the option is free to decide whether to exercise it or let it expire. An option contract can have different conditions. Call options and put options form the basis for a wide range of option strategies. An option can have the objective of hedging, income or speculation. Each option contract has a specific expiry date.

The terminology of options trading

Each option contract involves a buyer (also known as the holder) and a seller (also known as the writer). Each option has a premium. This is the fee that the buyer of the option must pay to the seller of the option. An option contract also contains the strike price. This is the price at which the underlying asset (e.g. the share) can be bought or sold. Furthermore, an option contract has an expiration date. The option can only be exercised up to this date. There are different types of exercise. The European option, for example, can only be exercised on the expiry date. The American option can be exercised on any trading day before the expiry date. The Bermuda option can be exercised at several predetermined times. An option is “in-the-money” if the market price of the share is above the strike price in the case of a call option or below the strike price in the case of a put option. In this case, the buyer exercises the option and receives a better price than on the market. An option is “out-of-the-money” if the market price is below the strike price in the case of a call option or above the strike price in the case of a put option. In this case, the buyer does not exercise the option and loses the premium. An option is “at-the-money” if the market price is equal to the strike price.

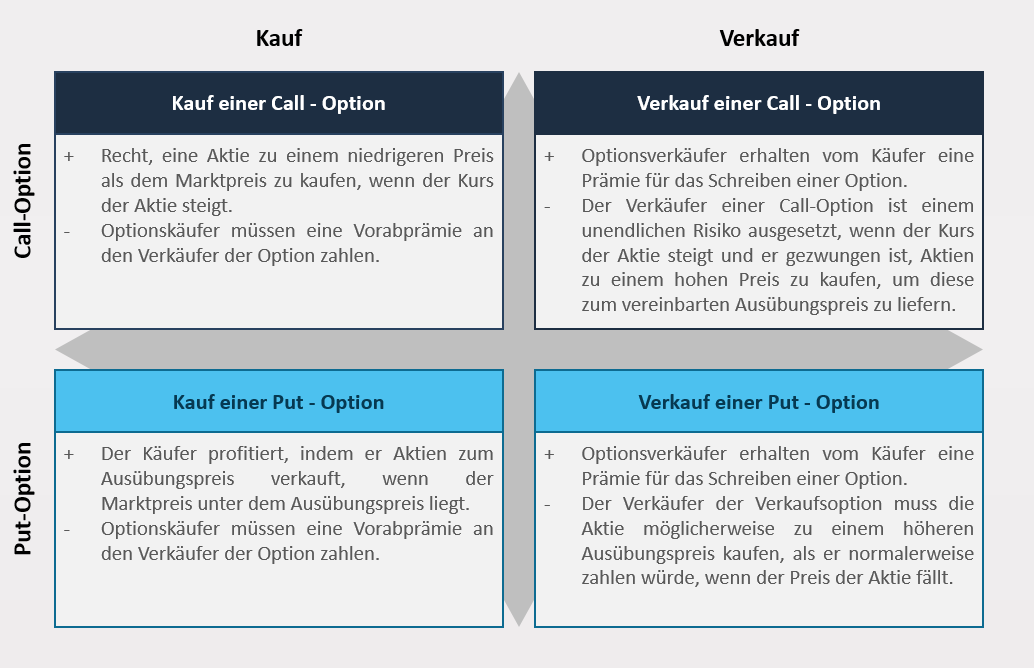

The call option

Call options offer the buyer the opportunity to purchase an asset at a certain price (strike price) within a defined period or at one (or more) specific points in time. The buyer’s risk is limited to the premium paid.

Buyers of a call option believe that the share price will rise above the strike price before the option expires. If this event occurs, the buyer can exercise the option, buy the share at the strike price and sell it immediately at the current market price for a profit. If the share price does not rise above the strike price by the expiry date, the option expires worthless. The buyer of the option is not obliged to buy the shares, but loses the premium paid for the call option.

The sale of call options is referred to as the conclusion of a contract. The seller receives the premium. The maximum profit is the premium received when selling the option. An investor who sells a call option is pessimistic and believes that the share price will fall during the term of the call option or remain relatively close to the strike price of the call option.

If the current share price is at or below the strike price when the call option expires, the call option expires and is therefore worthless for the buyer of the call option. The call option seller, on the other hand, pockets the premium as a profit. The call option is not exercised because the buyer would not buy the share at a strike price that is above or equal to the current market price. However, if the market price of the share is higher than the strike price when the call option expires, the seller of the call option must sell the shares to a call option buyer at this lower strike price. The seller’s risk is therefore higher than the buyer’s risk.

The put option

Put options offer the buyer the opportunity to sell an asset at a certain price (strike price) within a defined period or at one (or more) specific points in time. The buyer’s risk is limited to the premium paid.

Put options are therefore investments where the buyer of a put option assumes that the market price of the share will fall below the strike price on or before the expiry date of the put option. As the buyers of put options expect the share price to fall, the put option is profitable if the market price of the share linked to the put option is below the strike price on the expiry date. If the current market price at maturity is below the strike price, the buyer of the put option can exercise it. He sells the shares at the higher exercise price of the put option. If he wishes to replace his holding of these shares, he can repurchase them on the open market at a lower price. In this case, the difference between the higher strike price and the lower market price is the profit of the buyer of the put option, less the premiums he paid for the put option. The value of a put option therefore increases if the market price of the share linked to the put option falls. The risk when buying put options is limited to the loss of the premium if the put option expires worthless.

The seller of a put option assumes that the price of the share linked to the put option will remain the same or rise during the term. If the market price of the share linked to the put option is higher than the exercise price on the expiry date, the put option expires worthless. The put option is not exercised because the option buyer would not sell the share at the lower exercise price if the market price is higher. If the market value of the share falls below the strike price of the put option, the seller of the put option is obliged to buy shares of the share linked to the put option at the strike price. In other words, the put option is exercised by the buyer of the put option, who sells his shares at the strike price if this is higher than the market value of the share.

The risk for the seller of the put option is if the market price falls below the strike price. The seller is forced to buy the shares at the strike price at maturity. The seller’s loss can be very high, depending on how much the shares fall in value. The loss is reduced somewhat by the premium.

Reasons for buying an option

There are three main reasons to buy an option:

- Hedging: The risk should be limited, for example by using a put option to ensure that the shares can still be sold at a higher price (strike price) if the price falls.

- Gaining time: Buying a call option, for example, allows you to decide later whether the trade is the right one if you are uncertain about buying a share. In other words, in this case you are buying time. If the share is ultimately not bought, the loss is limited to the option premium.

- Speculation: With options, it is also possible to speculate on price movements.

Traders and investors buy and sell options for various reasons. Their terminology and mode of operation are described in detail below.

Example call option and put option

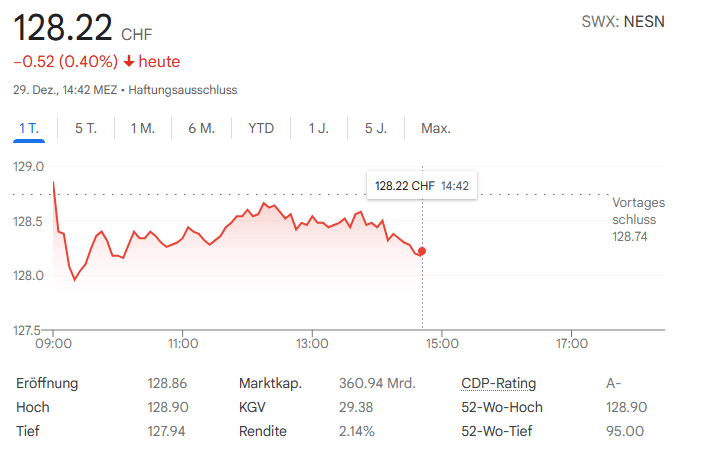

Assume you have bought a call option that allows you to buy Nestlé shares for CHF 120 today. The illustration shows today’s Nestlé share price. As the Nestlé share is trading at a higher price than CHF 120 today, you would exercise the call option as you can buy the share at a lower price than it is currently trading on the market. If you sell the share directly on the market again, you would make a profit of around CHF 8 (approx. CHF 128 less CHF 120 & option premium) per share.

Assuming you have bought a put option that allows you to sell Nestlé shares for CHF 120 today and assuming the chart shows today’s Nestlé share price of CHF 128.22: In this case, you would not exercise the put option as you can sell the shares on the market at a higher price. You therefore expected the Nestlé share price to fall below CHF 120, but this is not the case. In this case, you lose the premium you paid for the put option.

Nestlé share price, 29.12.2021

Source: www.finanzen.ch

What are the advantages and disadvantages of options?

Options can be very useful for achieving a leverage effect and hedging risks. The main disadvantage of options contracts is that they are complex and difficult to price. For this reason, they are considered an advanced form of investment that is only suitable for experienced professional investors. In recent years, they have become increasingly popular with retail investors. As they can generate above-average returns or losses, investors should be aware of the potential implications before entering into options positions. Failure to do so can result in devastating losses. A good asset manager can provide you with the best possible support when trading options.

Advantages and disadvantages of an option on shares:

Illustration: Estoppey Value Investments