What is the Unlevered Beta?

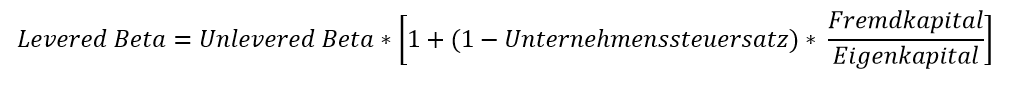

In general, beta measures market risk. Market risk is the risk of a change in the market price. Beta includes both equity and debt risk and is also referred to as leveraged beta or equity beta. The formula for the levered beta is as follows:

In statistical terms, beta is the slope of the coefficient for a share that is regressed against the benchmark market index. Beta is also an important component of the Capital Asset Pricing Model (CAPM). Beta therefore indicates how strongly a share fluctuates in comparison to the market.

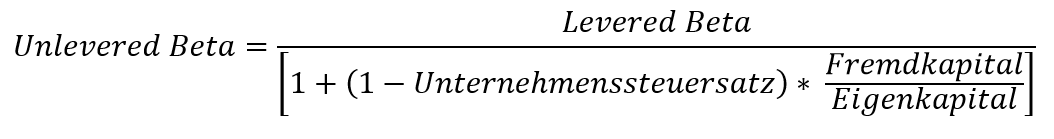

One part of the beta is the gearing ratio. This indicates the ratio between a company’s debt and equity. The unlevered beta adjusts the beta for all advantageous and disadvantageous effects arising from the use of debt capital. The unlevered beta thus eliminates the influence of debt. In other words, the unlevered beta represents the risk that is solely attributable to the company’s assets. If an investor wants to buy shares in a company, the unlevered beta is therefore the better measure to obtain clarity about the composition of the risk. Unlevered beta is also called asset beta. The formula for the unlevered beta is as follows:

Example for calculating the unlevered beta

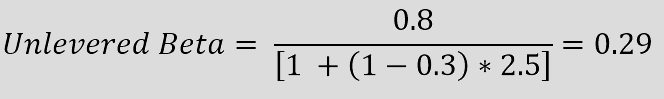

In order to adjust the leveraged beta for debt, both the leverage ratio and the corporate tax rate are required.

Assume a company has a levered beta of 0.8, a debt/equity ratio of 2.5 and a corporate tax rate of 30%. The unlevered beta is then calculated as follows:

If the unlevered beta is positive, investors will invest in the company’s shares if prices are expected to rise. A negative unlevered beta prompts investors to invest in the share when prices are expected to fall.

Systematic risk and beta

Systematic risk is the risk which, in contrast to unsystematic risk, cannot be eliminated by diversification, i.e. by spreading assets across different investment opportunities. Companies therefore have no influence on systematic risk. Examples of systematic risk include natural disasters, elections, wars and inflation. Beta is a measure of this risk. The risk of a share, for example, is compared with the risk of the broad market. The share is considered risky if the risk is higher than the risk on the market. If the beta is 1, the share is as risky as the market. If the beta is less than 1, the share is less risky than the market, while a share with a beta higher than 1 is riskier than the market. For example, the beta for Nestlé (1 year) is 0.88. The amount is less than 1, and therefore the company is currently less risky than the general market.