Who is Charlie Munger (Charles Thomas Munger)?

Charlie Munger (born 1924, † 2023) was a shareholder and vice chairman of BerkshireHathaway, a diversified conglomerate based in Omaha, Nebraska, which is managed by the famous American investorWarrenBuffet. Charlie Munger acted somewhat in the background, but thanks to his advice, Warren Buffett adapted his stock-picking methodology , without which Berkshire Hathaway would not be what it is today.

As Buffett’s closest business partner and “right-hand man”, Munger played a key role in Berkshire’s growth for over four decades. Berkshire Hathaway grew into a huge diversified holding company with a market capitalization of over 600 billion dollars (as of July 2022). Its subsidiaries operate in the insurance, rail freight, power generation/distribution, manufacturing and retail sectors, among others.

In addition to Berkshire Hathaway, Munger was a director of Costco Wholesale Corporation and Chairman of the Board of Daily Journal Corporation, a legal publishing company with a software business in automated court reporting. From 1984 to 2011, he was Chairman and CEO of Wesco Financial Corporation – a subsidiary of Berkshire Hathaway.

Life

Charles Munger was born in Omaha in 1924, where he grew up as the eldest son in a family of lawyers. During the Second World War, he enrolled at the University of Michigan to study mathematics. However, Munger dropped out a few days after his 19th birthday in 1943 to join the US Air Force, where he trained as a meteorologist and was promoted to second lieutenant. He later continued hisstudies in meteorology at Caltech in Pasadena, California. The city became his lifelong home.

After entering Harvard Law School – without a bachelor’s degree – he graduated magna cum laude in 1948. After graduation, Munger moved to Los Angeles, where he practiced law.

Munger did not have a successful start in the business world. On the contrary, his first venture was a company dedicated to the manufacture of transformers together with his partner Ed Hoskins, with which he lost almost everything. However, thanks to Munger’s discipline and knowledge, as he himself says, they managed to achieve a respectable return on the capital invested.

In 1961, an old acquaintance of Munger’s, Otis Booth, invited him to join him in a realestate deal, which was completed in 1967 and on the sale of which Munger made a profit of 400%. Munger stayed in the business for a few more years until he made his first million dollars.

He then founded his own investment company, which he managed from 1962 to 1975 and where he demonstrated his keen investment sense: he achieved an average annual return of 19%, while the Dow Jones achieved an average return of just under 5% over the same period.

Munger died in a hospital in California on November 28, 2023 at the age of 99.

Charlie Munger and Warren Buffett

After meeting at a dinner in Omaha in 1959, Munger and Buffet stayed in touch over the years as Buffett continued to build his investment firm and Munger continued to work as a real estate attorney.

Although Buffett and Munger did not work together, they met again and again in business. The reason for this is presumably the similar investment style pursued by the two. Examples of this are the investments made in the 1970s in the discount brand company Blue Chips Stamps and in the retail chain Diversified Retailing, which both made independently of each other.

The relationship between Munger and Buffett did not develop until 1978, when Warren Buffett merged his investment activities to form Berkshire Hathaway due to the US Securities and Exchange Commission. Diversified Retailing was merged with Berkshire and Munger received two percent of Berkshire shares for his stake and became Vice Chairman. He also became managing director of Berkshire subsidiary Wesco Financial Corporation.

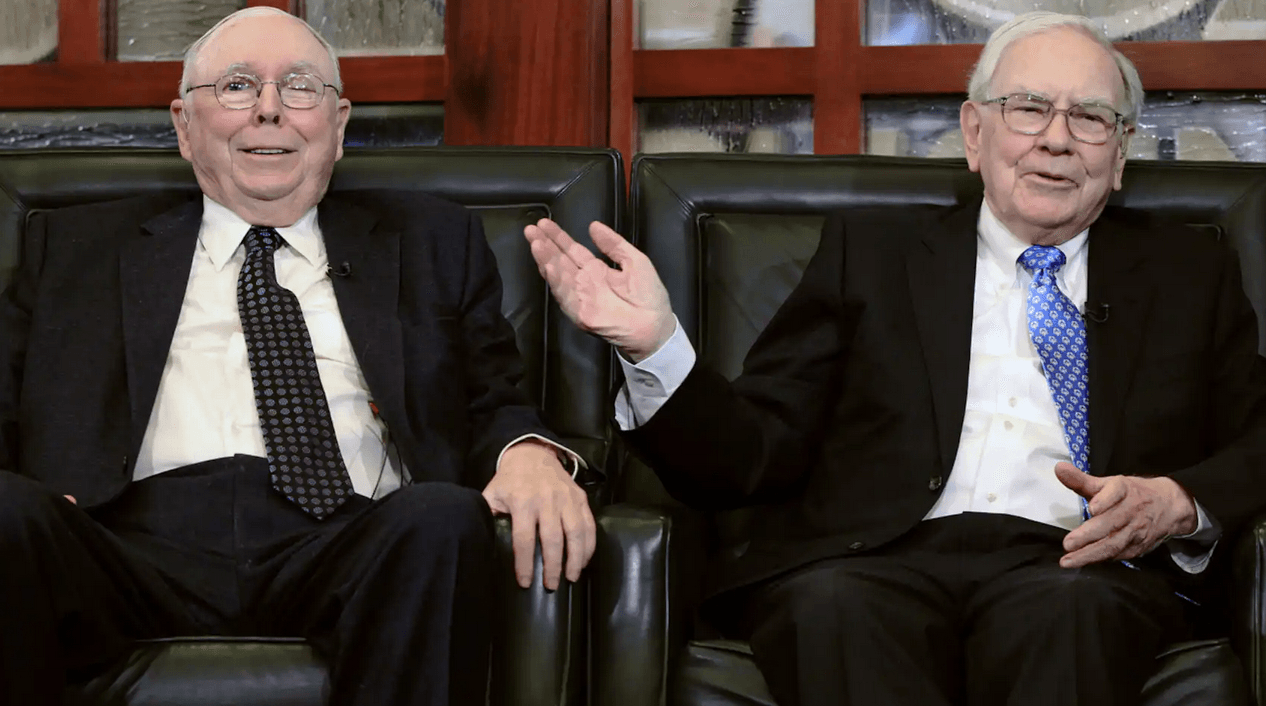

Charlie Munger (l.) and Warren Buffett (r.), Source: Keystone

Charlie Munger’s investment style

Charlie Munger was a value investor and believes that anyone who adopts this style is an intelligent investor. However, Munger’s interpretation of valueinvesting was very different from Buffett’s interpretation. Buffett has also always been a value investor. He actively sought out and analyzed stocks that were trading below their true value. Buffett learned this strategy from his mentor Benjamin Graham.

In 1989, Buffett told hisshareholdersthat it was Munger who educated him that Berkshire should not pursue the “cigar-butt” version of value investing – a term used to describe investors who buy a dying company currently worth $1 for $0.75 just to get the $0.25 “free puff” left in the business. According to Buffet, he started his own career by looking for just such companies and it was Munger who recognized the folly of this approach long before he did. He said:“Charlie understood this early on; I was a slow learner“.

So Munger believed that the cheap price for a struggling company with numerous flaws would too often turn out to be a false discount in the end and any immediate gain would soon be eroded by low returns. Instead, Munger and Buffett would rather buy a great company for $1.25 when it is currently worth $1 but will definitely be worth $15 in 10 years. This is how Berkshire Hathaway became one of the most successful companies.

One of the main reasons for their spectacularly successful business partnership was that Munger and Buffett were in complete agreement about adhering to industry-leading standards of ethical business practice. Munger has often stated that high ethical standards are an integral part of his success. In 2009 at the Wesco Financial Corporation annual meeting, he made a very frequently quoted statement: “Good companies are ethical companies. A business model that relies on trickery is doomed to fail”.

The above is Berkshire Hathaway‘s investment philosophy, but as an additional strategy, Munger has defined himself as an enemy of excessive diversification. He demonstrated this with the concentrated portfolio of just four stocks he managed at Wesco. Munger defended his strategy by arguing that a concentrated portfolio delivers better returns over the long term than a highly diversified portfolio if you know the company and therefore the risks and potential.

Munger said that if there was one skill he had learned, it was playing cards, because it teaches you to fold in time when the odds are against you and to take advantage of opportunities when they present themselves. If anyone managed to set a good example, it was himself: Thanks to this ability, he was one of the richest men in the world. Until his death, he was an architecture enthusiast and lived an active yet quiet life. He was also a member of the board of Berkshire Hathaway.

In 2022,BerkshireHathaway‘s Annual General Meeting was held live with shareholders for the first time since the coronavirus pandemic. Charlie Munger also took part and answered numerous questions together with Warren Buffett for over five hours – at the age of 98, mind you.

Otherwise, like many other millionaires, Charlie devoted time and resources to philanthropy. From 2011 to 2013, he donated more than 110 million dollars to his alma mater. He also donated money to other universities in the USA. Charlie Munger was a role model from whose story we can all learn important lessons, such as resilience and applying logic to our decisions. Especially in wealth management and when making investment decisions, his very down-to-earth and practical advice is valuable.