What is the Total Expense Ratio (TER)?

The Total Expense Ratio (TER) is a key figure that indicates the costs incurred in the management and operation of a collective investment scheme (e.g. a fund). The items to be included in the TER vary greatly from country to country. In Switzerland, the recommendation of the EU Commission was implemented by the Swiss Fund Association (SFA) by means of a guideline that lists all costs that should be taken into account. Accordingly, all commissions and costs charged during the fund’s operating period must be taken into account in the TER. These include the fund management company’s commission, the custodian bank’s commission and other expenses depending on the breakdown of the income statement (e.g. costs for auditing, legal advice, publications).

Operating expenses do not include incidental costs arising from the purchase and sale of investments. These costs are part of the production costs of the investments and are therefore part of the capital gains/losseson sale.

The TER therefore describes the operating costs of a collective investment scheme in relation to its assets. It therefore measures the operational efficiency of a collective investment scheme. The level of operating costs varies from fund to fund. The largest part of the operating costs is usually the fee paid to the investment manager or advisor of the collective investment scheme.

The TER is important for the investor because the costs are deducted from the collective investment. The costs therefore have a negative impact on the return. The TER is usually expressed as a percentage of the assets of the collective investment scheme. This means that the actual amount depends on the performance of the respective collective investment scheme. These funds are used to cover the operating costs associated with the collective investment scheme. The more actively a collective investment scheme is managed, the higher the TER, as higher personnel costs are incurred, for example. Passively managed index funds, for example, generally incur lower costs as a specific index is replicated, which is a highly automated process. Actively managed funds, on the other hand, employ research analysts, for example, who review, analyze and evaluate companies as potential investments.

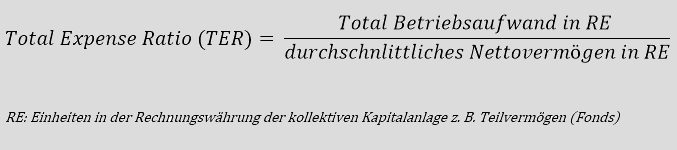

The formula for the Total Expense Ratio (TER)

The formula below is used to calculate the TER. The basis for the calculation is the commissions and costs to be taken from the income statement.

Disadvantages of the Total Expense Ratio (TER)

It is often mistakenly assumed that all costs of a collective investment scheme are covered by the TER. Unfortunately, this is not the case. Some costs are not taken into account, such as costs that are only incurred once and ancillary costs, such as transaction costs arising from the purchase and sale of investments. The items included in the TER also vary greatly from country to country.

For this reason, the TER is only suitable for comparing different collective investment schemes to a limited extent. In addition, costs that are not included in the TER should be taken into account by the investor. The unconsidered costs can make up a large part of the costs. One variant of the TER, for example, is the real total expense ratio (RTER or realTER). This ratio includes all costs at fund level. Unfortunately, this ratio is hardly ever published in fund prospectuses or other information documents. A good asset manager is very familiar with all possible costs incurred and can also provide you with the best possible advice in this area.