What is Yield to Maturity (YTM)?

The Yield to Maturity (YTM) is the average annualized yield of a bond if the bond is held to maturity and all interim coupon payments are also invested at the same interest rate. The YTM is expressed as an annual rate and is also referred to as the “book yield” or “redemption yield”. Essentially, the YTM is the internal rate of return (IRR) if the bond is held to maturity. The calculation assumes that all coupon payments are reinvested at the same yield rate or interest rate.

The calculation of the yield to maturity

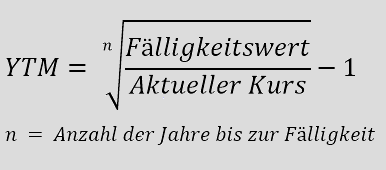

As the calculation of the YTM is complex, the following formula initially refers to a discount bond. A discount bond has a discount instead of a coupon. The investor pays less to buy the discount bond than he gets back at the end. The difference represents the yield. In this case, the YTM can be calculated using the following formula:

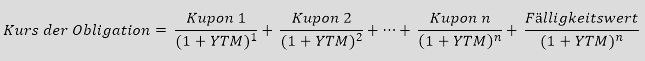

The calculation becomes more complicated if coupons have to be included in the calculation. If a coupon is paid each period, which is reinvested at a constant interest rate until the maturity date, the market price of the bond is the present value of all future cash flows. The investor knows the current price of the bond, the amount of the coupon payments and when they will be paid out. However, the discount rate cannot be calculated directly. However, the YTM can be calculated using the trial-and-error method. The following formula applies:

The YTM is merely a snapshot of the yield of a bond, as the coupon payments cannot always be reinvested at the same interest rate. If interest rates rise, the YTM rises. If interest rates fall, the YTM falls. Since calculating the YTM is difficult, the YTM value can also be approximated using a yield table for bonds, a financial calculator or an online calculator for the YTM.

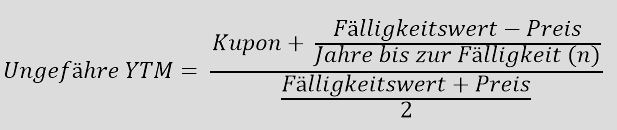

As an approximate value, the YTM can be calculated using the following formula:

The YTM can be used to compare it with the desired return. This allows an investor to decide whether it is worth investing. Since the YTM is expressed as an annual rate, bonds with different maturities can also be compared. If the YTM is higher than the coupon, the bond is traded at a discount. If the YTM is lower than the coupon rate, the bond is traded at a premium.

Variations of the Yield to Maturity

There are several common variations of the YTM, which take options into account and are described below:

- Yield to Call (YTC): Here it is assumed that the bond will be repurchased before maturity.

- Yield to put (YTP): Here it is also assumed that the bond will not be held to maturity. The holder of the put bond can decide to sell the put bond back to the issuer early at a fixed price.

- Yield to Worst (YTW): If a bond is linked to several options (callable, puttable, exchangeable, or other), the YTW is calculated. This offers the lowest yield.

Disadvantages of yield to maturity

The YTM does not take into account the payment of taxes or other purchase or sales costs. In addition, assumptions are made, such as the investment of all coupon payments at the same interest rate. This is not always feasible. Furthermore, not all bonds run to the end of their term.