What is the Swiss Market Index (SMI)?

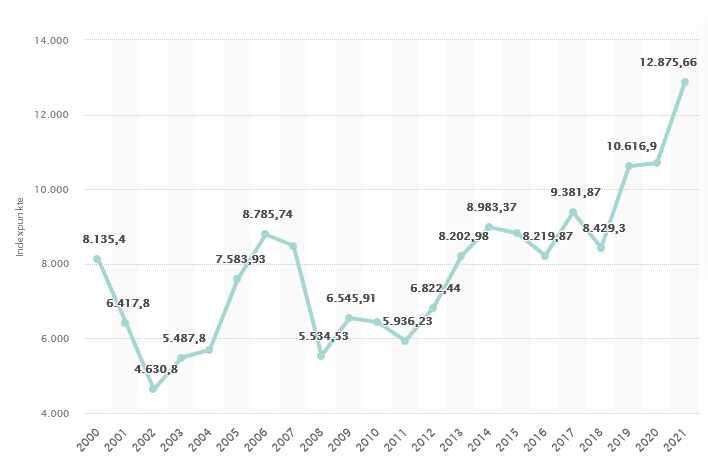

The Swiss Market Index (SMI) is a blue-chip index and is the most important share index in Switzerland. It was launched on June 30, 1988 with a base value of 1500 points. The SMI currently stands at 11,491.80 points (as at 25.5.2022). A blue chip index is an index that tracks the shares of well-known and financially stable listedcompanies, so-called blue chips. Blue chip stocks offer investors consistent returns, making them desirable investments, and are considered a gauge of the relative strength of an industry or economy. The chart shows the annual price data of the SMI from 2000-2021, during which time the index rose from 8135.5 points to 12,875.66 points.

Annual SMI price data from 2000 to 2021; source: www.statista.com

The SMI comprises the 20 largest companies in the Swiss Performance Index (SPI) and thus represents around 80% of total capitalization. The SPI is the Swiss Performance Index. Together with the SMI, it is one of the most important share indices. The SPI includes almost all listed Swiss stock corporations (companies domiciled in Switzerland or the Principality of Liechtenstein). The SPI therefore reflects the Swiss stock market. The SPI currently stands at 14,708.47 (as at 25.05.2022) and includes 220 companies.

The SMI follows the free float principle. This means that the total number of shares in circulation has been adjusted by the respective fixed ownership. For this reason, only the currently tradable portion is included in the index. In addition, a weighting was implemented. This means that none of the 20 companies can have a higher weighting than 20% of the index. The SMI serves as a benchmark index for the Swiss equity market.

The SMI is published as a price index, but also as a performance index under the name SMIC. As a rule, unlike a performance index, a price index does not take dividend paymentsinto account.

The following companies are currently included in the SMI (as at 25.05.2022):

Excursus performance index vs. price index

A performance index is a stock indexthat adds the amount of all dividend payments, capital gainsand other cash distributions to the net share price. When measuring performance over a given period, the performance index adds these transactions to the net share price before calculating the index return.

In contrast, a price index (non-performance index) calculates the return based on the weighted market value without taking cash payouts into account. Some investors believe that compared to the price approach, a performance-based calculation provides a more accurate measure of performance.

The SMI family

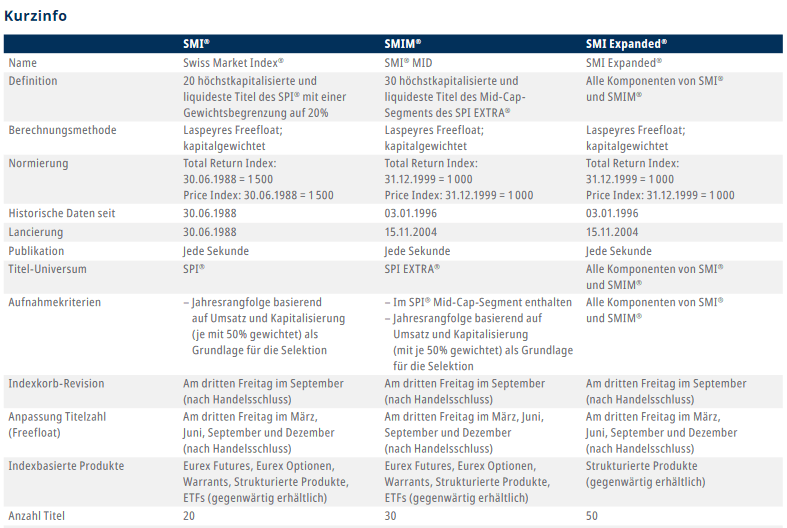

The SMI family is made up of the 50 largest and most liquid shares on the Swiss stock market. In addition to the SMI, the SMIM and SMI-Expanded indices are also part of the family. The SMIM contains the 30 most liquidand highly capitalized mid-cap stocks, while the SMI-Expanded contains all SMI and SMIM stocks together.

The table shows the most important information on the indices:

Source: www.six-group.com, Swiss Market Index -Family 09.2018