What is the utilities sector?

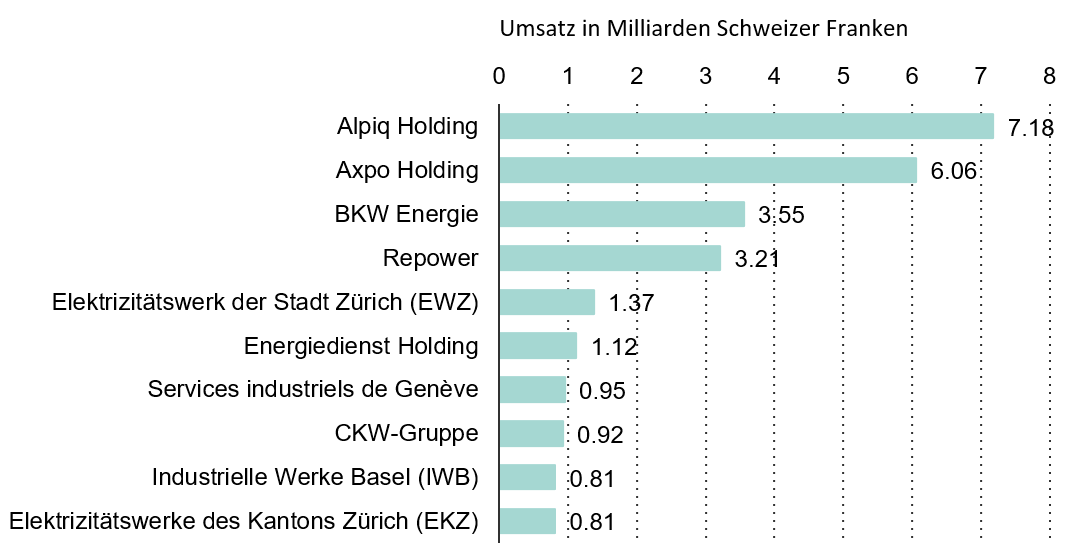

The utilities sector includes companies such as electricity, gas and water suppliers. Companies that are responsible for generating or distributing electricity are also part of the utilities sector. Some utilities rely on clean and renewable energy sources such as wind turbines and solar panels to generate electricity. The figure shows a selection of the leading energy suppliers/distributors in Switzerland by turnover in 2020/2021.

Selection of leading energy suppliers/distributors in Switzerland by turnover in 2020/2021

Quelle: www.statista.com

Those who include utility companies in their securities portfolios hold them as long-term investments and generally use them to generate income through dividends. Companies in the utilities sector have lower price volatility compared to the general equity markets. Price volatility is a measure of the range of fluctuation (standard deviation) of the price of a share. Low price volatility means that the price of a share is not strongly influenced by market fluctuations. This is also due to the fact that supply must be guaranteed in any economic situation. This is why companies in the utilities sector perform well during economic downturns, but companies in the utilities sector usually do not benefit from good economic conditions and fall behind somewhat compared to companies in other sectors during these times. Shares in companies in the utilities sector are therefore very suitable for reducing the risk of a securities portfolio. A good asset manager can provide you with the best possible support in creating a securities portfolio that matches your risk profile.

Companies in the utilities sector require an expensive infrastructure. For this reason, the proportion of borrowed capital is often very high. This is why companies in the utilities sector react very sensitively to changes in marketinterest rates. Since July 2022, rising inflation has also had a negative impact on the utilities sector.

Advantages and disadvantages of the utilities sector

Investing in companies in the utilities sector is particularly worthwhile due to the generally higher dividends and stability against economic downturns, which is why investments in the utilities sector are also very suitable for diversifying securities portfolios. One disadvantage of companies in the utilities sector is the high level of debt, as expensive infrastructure is generally required. This also makes the companies susceptible to interest rate risk. The advantages and disadvantages are listed again below.

Vorteile

- Stable investments, stable against economic downturns

- Higher, regular dividends

- Many investment options(bonds, shares, ETFs)

Disadvantages

- Strict regulatory controls (e.g. hardly any room for price increases)

- Require expensive infrastructure, high debt ratio

- Interest rate risk, higher interest rates mean that higher yields have to be paid due to bond investors