What are retained earnings?

In Kürze sind einbehaltene Gewinne nicht ausbezahlte Gewinne. «Einbehalten» sind die Gewinne deswegen, weil sie nicht z.B. als Dividenden an die Aktionäre ausbezahlt werden, sondern im Unternehmen verbleiben. Die einbehaltenen Gewinne steigen, wenn neue Gewinne entstehen, und fallen, wenn Dividenden ausgeschüttet werden. In anderen Worten ausgedrückt ist der einbehaltene Gewinn der Nettogewinn, welcher nach der Ausschüttung der Dividenden übrigbleibt. Die Gewinneinbehaltung stellt eine Form der Selbstfinanzierung dar. Ein wachstumsorientiertes Unternehmen verwendet die einbehaltenen Gewinne bevorzugt zur Finanzierung von Expansionsaktivitäten, anstatt eine Dividende auszuzahlen. Die einbehaltenen Gewinne können auch genutzt werden, um einen Teil der im Unternehmen entstandenen Schulden zurückzuzahlen.

The decision to retain or distribute profits is normally made by the company management. However, it can be contested by the shareholders through a majority decision, as they are the actual owners of the company. In the long term, however, retained earnings can lead to better returns for shareholders than dividend distributions. However, shareholders seeking short-term gains may prefer dividend payments. In most cases, management takes a balanced approach.

The amount of retained earnings is shown in the balance sheet under equity. The figure is also shown in the statement of retained earnings. Retained earnings are also referred to as the retention ratio (expressed as a percentage of total income) or profit surplus.

The formula for retained earnings

Retained earnings = BP + net profit (or loss) – C – S

BP = retained earnings from the previous period

C = cash dividends

S = stock dividends

Retained earnings are calculated by adding the net profit to (or deducting the net losses from) the retained earnings of the previous period and then deducting the net dividend(s) paid to shareholders. The figure is calculated at the end of each accounting period (monthly/quarterly/annually).

Dividends and retained earnings

Dividends can be distributed in the form of cash or shares. Both forms of distribution reduce retained earnings. The cash distribution of dividends leads to an outflow of funds and is recognized as a net reduction in the balance sheet. The payment of cash dividends reduces the asset value of the company in the balance sheet, which has an impact on retained earnings.

In contrast to cash dividends, share dividends do not lead to an outflow of funds. However, some of the retained earnings are transferred to ordinary shares through the share dividend. For example, if a company pays one share as a dividend for each share held by investors, the price per share is reduced by half as the number of shares doubles. As the company has not created any real value simply by announcing a scrip dividend, the market price per share is adjusted in line with the proportion of the scrip dividend. Even if the increase in the number of shares does not affect the company’s balance sheet because the market price is automatically adjusted, the value per share is reduced, which is reflected in the capital accounts and therefore also affects the retained earnings.

Retained earnings in relation to market value

Looking at the amount of retained earnings in a particular quarter or year is not really meaningful. An investor is much more interested in what returns the retained earnings were able to generate. One way to assess the success of a company through the use of retained earnings is to look at the ratio of retained earnings to market value. The ratio is calculated over a certain period (several years) and evaluates the change in the share price in relation to the company’s retained net earnings. The purpose of the ratio is to check whether the retention of profits has increased the market value of the company. The retained capital should therefore generate additional profit.

Example for calculating the ratio of retained earnings to market value

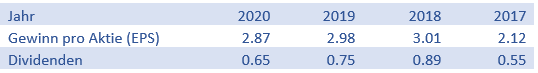

Suppose the table above shows the earnings per share and dividends over a given period for company Y. The company’s share price increased from CHF 30 to CHF 100 between 2017 and 2020. The total earnings per share over the years amounted to CHF 10.98 (2.87+2.98 +3.01 +2.12) and the total dividends amounted to CHF 2.84 (0.65+0.75+0.89+0.55).

The difference between the earnings per share accumulated over the years and the dividend accumulated over the years results in the retained net earnings per share of CHF 8.14 (10.98 – 2.84). During the same period, the share price rose by CHF 70 per share. Dividing the increase in the share price per share by the retained net earnings per share results in a factor of 8.59 (70/8.14). This means that company Y has created a market value of CHF 8.59 for every franc of retained earnings. This value can now be compared with alternative investment opportunities. A good asset manager can help you with this.