What is total shareholder return (TSR)?

Total shareholderreturn (TSR) is the total amount an investor earns from an investment and is expressed as a percentage of the capital invested. To determine the total amount, TSR takes into account capitalgains and dividends from a share; it may also include special distributions, stock splits and warrants. The stock return formula therefore summarizes all returns to give an overall perspective on the investment.

There are basically two sources of income from shares. One is capital gains, i.e. a rising share price, and the other is current income (dividends). When calculating the TSR, an investor can only take into account the dividends that he has actually received or to which he was entitled. The ex-dividend datemust be taken into account in the calculation. As a rule, the ex-dividend date for a share is one working day before the record date, i.e. an investor who buys the share on the ex-dividend date or later does not benefit from the announced dividend. Rather, the dividend will be paid to the person who owned the share on the day before the ex-dividend date. Therefore, an investor must know the ex-dividend date, not the dividend payment date, when calculating the TSR.

TSR is most useful when measured over a longer period of time, as it shows the long-term value of an investment – the most accurate measure of success for most individual investors. TSR is best used when analyzing venture capital and private equity investments. These investments typically involve multiple cash investments over the life of the company and a single cash outflow at the end through an IPOor sale.

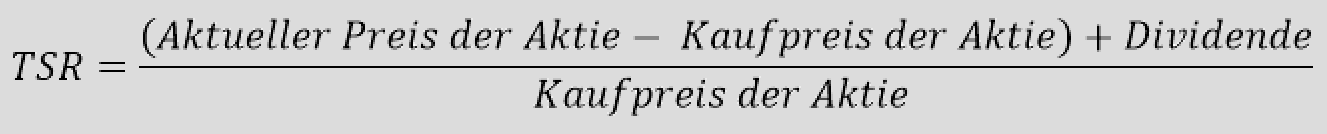

The formula for calculating total shareholder return (TSR)

The total shareholder return is calculated from the total increase in the share price per share, plus the dividends paid by the company during a given period. This sum is then divided by the original purchase price of the share to obtain the TSR:

An example of the calculation of total shareholder return (TSR)

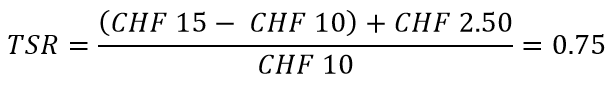

Suppose an investor buys 200 shares in a company. Each share costs CHF 10. After three years, the share is traded at CHF 15. The share price has therefore risen. In addition, CHF 2.50 per share has been distributed to the investors. The TSR is therefore calculated as follows:

The investor has gained CHF 7.50 per share, as the price per share has risen by CHF 5 and a dividend of CHF 2.50 per share has been paid out. This is also known as the stock return cash value. CHF 7.50 is 75% of what the investor originally invested.

Advantages and disadvantages of total shareholder return (TSR)

Vorteile

- The ratio is easy to understand and easy to calculate. It shows the total financial benefit that an investor could have achieved over a certain period of time.

- The key figure is expressed as a percentage and can therefore be easily compared with an industry reference value or with the TSR of another company in the same industry.

- The TSR is a good benchmark for long-term performance.

Nachteile

- Like most key figures, the TSR relates to the past. It therefore does not reflect a forecast for the future.

- The TSR is only ever published for an entire company, but not for specific divisions of the company.

- The key figure is externally oriented and reflects the market’s perception of performance. For this reason, TSR is easily influenced by short-term fluctuations in the share price.

- The TSR does not measure the absolute size of an investment or its return. For this reason, the TSR can favor investments with high returns, even if the Swiss franc amount of the return is low.

- The TSR cannot be used if the investment generates interim cash flows.

- In addition, the TSR does not take into account the cost of capital and cannot compare investments over different time periods.