What is the Yearly Rate of Return method?

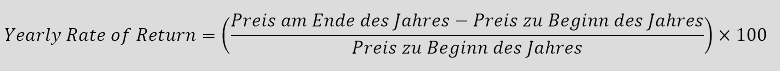

The yearly rate of return method is used to calculate the return generated by a fund over an entire year, for example. The formula is similar to the formula for calculating the simple rate of return. For this purpose, the value of the fund at the beginning of the year is deducted from the value of the fund at the end of the year (value difference) and divided by the value of the fund at the beginning of the year.

Calculation of the annual rate of return

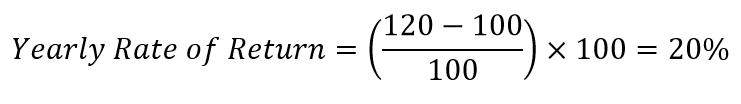

Example for calculating the annual rate of return

Assuming a share has a price of CHF 100 at the beginning of the year and a price of CHF 120 at the end of the year, the increase is CHF 20. If the increase is now divided by the price at the beginning of the year and multiplied by 100, the result is the percentage increase in value of the share. In this simple example, the annual rate of return is 20%. It should be noted that no dividends were paid out in this example. Dividends also represent an increase in value and should therefore also be taken into account.

Other return formulas

The yearly rate of return only indicates the percentage change in price over a single year. A clear advantage is the simplicity of the formula. Unfortunately, it also has certain disadvantages. The formula does not take growth rates into account . Since not all investment options have the same term, it can be difficult to compare the returns of these investment options with each other. In addition, funds can be added to an investment as well as withdrawn from it. There are therefore some alternative return formulas that may be more suitable depending on the investment opportunity.

An alternative to the yearly rate of return method is the annualized rate of return method. Not every investment has the same term and often the terms differ from one year. The annualized rate of return method calculates the annual return on such investments by annualizing the returns. In other words, the maturities are converted to one year in order to determine the return for one year. This gives the investor the opportunity to compare returns on different investments.

Another option is to calculate the time-weighted and money-weighted returns. The calculation of these returns is very popular among asset managers who want to calculate the performance of securities portfolios. The money-weighted return calculates cash flows, while the time-weighted return takes growth rates into account.